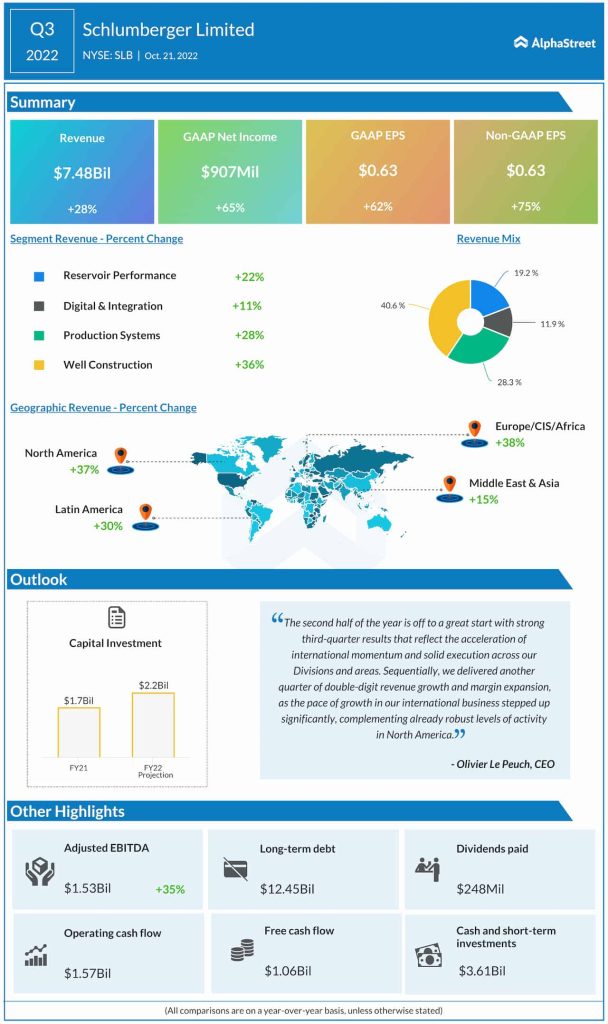

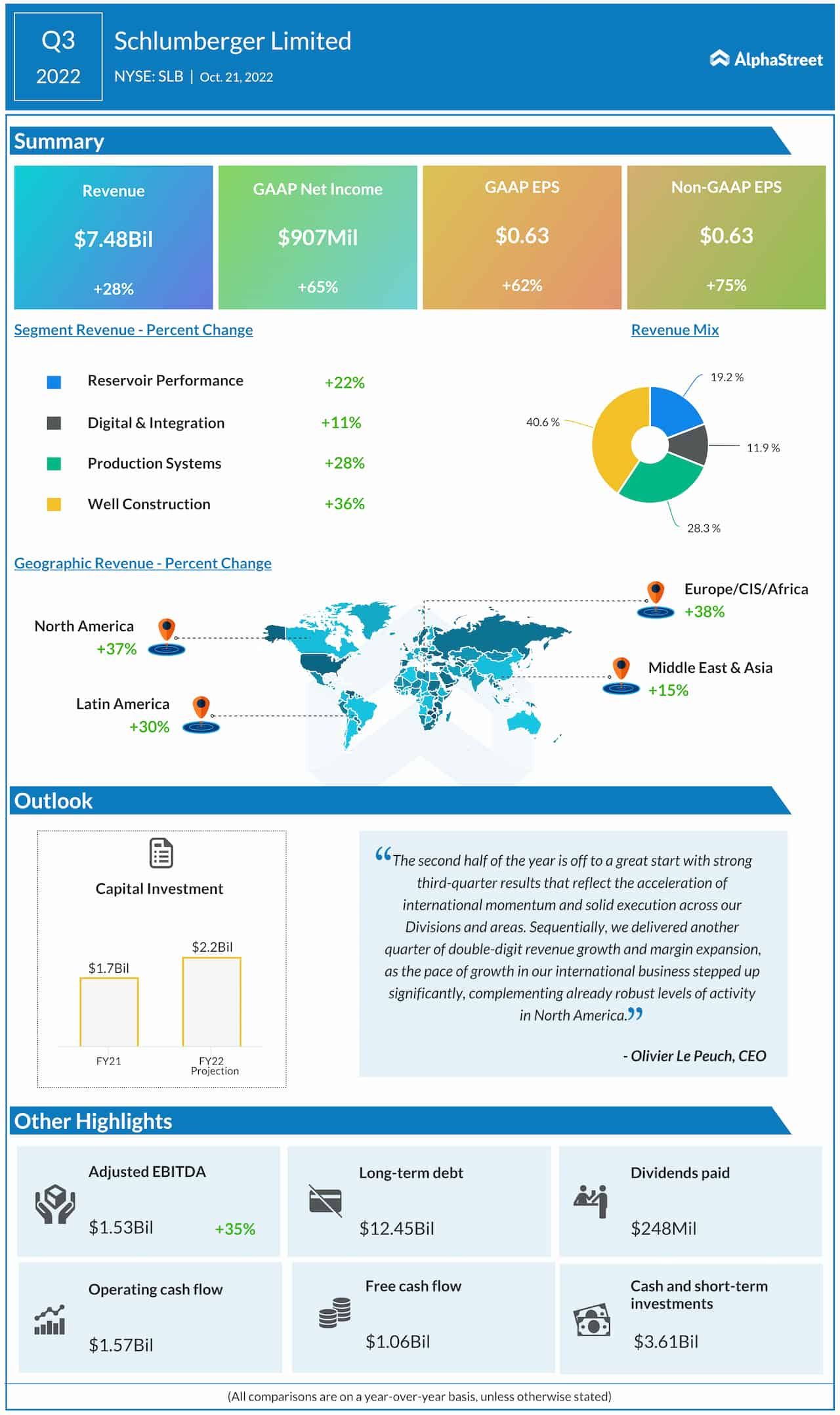

At $7.5 billion, total revenues were up 28% year-over-year. The core Well Construction and Production Systems segments grew 36% and 28% respectively.

The strong top-line growth translated into a 75% increase in adjusted earnings to $0.63 per share. Third-quarter unadjusted profit rose sharply to $907 million or $0.63 per share from $550 million or $0.39 per share in the comparable period of 2021. The management expects the full-year 2022 capital investment to be $2.2 billion.

Check this space to read management/analysts’ comments on Schlumberger’s Q3 2022 earnings

“Sequentially, we delivered another quarter of double-digit revenue growth and margin expansion, as the pace of growth in our international business stepped up significantly, complementing already robust levels of activity in North America,” said Schlumberger’s CEO Olivier Le Peuch.