The company, which went public in April last year, provides various cloud-based platforms, including Smartdashboards, Smartportals and Smartcards, all of which help in streamlining operations and workflow of businesses. Smartsheet competes with companies including Atlassian (TEAM), Salesforce (CRM), ServiceNow (NOW), Workday, Adobe etc.

Since going public, the stock has almost tripled, thanks to the company’s ability to steadily increase its revenue and bookings. The Bellevue, Washington-based firm also boasts of a healthy balance sheet as well as a high ROE. Since the beginning of this year, the stock has gained 83%.

Investors will also be keen to hear out how the newly-appointed Chief Technology Officer Praerit Garg plans to manage the firm in the coming days. It may be noted that Garg is an executive with over 20 years of experience, including founding two cloud-based start-ups.

READ: DOCUSIGN SURPRISES WALL STREET WITH A PROFIT IN Q4

The stock has an average 12-month price target of $10.92, suggesting a 6.5% upside from Friday’s close. SMAR has a Moderate Buy rating.

In Q3

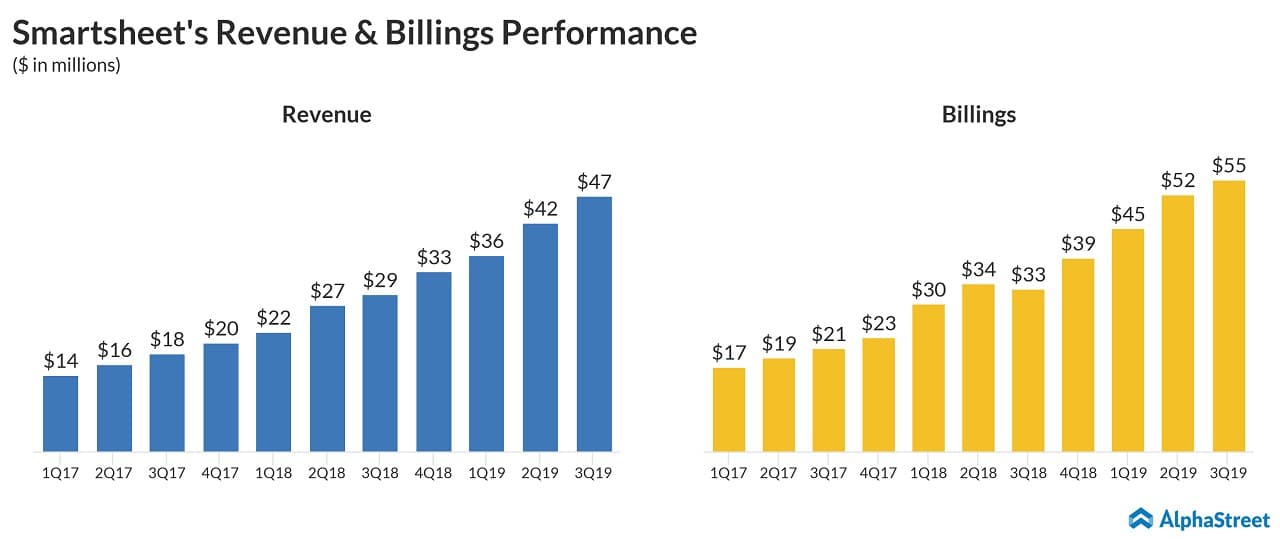

For the last reported quarter, Smartsheet posted a loss of 9 cents per share and revenue of $47 million, beating analysts’ estimates. Subscription revenue surged 57% to $41.5 million and professional services revenue climbed 81% to $5.3 million. The stock jumped about 8% during the extended trading hours.