Silvergate Capital Corp., the parent company of San Diego, California-based Silvergate Bank, has filed for an IPO last Friday. Silvergate Capital, which provides financial infrastructure solutions and services to its clients in the digital currency industry, plans to generate $50 million through the initial public offering. The Bank has applied to list its Class A common stock on the NYSE under the trading symbol “SI”.

Silvergate said that it will use the net proceeds from this offering to fund organic growth and for general corporate purposes, including repayment of long-term debt, future acquisitions and other growth initiatives.

The majority of Silvergate’s funding comes from non-interest bearing deposits associated with clients in the digital currency industry. The financial institution’s digital currency customers grew more than threefold to 483 as of September 30, 2018, from 114 as of September 30, 2017. Also, the company had 145 prospective digital currency customers in various stages as of September 30, 2018. Silvergate’s notable clients include digital currency exchanges like Coinbase, Kraken, Bitstamp, Circle and Bittrex.

Non-interesting bearing deposits surged 181% year-over-year to $1.709 billion at the end of Q3, which accounts for 88% of the Bank’s total deposits. Silvergate plans to transition further from a traditional asset-based bank model focused on loan generation to a deposit based model focused on increasing non-interest bearing deposits.

Last year, Silvergate launched its cryptocurrency infrastructure solution named Silvergate Exchange Network (SEN) and tested it with limited customers. SEN was made available to all digital currency customers in early 2018.

To increase its focus on digital currency initiative, Silvergate entered into an agreement to sell its small business lending division and a retail branch located in San Marcos, California to HomeStreet Bank last week. As per the terms of the transaction, which is expected to be completed in Q2 2019, HomeStreet Bank has agreed to acquire about $123 million of business loans and assume around $124 million of deposits of the Bank.

In February 2018, Digital Currency Group, a New York-based venture capital company, invested $114 million in Silvergate through a private offering of 9.5 million shares of the Bank’s Class A common stock.

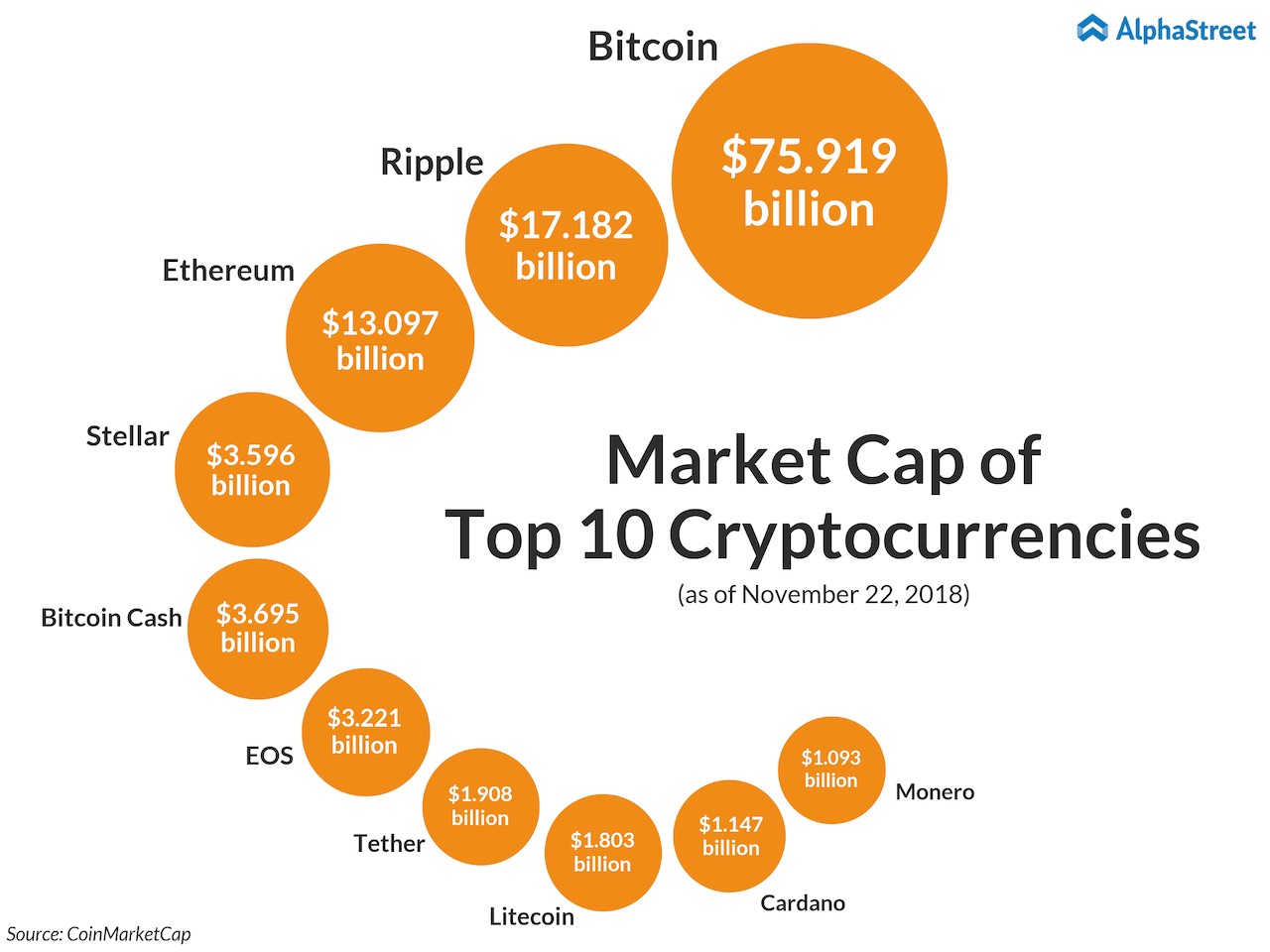

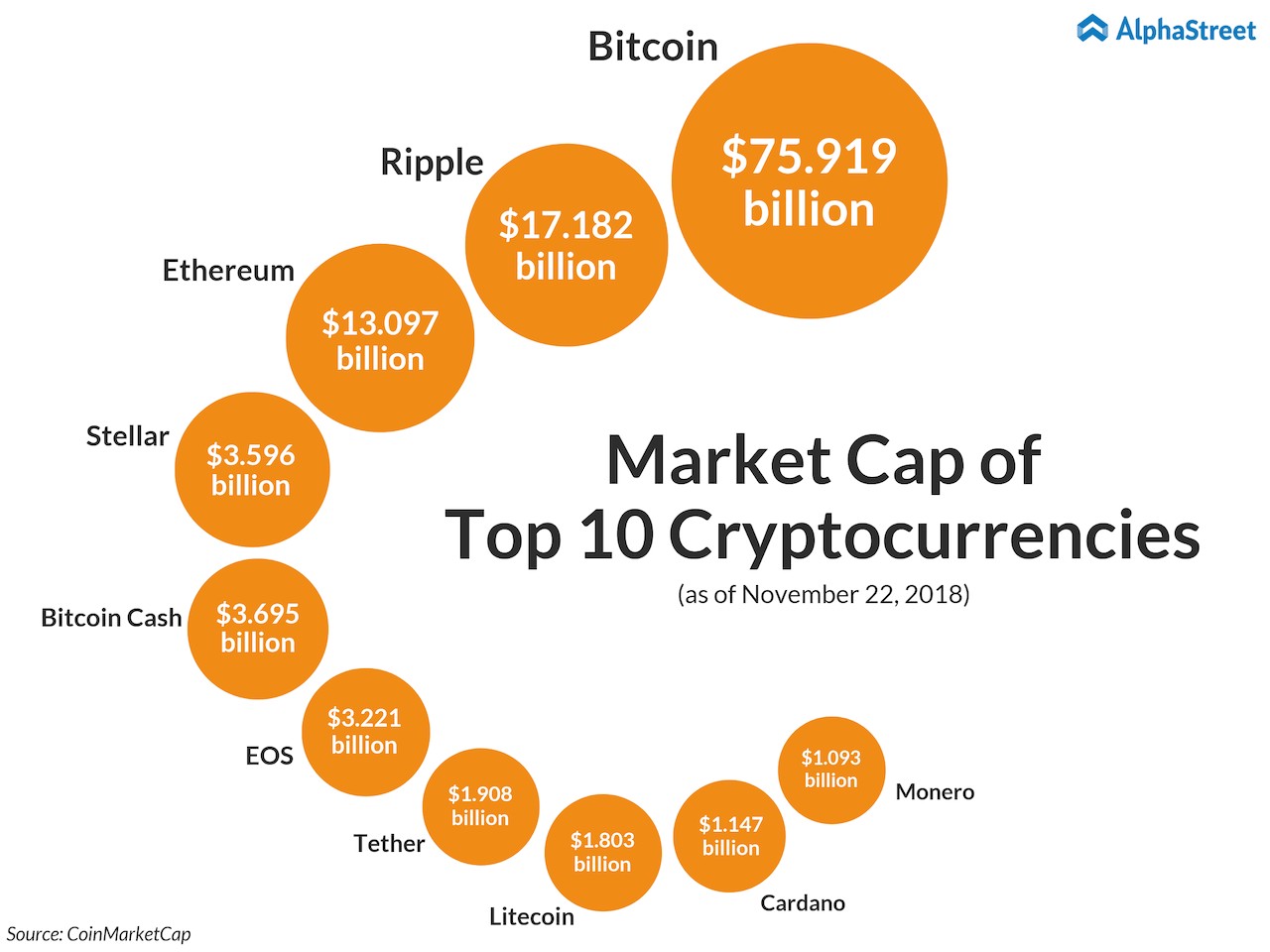

Even though the cryptocurrencies have crashed recently from its peak in January, experts feel that this is just a correction and they estimate the cryptocurrency market to bounce back in 2019. According to Bridget van Kralingen, SVP and head of IBM’s blockchain platform, the digital currency market is estimated to be worth trillions of dollars by 2025.