The opening of stores remained at a much more balanced pace than the compression it experienced late in 2018. Also, in the coming years, the international business is likely to contribute more to Shake Shack backed by a well-established supply chain and key strategic partnerships.

Analysts expect the company’s earnings to decline by 4.80% to $0.20 per share while revenue will jump by 32% to $157.83 million for the third quarter. The company has surprised investors by beating analysts’ expectations thrice in the past four quarters. The majority of the analysts recommended a “hold” rating with an average price target of $85.

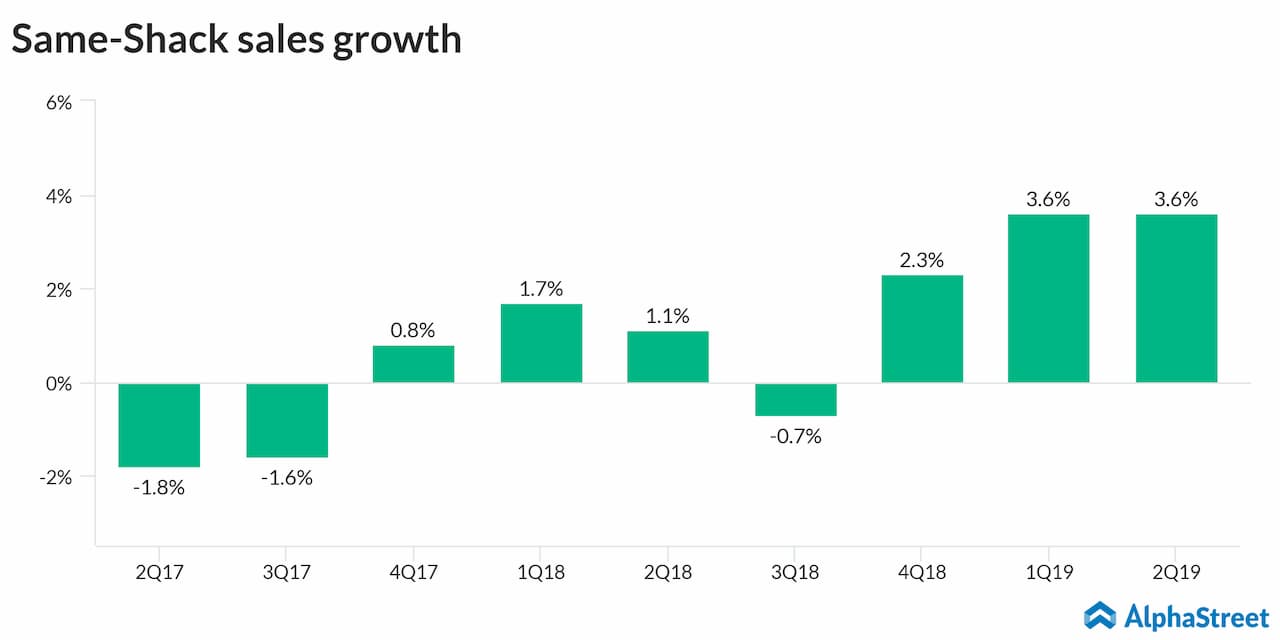

For the second quarter, Shake Shack posted an 18% increase in earnings driven by lower interest expense, higher other income, and lower-income tax expense. The top line soared by 31% year-over-year driven by the opening of 40 new domestic company-operated Shacks and 18 net new licensed Shacks as well as same-Shack sales growth.

Looking ahead into the full year 2019, the company expects total revenue in the range of $585 million to $590 million and same-shack sales growth of about 2%. The company expects to open 38 to 40 domestic company-operated Shack stores and 18 to 20 licensed Shack stores for the full year.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions