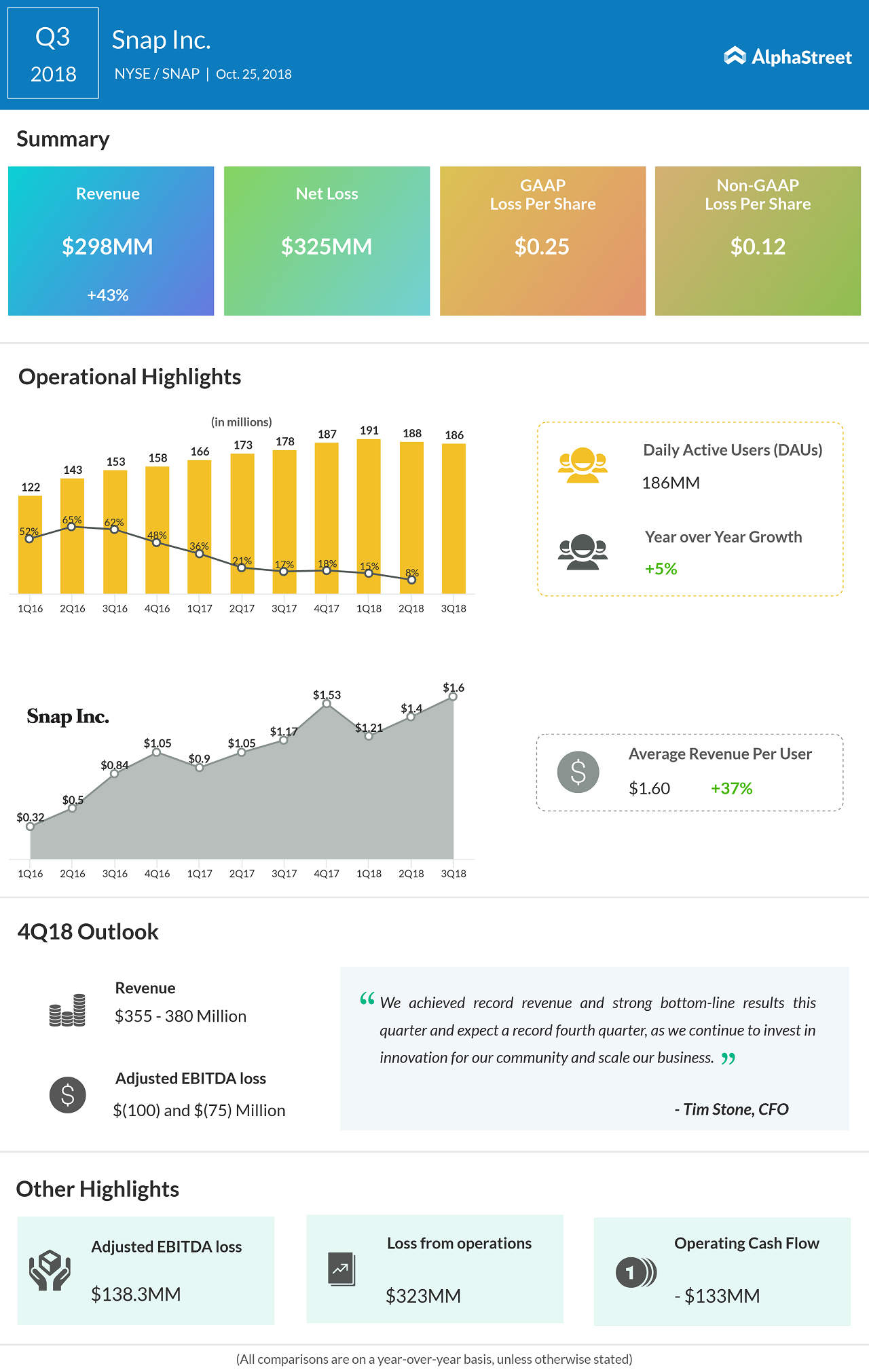

The number of daily active users, a key measure of operating efficiency, moved up 5% to 186 million, which is down 1% sequentially but in line with estimates.

In a sign that the management’s efforts to improve pricing are yielding the desired results, average revenue per user rose to $1.60 and came in above forecasts. The impressive third-quarter results complement the company’s target of achieving breakeven by next year, with continued focus on third-party advertising and strategic content partnerships.

The number of daily active users, a key measure of operating efficiency, moved up 5% to 186 million

Snap is looking for revenues between $355 million and $380 million for the fourth quarter, a new high that represents a 24- 33% year-over-year growth. Adjusted EBITDA loss is expected to narrow sharply from last year to $100 million.

Defending criticism over the app’s controversial redesign, CEO Evan Spiegel recently said the upgrade was done without proper insight, causing it to slow down. The flawed upgrade had resulted in a fall in the number of daily users.

Snap shares have been under stress as profitability continues to elude the company. After having closed Thursday’s regular trading session higher, the stock witnessed sharp fluctuation during the extended trading session and dropped 7%.