On a GAAP basis, earnings fell to 8 cents per share in Q3 2019, from $1.37 per share a year ago.

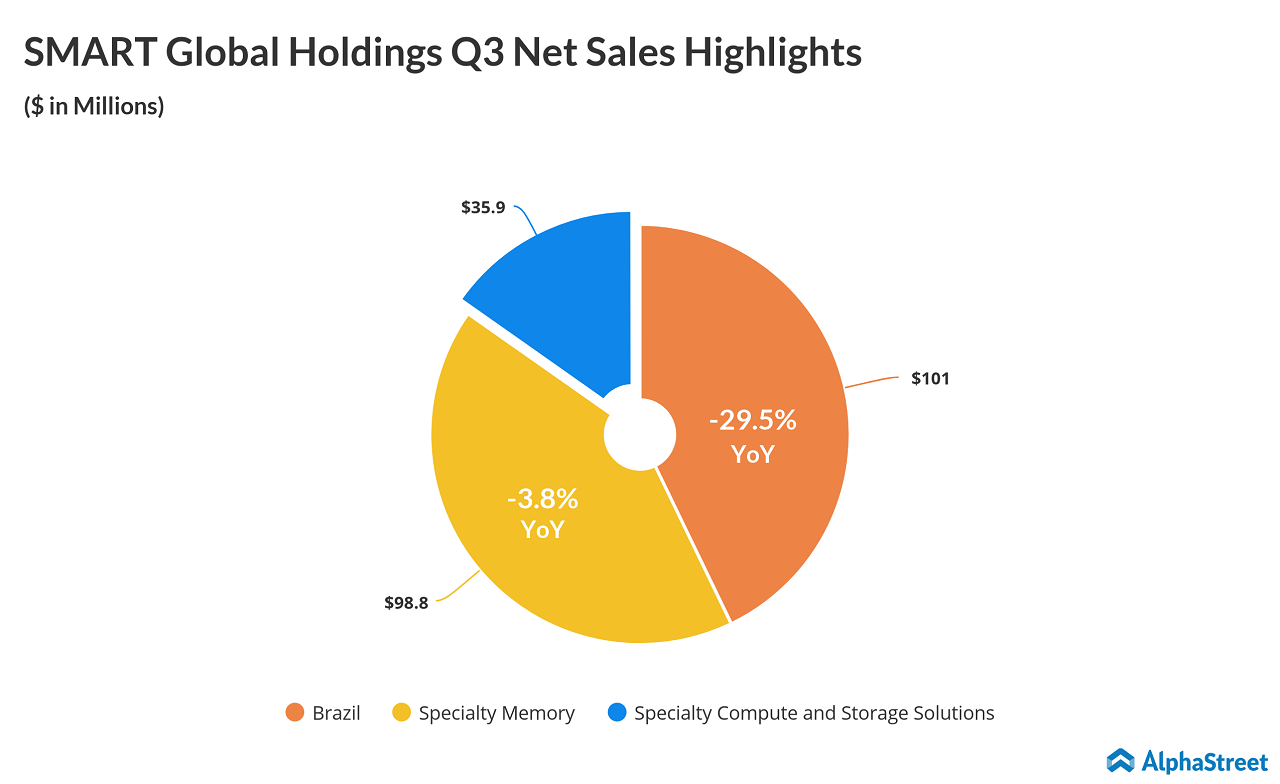

Net sales declined 30% to $235.7 million, which missed the market projection of $265.11 million.

SGH shares tumbled 14% on the disappointing third-quarter results. The stock has fallen 32% in the trailing 12 months.

CEO Ajay

Shah said, “As we look forward to our fourth fiscal quarter ending in August,

we are forecasting significantly better revenue and earnings performance even

though the memory pricing environment remains weak. This is due to improvements

in Specialty Memory unit volumes and strength in Specialty Compute.”

Looking

ahead, Smart Global expects net sales of $270 to $280 million for fiscal 2019.

Adjusted earnings is projected in the range of $0.55 to $0.65.