It’s been a pretty rough year so far for Japanese conglomerate Softbank, which invests primarily in technology firms around the globe. It’s ride-hailing darling Uber (NYSE: UBER) had a forgettable IPO despite all the hype, and the workplace collaboration platform Slack Technologies (NYSE: WORK), which had a fairly receptive direct listing, is currently trading 35% below its offer price.

WeWork, where it holds approximately 29% stake, was forced to postpone its IPO plans as questions were raised on its valuation and path to profitability. All this has contributed to analysts and market observers questioning the rationale behind the Tokyo-based holding company’s investment strategy.

However, there is one India-based start-up in its kitty that has been undergoing robust global expansion. Softbank will be pinning its hopes on this company’s profitability.

For those who have traveled across Asia in the past two years, the red round logo of Oyo may not be unfamiliar. Founded in 2013, OYO Homes & Hotels is today the world’s third-largest chain of franchised hotels and living spaces with over 1.2 million rooms spanning across more than 80 markets.

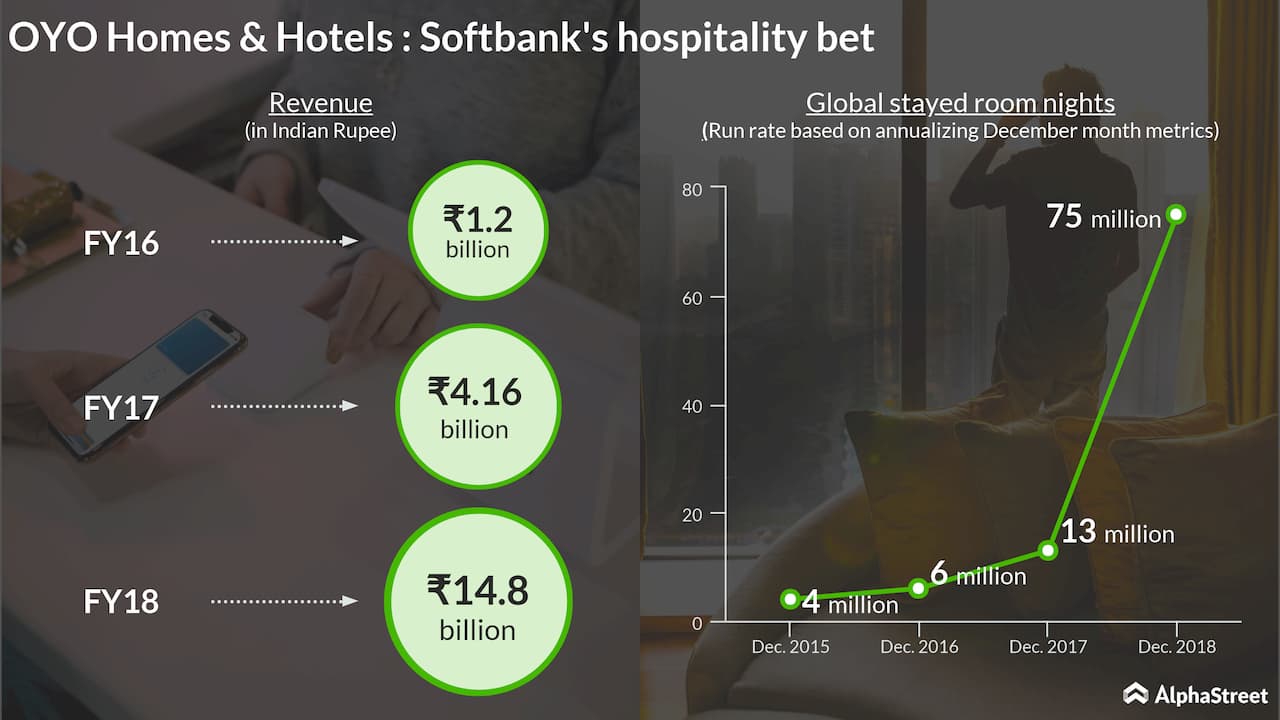

The robust growth in

its short span was spearheaded by its now 25-year-old CEO Ritesh Agarwal.

Softbank Vision Fund has injected $1 billion (owning around 40% stake) into this unicorn, which currently has a valuation of approximately $10 billion. This, along with funding from other key investors including Sequoia Capital, Lightspeed, Greenoak Capital and Airbnb has helped the firm expand into Japan, China, Malaysia, UAE, etc.

Recently, the company bought and rebranded the Hooters Casino Resort in Las Vegas for approximately $135 million, establishing a firm footing in the US. Oyo is making considerable investments in Europe as well through the $415-million purchase of Leisure Group among others.

However, Oyo’s lack of profitability doesn’t help Softbank ease the criticism it is currently facing. Softbank CEO Masayoshi Son is reportedly struggling to raise investment for Vision Fund 2 after the recent lackluster performance of its holdings.

Bottomline bites

Meanwhile, a few critics have come out strongly comparing Oyo with WeWork. New York University professor Scott Galloway has said, with too much funding from Softbank and lack of clarity with respect to achieving profitability, Oyo is almost like WeWork.

With its reputation stake, Softbank is betting big on the profitability of Oyo to regain its lost status as a prudent investor. While the accelerated growth offers some temporary respite, a lot would depend on bottom-line results.

Listen to on-demand

earnings calls and hear how management responds to analysts’ questions