Shares of Smartsheet (NYSE: SMAR) jumped 7% in the extended hours of trading after the company posted strong Q4 results, surpassing analyst estimates. The company’s stock has jumped 75% this year and it’s having a dream run in the bourses since IPO last April. The Smartsheet stock has skyrocketed about 185% from the list price of $15, aided by solid revenue growth.

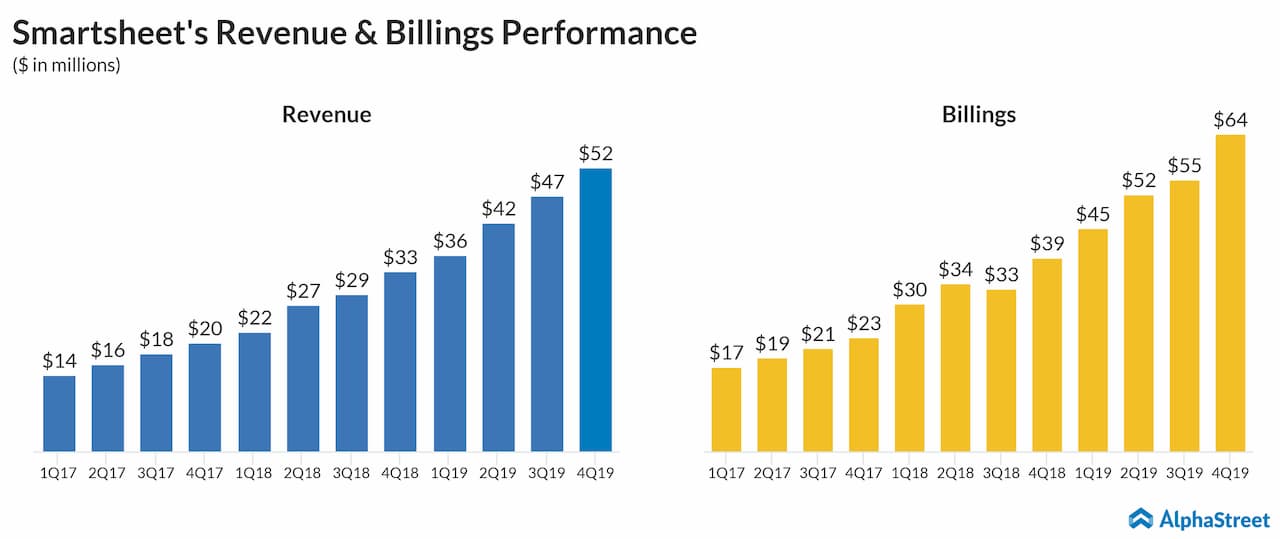

Smartsheet’s Q4 revenue jumped 58% to $52.2 million aided by strong growth from the subscription front. Non-GAAP loss per share came in at $0.07 over $0.08 reported last year. Analysts were expecting the cloud-based platform to report a loss of $0.14 per share on sales of $49.75 million. Last quarter, the company guided Q4 revenues of $49 million to $50 million and loss per share to be between $0.13 and $0.15.

Commenting on the fourth quarter results, CEO Mark Mader said, “Our work execution platform continues to empower customers across the globe”. CFO Jennifer Ceran added, “The momentum in our business is supported by strength across our key metrics.”

Subscription revenues jumped 56% to $46.5 million. It’s worth noting that revenue from subscription contributes to the lion’s share to the top line results. Solid subscription growth shows the increasing adoption of the company’s products by clients across industries, which is a good sign for investors about the long-term potential of the firm.

Key Metrics Performance

On the key business metrics front, Smartsheet continues its positive momentum from the Q3 period. The company added 1,066 customers in the fourth quarter ending with 78,959 customers over the last quarter. The number of customers with annual contract value more than $50,000 touched 444, which is a 135% jump over last year.

Average contract value surged 50% to $2,454 which shows bigger companies are moving towards a cloud-based collaboration environment. This is a positive sign for investors as the company would benefit from improved market penetration and diversified customer base.

The retention rate for the quarter was 134% compared to 132% reported last quarter. The improvement in dollar retention rate shows the ability to retain and upsell more products to its existing customers who are with the firm for more than a year.

Fiscal Guidance

Smartsheet expects Q1 revenue for fiscal 2020 to be $54 million to $55 million. This is higher than what street was expecting from the firm of $52.05 million. On an adjusted basis, loss per share is forecasted in the range of $0.19 to $0.18.

For the fiscal 2020 period, sales is guided between $253 million to $257 million, eclipsing $243.77 million expected by analysts. Non-GAAP loss per share is forecasted to come in at $0.59 to $0.55. However, the street expects a loss per share of $0.52 for the next fiscal period.

The company’s cloud-based tools compete with the likes of Atlassian (TEAM), Salesforce (CRM), ServiceNow (NOW), Workday, Adobe (ADBE), Asana, Planview, Workfront, Microsoft (MSFT) and Google (GOOGL).