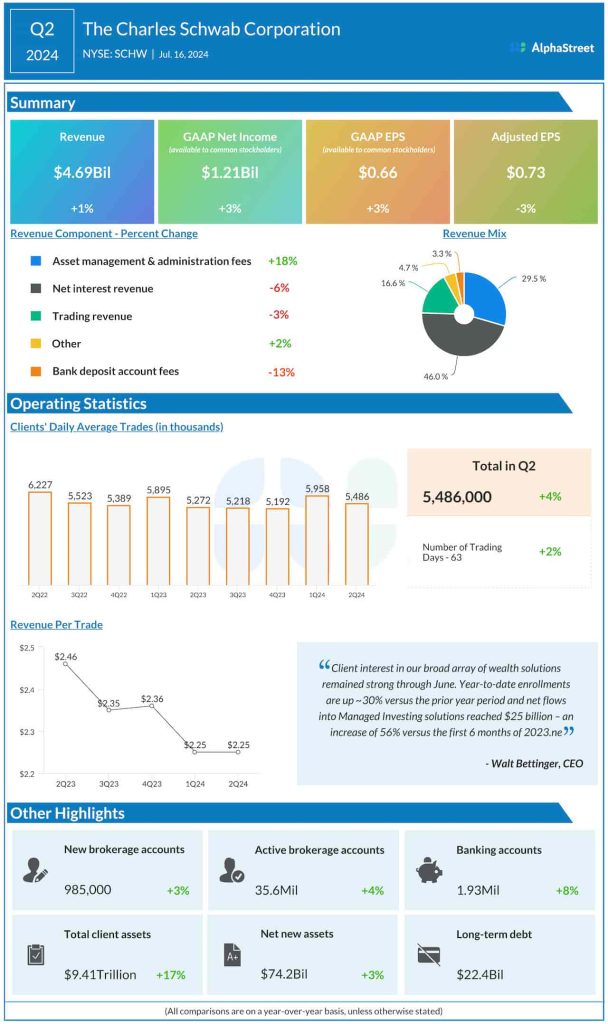

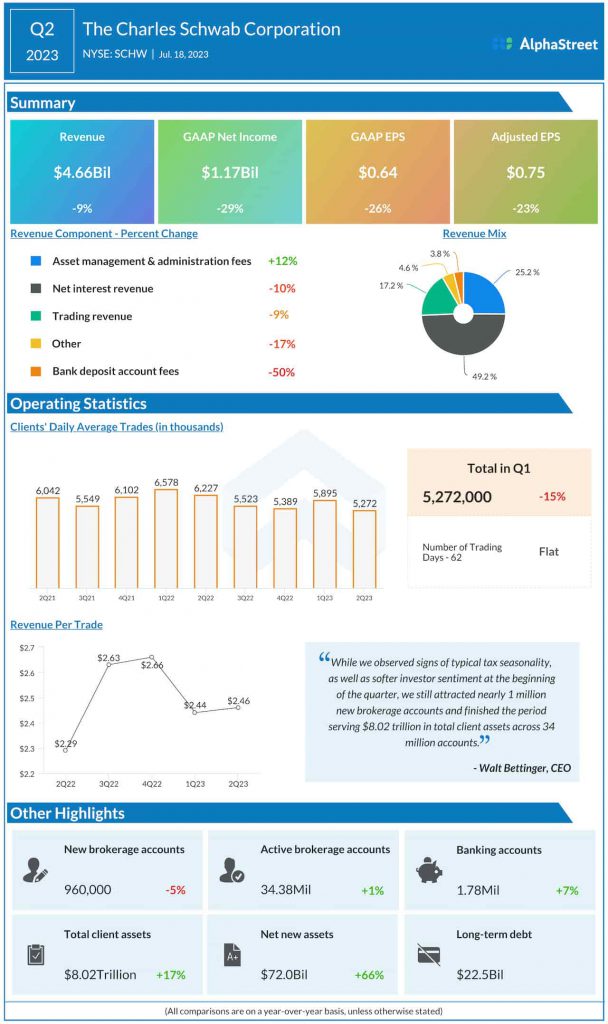

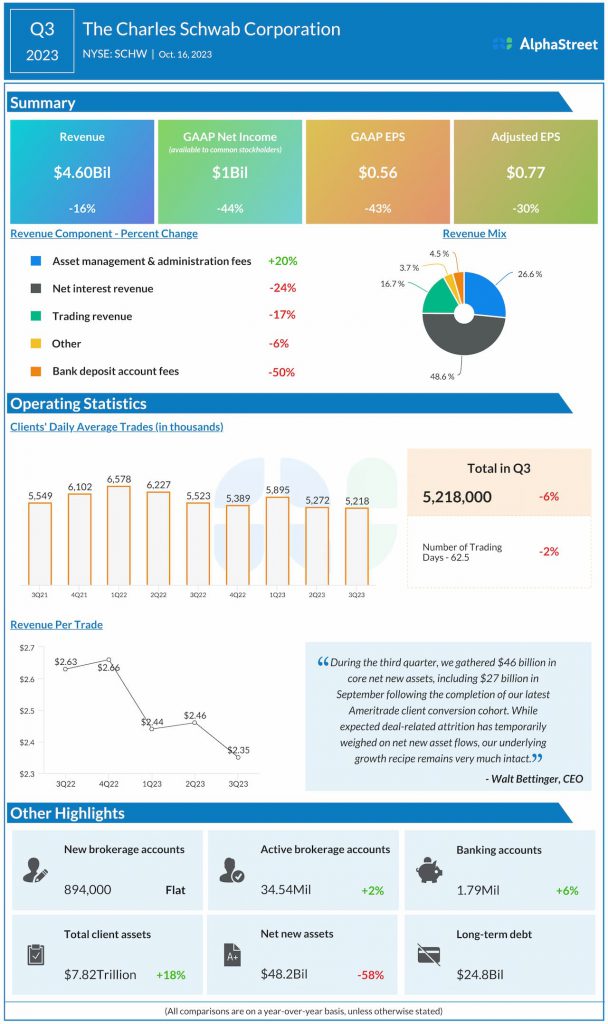

Total revenues edged up 1% year-over-year to $4.69 billion in the second quarter. The topline benefitted from an increase in total client assets amid sustained equity market strength and organic asset gathering.

Net income available to common stockholders was $1.21 billion or $0.66 per share in Q2, compared to $1.17 billion or $0.64 per share in the prior-year quarter. Adjusted profit declined to $0.73 per share from $0.75 per share last year.

“Record asset management and administration fees, along with our balanced approach to expense management, helped Schwab produce a second-quarter pre-tax margin of 37.2% – 41.0% adjusted,” said the company’s CFO Peter Crawford.