Digital workflow solutions provider ServiceNow (NYSE: NOW) reported third quarter 2019 earnings results that topped analysts’ views. ServiceNow posted adjusted earnings of $0.99 per share on revenue of $886 million. Wall Street had projected the company to post a profit of $0.88 per share on revenue of $884.97 million in the third quarter. ServiceNow stock rose about 4% in the after-hours session.

GAAP revenue surged 32% in the quarter ended September 30, 2019, while adjusted revenue climbed 34% to $899 million. GAAP earnings stood at $0.21 per share in the recently ended quarter.

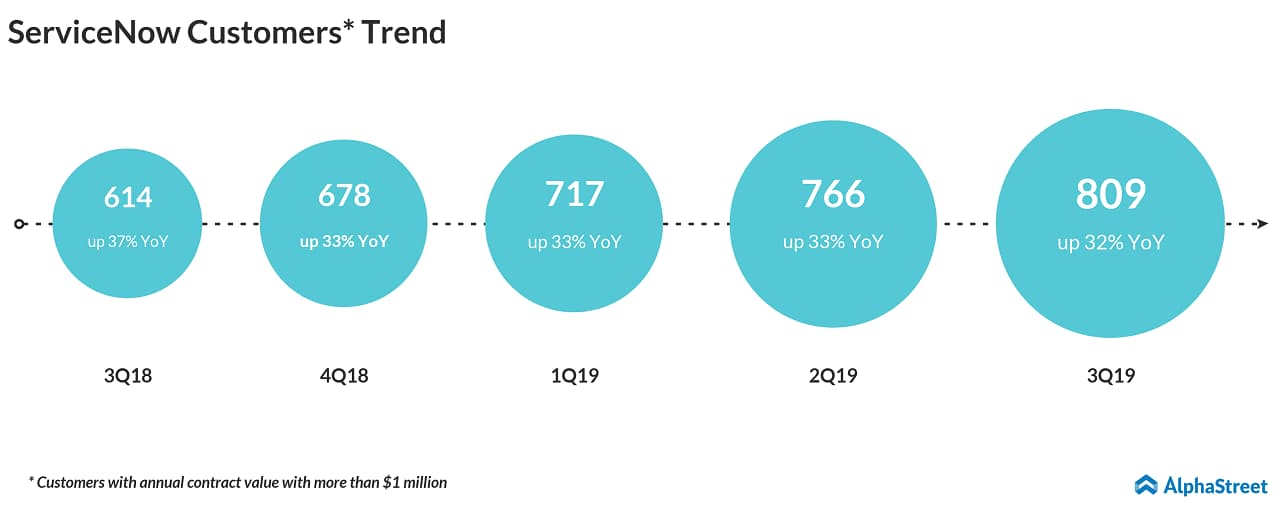

At the end of September 30, 2019, ServiceNow’s customers, with more than $1 million in annual contract value, grew 32% year- over-year to 809. ServiceNow closed 46 transactions with more than $1 million in net new annual contract value (ACV), representing 84% year‑over‑year growth.

Subscription revenues advanced 33% to $835 million on a GAAP basis, and spiked 35% to $848 million on an adjusted basis. Total billings growth of 27% to $915 million was helped by subscription billings growth of 28% to $864 million. on a non-GAAP basis, total billings grew 28% to $921 million and subscription billings grew 29% to $869 million.

For the fourth quarter of 2019, ServiceNow expects GAAP subscription revenue to grow 33% year-over-year in a range of $884 million to $889 million and non-GAAP subscription revenue to grow 35% in the range of $897 million to $902 million.

“We delivered another strong quarter, continuing our focus on driving customer success and expanding our footprint across 75% of the Fortune 500,” said CEO John Donahoe.

Yesterday, ServiceNow appointed SAP’s Bill McDermott as its new CEO replacing John Donahoe who will be joining the sneaker giant Nike effective January 2020. McDermott will join ServiceNow at the end of 2019.

NOW stock, which closed down 3.65% at $220.01, has advanced 24% since the beginning of 2019 and 21% from this time last year.