The oil market continued to tighten in the third quarter as seen by a further draw in global oil inventories and a significant increase in oil prices despite continued strong production from the US and increasing output from key OPEC countries.

The tightening supply and demand balance is driven by accelerating decline rates in the international production base and is further exacerbated by the ongoing reduction in Venezuelan and Iranian exports.

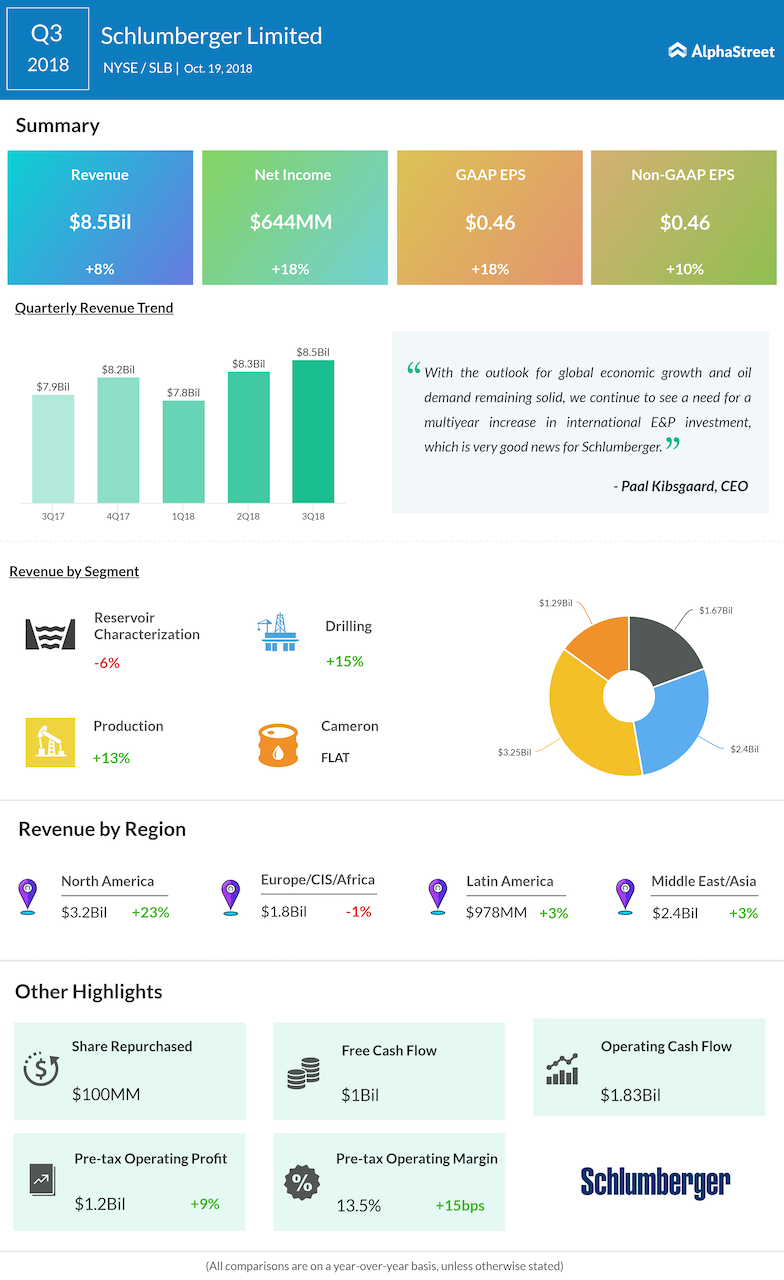

Sequentially, North America Area revenue rose 2% on robust growth of Drilling products and services on land, which grew 5% sequentially outperforming the 3% increase in US land rig count. Growth was driven by the continued demand for rotary steerable systems in horizontal wells.

Revenue in the Latin America Area increased 6% sequentially on a strong performance in the Mexico & Central America GeoMarket as revenue climbed from higher multiclient seismic license sales and increased IDS activity following contract mobilizations in the previous quarter.

Peak summer drilling campaigns that benefited the Wireline, Drilling & Measurements, and Testing Services product lines drove revenue from Europe/CIS/Africa Area higher by 2% from last quarter. Revenue in the Middle East & Asia Area rose 2% on the continued ramp-up of LSTK projects in Saudi Arabia and strong IDS activity in Iraq and India.

Peak summer activity in Russia that benefited the Wireline and Testing Services product lines drove Reservoir Characterization revenue higher by 2% sequentially. Drilling revenue increased 9% sequentially, while revenue from Production and Cameron remained flat from the previous quarter.

On October 18, Schlumberger’s board of directors approved a quarterly cash dividend of $0.50 per share of outstanding common stock. The dividend is payable on January 11, 2019, to stockholders of record on December 5, 2018.

Shares of Schlumberger ended Thursday’s regular session down 1.37% at $58.43 on the NYSE. The stock has fallen over 13% in the year so far and over 11% in the past year.