Smart Global Holdings (SGH) swung to a profit in the fourth quarter from a loss last year, helped by the strength in its Specialty Memory business. The top and bottom line came in above analysts’ expectations. The specialty memory services maker’s stock gained more than 4% in the extended -hours of trading after guiding profit above consensus for the first quarter of 2019.

Net income for the quarter was $29.7 million or $1.28 per share compared to a loss of $10.2 million or $0.48 per share a year ago. Non-GAAP earnings jumped by 129% to $1.72 per share.

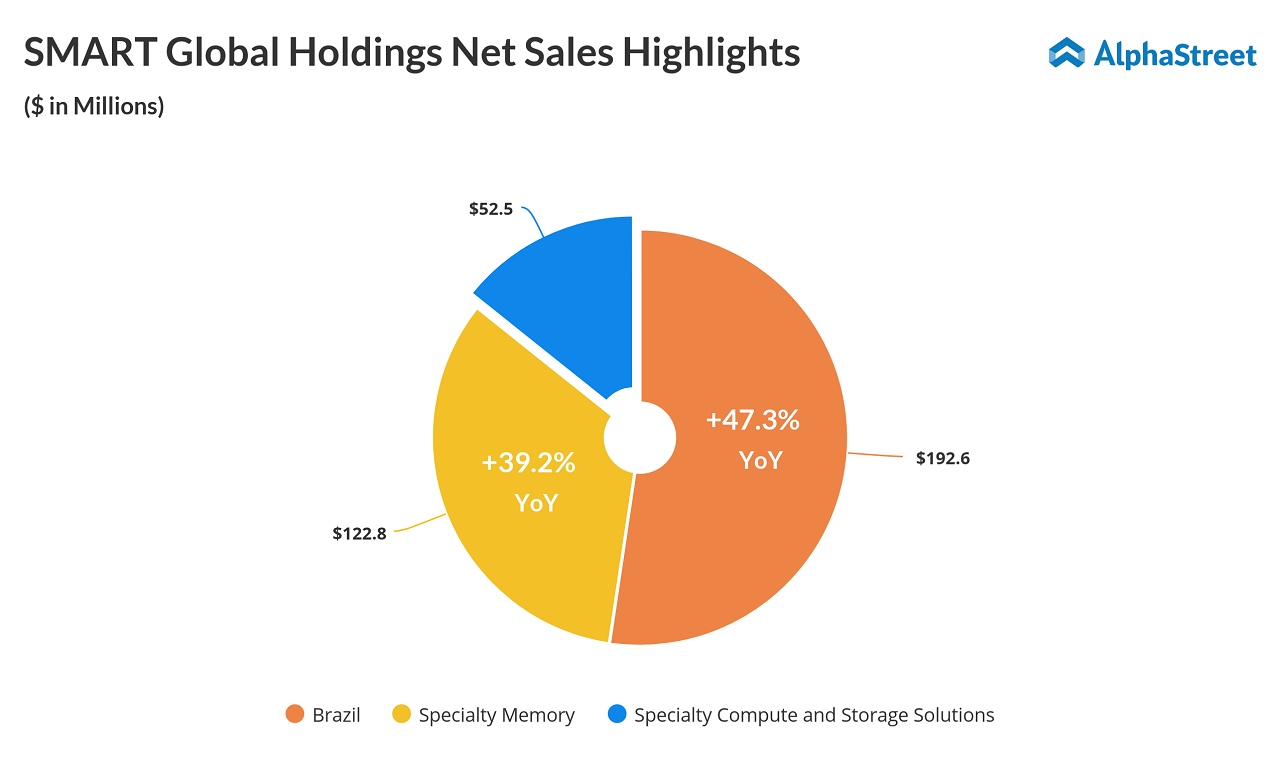

Net sales soared by 68% to $374 million, benefitted by the strength in the Specialty Memory business. The company also received major design wins at major Storage and Server customers, ruggedized SSD products and its Embedded Data Cache product in the Industrial Automation market.

Brazil continued to be the major contributor to the company’s strong performance and added many new memory products for PC, server and smartphone applications as well as a new polymer cell-based battery product for smartphones. The company continues to be focused on growing all its lines of business over the new fiscal year.

Looking ahead into the first quarter of fiscal 2019, the company expects net sales in the range of $375 million to $390 million and non-GAAP earnings of $1.74 to $1.79 per share. GAAP EPS is predicted to be in the range of $1.49 to $1.54.

Smart Global appointed an additional independent director, Bryan Ingram, Senior Vice President and General Manager of the Wireless Semiconductor Division of Broadcom Inc., to its board of directors and its Compensation Committee.

Shares of Smart Global ended Thursday’s regular session down 6.08% at $27.17 on the Nasdaq. The stock had dropped over 11% in the past year and over 19% in the year-to-date period.