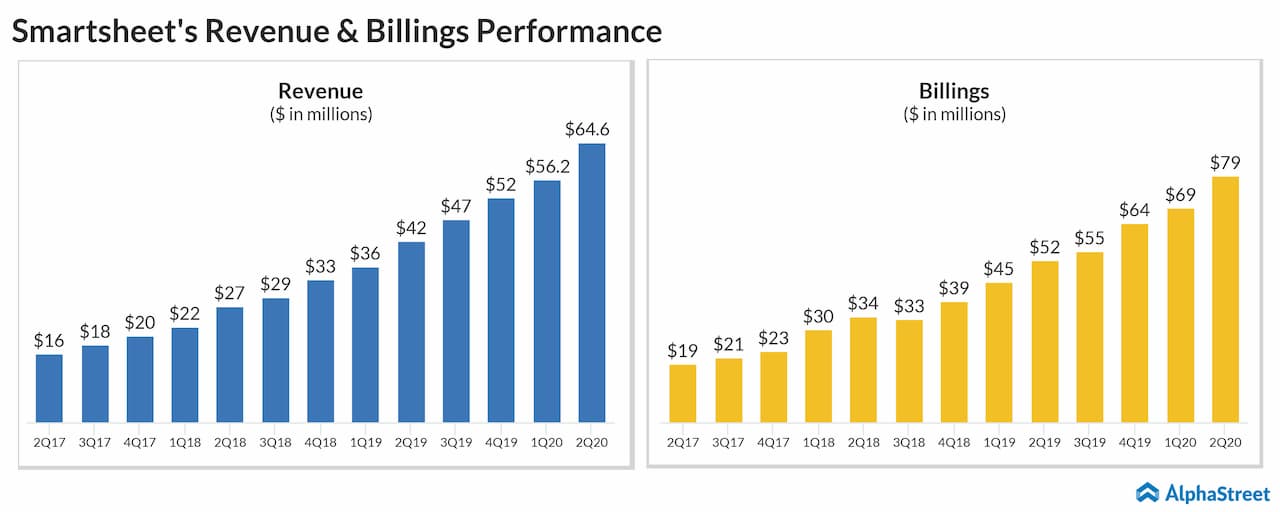

Revenue jumped 53% to $64.6 million. Subscription revenue soared by 56% year-over-year and professional services revenue increased by 29%.

For the third quarter, the company expects revenue in the range of $69 million to $70 million and adjusted loss in the range of $0.19 to $0.18 per share. For fiscal 2020, the company lifted its revenue outlook to the range of $265 million to $268 million from the previous range of $262 million to $265 million. Smartsheet tightened its full-year adjusted loss guidance to the range of $0.58 to $0.54 per share from the prior range of $0.59 to $0.54 per share.

For the full year, the company now predicts billings in the range of $320 million to $324 million, representing year-over-year growth of 48% to 50%. Adjusted operating loss is now predicted to be in the range of $70 million to $66 million. Net free cash flow burn is projected to be up to $25 million for fiscal 2020.

The company ended the second quarter with 82,186 domain-based customers. The number of all customers with annualized contract values (ACV) of $5,000 or more grew to 7,673, an increase of 55% year-over-year. The number of all customers with ACV of $50,000 or more grew by 113% to 635 and the number of all customers with ACV of $100,000 or more soared by 128% to 226. Average ACV per domain-based customer increased by 48% to $2,972. The dollar-based net retention rate was 134%.

Smartsheet has incurred losses in each quarter since incorporation in 2005. This reflects the substantial investments the company made to develop its platform and acquire new customers. The losses are likely to continue for the foreseeable future as investments are likely to increase operating expenses. The company’s future growth depends upon increasing its customer base and expanding sales of its platform to existing customers.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.