In a sign that the tech firm is yet to emerge from the demand slump and pricing issues, Wall Street predicts that earnings would drop about 42% year-over-year to $1 per share. The estimate for first-quarter revenue is $2.57 billion.

Bet on Big Data

Of late, the company has been selling higher-capacity hard disk drives (HDD) to cloud service providers who are looking for affordable alternatives to SSDs. The strategy has helped it overcome the stress on margins due to falling flash memory prices. Considering the rapid growth in enterprise data, the demand for high-capacity devices is bound to increase in the coming months.

Related: Intel Q3 earnings drop 6% but top estimates

Complementing its shift to mass storage systems and innovation in the conventional products, Seagate keeps expanding assets through strategic investments such as the recently-announced wafer manufacturing project in Europe. Also, the emergence of 5G technology will drive capacity shipments outside the PC market, which accounts for the lion’s share of the company’s revenues.

Memory Woes

However, profitability will remain under pressure until the market for NAND memory recovers. It is estimated that the demand slowdown, due to falling prices and inventory imbalance, negatively impacted Seagate’s sales in the first quarter.

Of late, the company has been facing stiff competition from Intel (INTC) and Western Digital (WDC), which this week reported lower earnings for the first quarter, hurt by a sharp fall in sales. While the results exceeded estimates, the management issued guidance that came in below estimates.

Looking Back

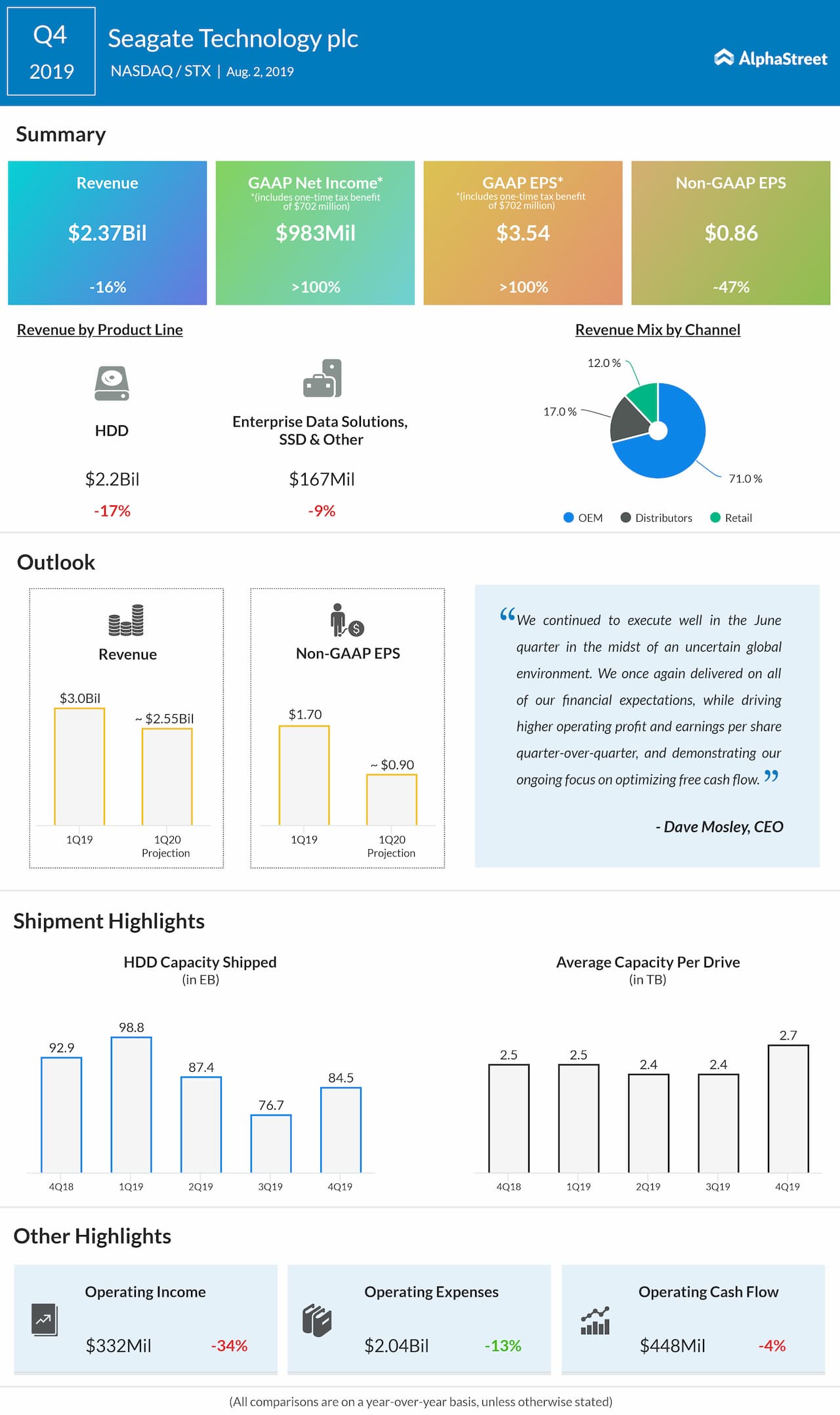

In August, Seagate released first-quarter guidance that fell short of expectations, spurring a stock selloff. Its fourth-quarter earnings fell sharply to $0.86 per share on revenues of $2.37 billion, down 16%. The results, however, topped expectations. Average capacity per drive was 2.7 terabyte.

Also see: Seagate Q4 2019 Earnings Conference Call Transcript

ADVERTISEMENT

Seagate shares had a positive start to 2019, and maintained the uptrend since the beginning of the year. Ahead of the earnings report, the stock traded 30% above last year’s levels.