Mixed Outcome

The impressive overseas performance reflects favorable market conditions and high exploration activity. In North America, the results were impacted by weakness in the land market and lower customer spending, which affected the Production and Cameron segments.

Related: Schlumberger Q3 2019 Earnings Conference Call Transcript

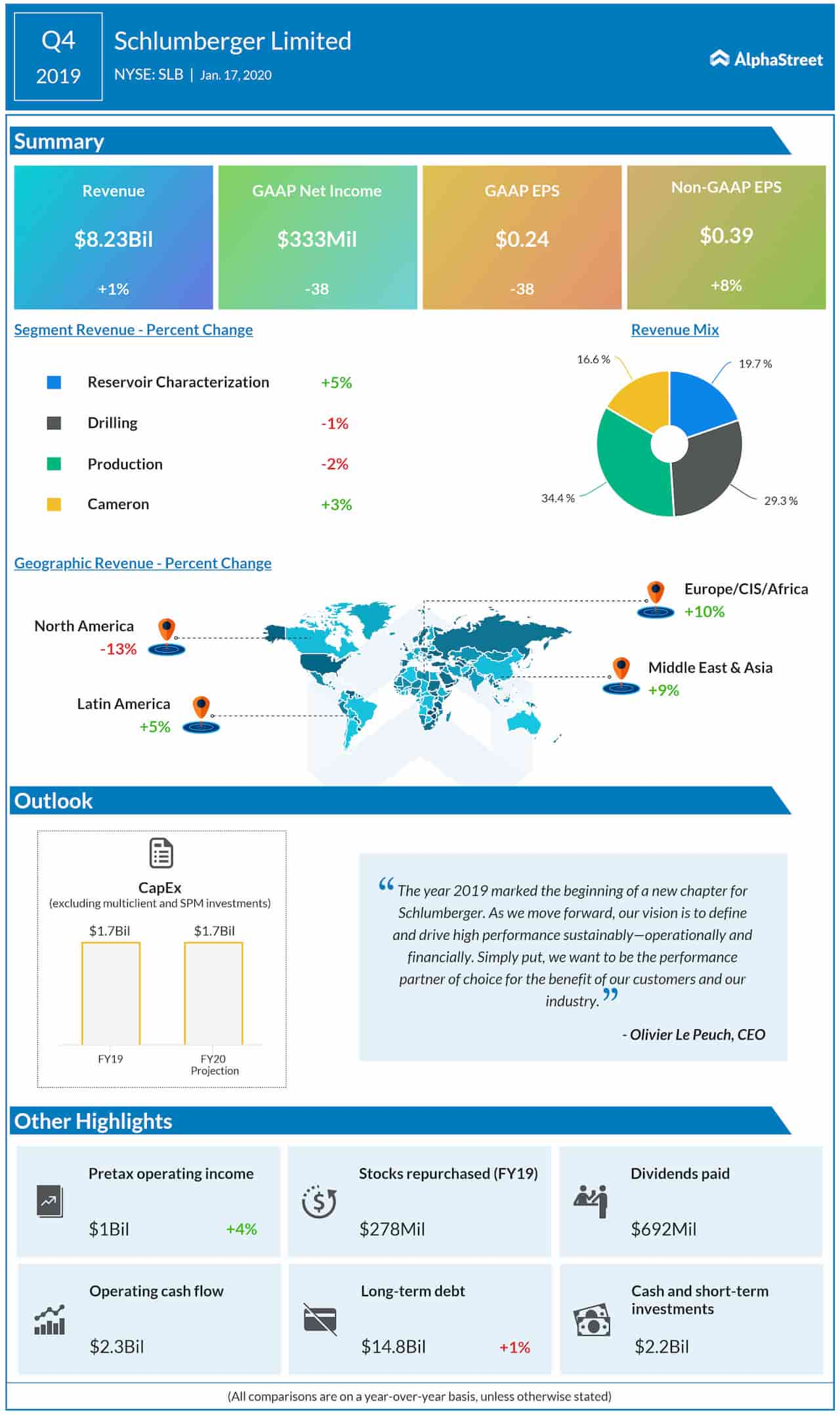

Adjusted earnings edged up to $0.39 per share from $0.36 per share in the fourth quarter of 2018. Analysts had forecast a lower profit. Unadjusted profit was $333 million or $0.24 per share, compared to $538 million or $0.39 per share a year earlier.

Schlumberger’s CEO Olivier Le Peuch said, “We ended the year building on the strength of our international franchise, driven by the breadth of the international recovery, after four consecutive years of declining revenue. We initiated our scale-to-fit strategy in North America land amid continued challenging market conditions, removed structural costs to protect margins, and accelerated technology-access business models and asset-light operations transformation.”

Other Updates

In the fourth quarter, the company approved a quarterly cash dividend of $0.50 per share and repurchased $1.1 billion of its outstanding notes. It also formed the Sensia joint venture and divested its Drilling Tools business. The proceeds from the transactions were used for reducing debt.

Also see: FuelCell Energy stock rebounds on growth prospects

Last month, Schlumberger announced that Simon Ayat, EVP and chief financial officer, will step down effective January 22, 2020. However, Ayat will remain with the company as senior strategic advisor to the chief executive officer for a period of two years.

Outlook

The company expects the rate of exploration & production capital expenditure growth in the international markets to be in the mid-single-digit range this year, considering a potential increase in oil prices due to the recent escalation of geopolitical risks. It also sees a reduction in investment and activity in the first half, mainly in the Middle East and Russia, in line with the OPEC+ agreement on production cuts.

After falling to a multi-year low, Schlumberger shares have been on the recovery path since the last earnings report. In the past twelve months, however, they dropped 11% and underperformed the market.