User growth and engagement

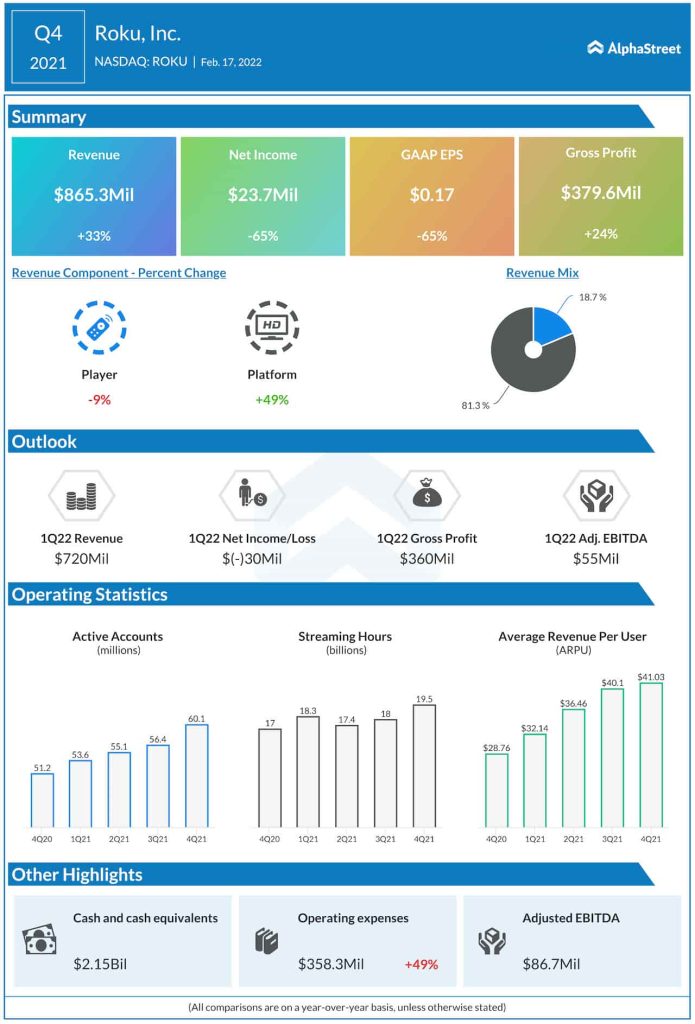

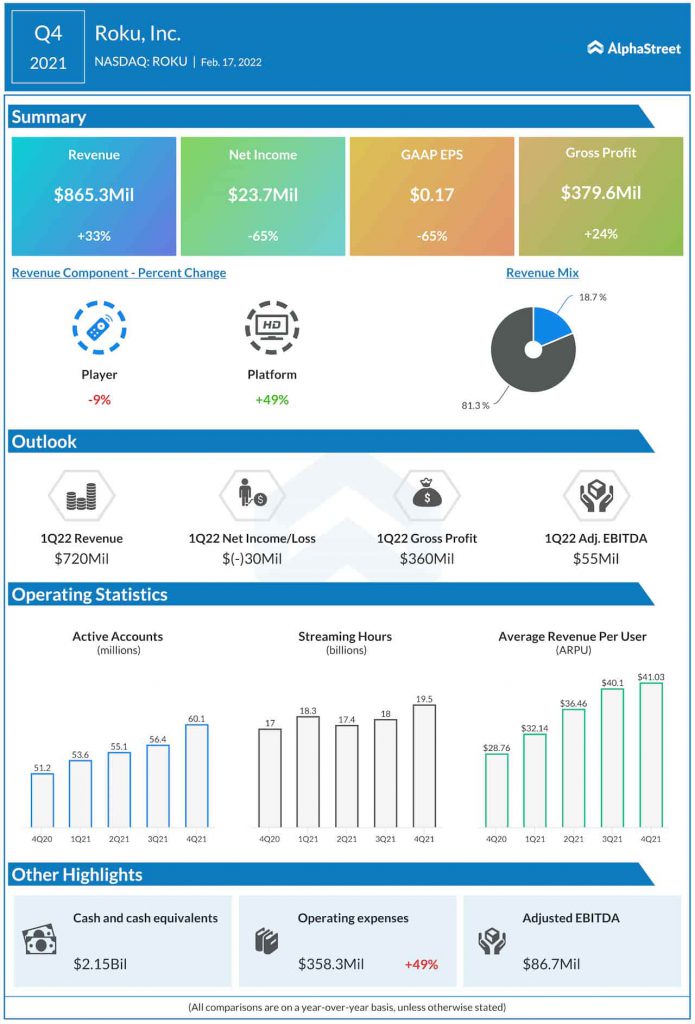

Platform revenue increased 49% YoY while player revenue dropped 9%. Total revenue rose 33% to $865.3 million which did not meet market expectations. EPS fell 65% YoY to $0.17 but exceeded analysts’ projections.

There is an increased shift to TV streaming due to factors such as convenience and a wide range of content options. In the US, Roku’s active account base surpassed the video subscribers of all the cable companies combined during 2021. Roku was the number one streaming platform by hours streamed in the US, Canada and Mexico.

The pandemic-fueled streaming boom is expected to decline going forward. Nevertheless, Roku grew engagement per user globally, with streaming hours per active account per day of 3.6 hours. The company sees significant room for growth in engagement.

For the full year of 2022, Roku expects revenue growth of 35%. For the first quarter of 2022, revenue is expected to grow 25% YoY to $720 million.

Margins

The US TV market was hit by global supply chain disruptions during 2021. Roku felt the impact of these disruptions as its overall TV unit sales in Q4 fell below pre-pandemic levels. Some of its TV OEM partners faced inventory headwinds which took a toll on their unit sales and market share during the quarter. The company believes this was one of the key reasons that caused a slowdown in its active account growth rates during the year.

Roku chose not to pass on the rising material and shipping costs in its player business to its customers through increased prices in order to drive account acquisition. This led to player gross margin of negative 28.4% in Q4.

The ongoing supply chain disruptions are expected to continue in 2022 which in turn will affect the consumer electronics space and the TV industry in particular. Roku’s TV unit sales are expected to remain below pre-pandemic levels, which could affect its active account growth. The company will continue to give preference to account acquisition thereby not increasing prices to absorb the costs which in turn will continue to impact player gross margins. There is a mixed sentiment around Roku. While some experts believe it could be a good choice for long-term investors, there are others who prefer taking a cautious approach to this stock.

Click here to read the full transcript of Roku’s Q4 2021 earnings conference call