Off late, Rite Aid has been grabbing the headlines. Firstly, due to its store transfer to Walgreens that was a part of a larger deal. And secondly, due to its takeover by private company Albertsons.

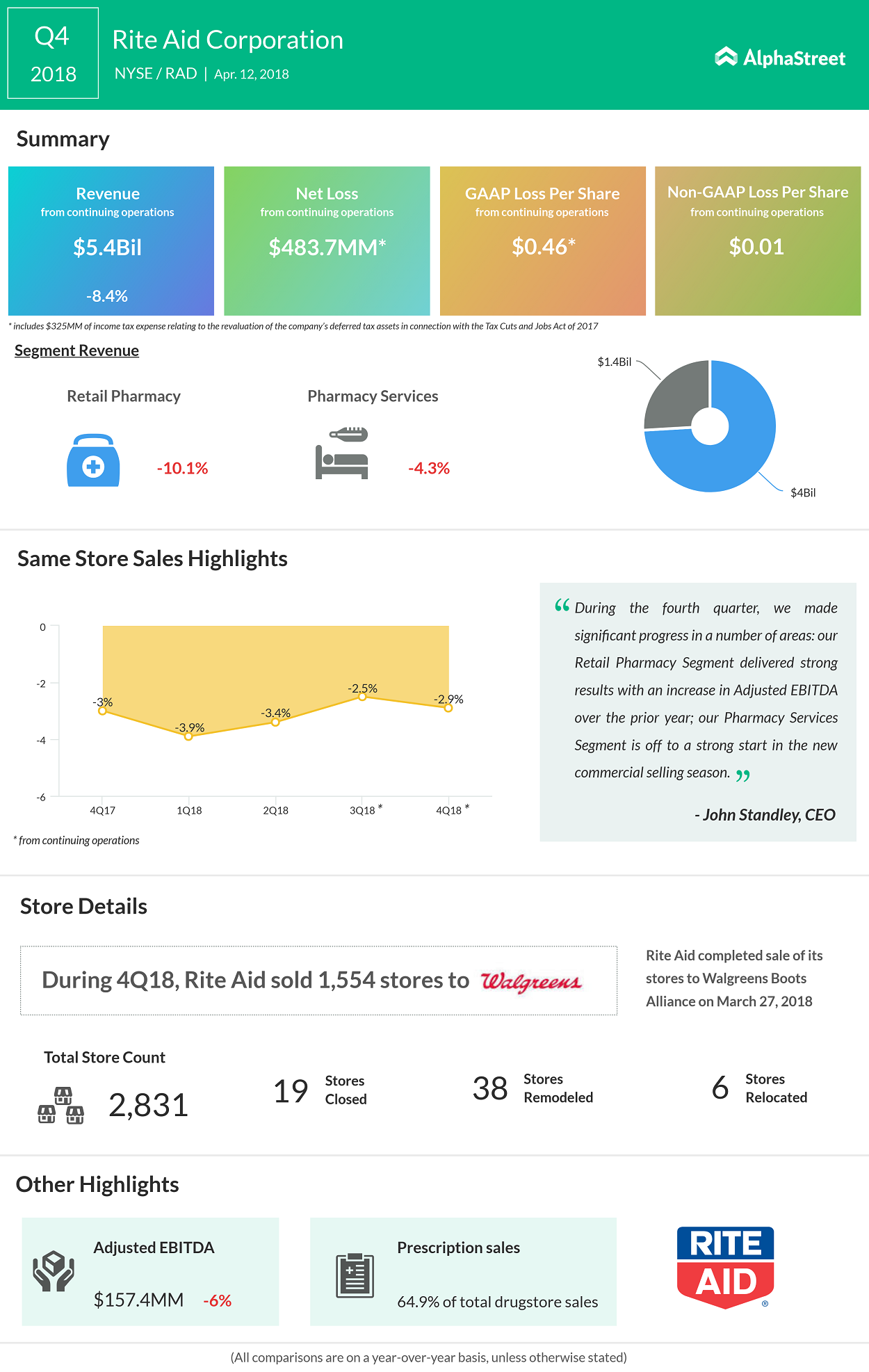

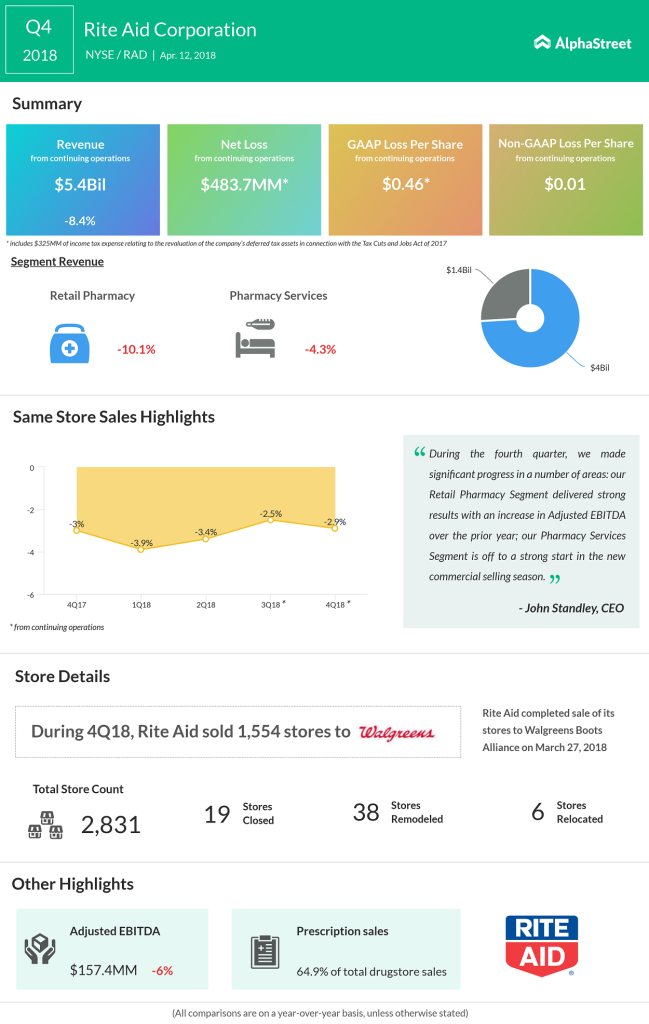

Rite Aid completed the store transfer to Walgreens on March 27, 2018. In relation to this store transfer, during the fourth quarter, the company received an after-tax gain of about $1.2 billion, relating to the 1,554 stores as well as due to the sale of related assets to Walgreens. This led to the drug retailer reporting a net income of $767.1 million, or $0.73 per share, compared to a loss of $21.14 million, or $0.02 per share.

Apart from the sale of 1,554 stores to Walgreens, the company shut down 19 stores during the quarter bringing the total store count to 2,831.

Rite Aid also provided the outlook for 2019 which did not reflect the impact of the pending deal with Albertsons. For the fiscal year 2019, the company expects sales to be in the range of about $21.7 billion to $22.1 billion and net loss is expected to be between $40 million and $95 million.

Rite Aid witnessed contractions in revenues from both segments – the Retail Pharmacy and Pharmacy Services

The awaited merger with the debt-burdened company Albertsons is said to transform the drugstore chain into a food, health and wellness chain. Albertsons selected the stores that Walgreens couldn’t acquire. Once the merger takes place- which is expected to happen later this year – Albertsons plans to go public.