Shares of Yelp (NYSE: YELP) were down over 15% on Friday, a day after the company reported a decline in revenue along with a net loss for the second quarter of 2020. Despite the drop, the results were better than Street projections, which gave the stock a boost at the time. Yelp’s stock has declined 34% since the beginning of this year.

Quarterly results

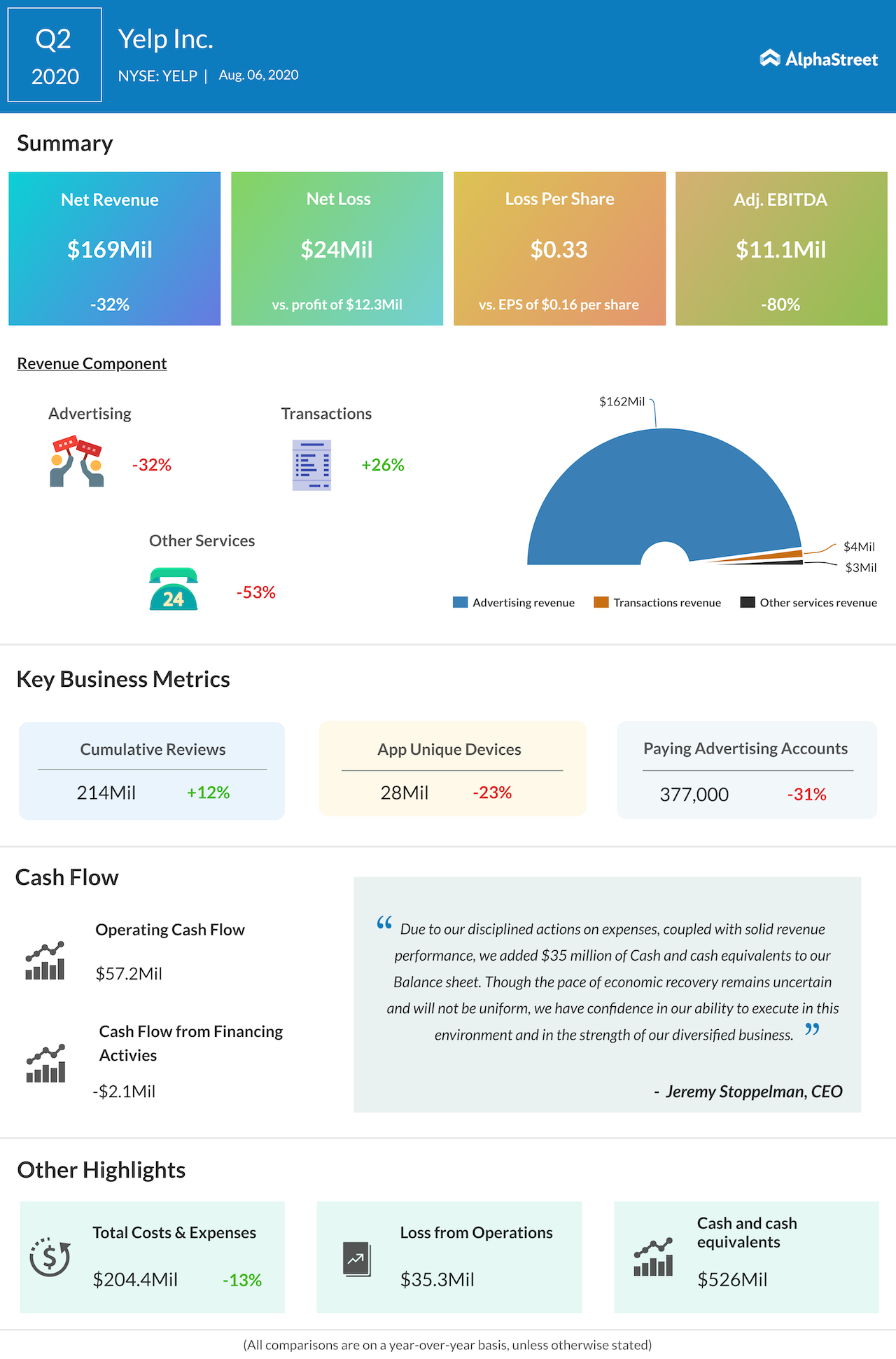

Yelp’s net revenue fell 32% to $169 million, mainly due to the health crisis and related relief incentives offered to advertising and other services customers. At the end of April, the company’s traffic was at around half of its pre-COVID level and its CPC advertising budgets had reduced significantly due to businesses and customers being impacted by the shelter-in-place orders.

Yelp paused and waived advertising campaigns and fees and provided free products and services to its customers in order to support them. These efforts resulted in a decline in the top line. Traffic and ad budgets began to improve in May and by June, the company began to see steady improvements.

The decrease in net revenues led to a net loss of $24 million, or $0.33 per share, compared to a net income of $12 million, or $0.16 per share, last year.

Advertising business

Advertising revenues fell 32% as customers reduced ad budgets, mainly in the restaurant and nightlife categories, due to the pandemic and related restrictions. Ad budgets began to pick up by late May and improved in June, with varied results across categories.

Page views and searches in Home & Local Services, which fell 40% in March, rebounded to reach pre-pandemic levels by the end of the second quarter. Ad budgets saw a recovery from April levels, which led to a mid single-digit percentage decline in category revenue. Within the category, local services were impacted more than home services.

The Restaurant category saw a revenue decrease of over 60%, despite traffic improving moderately, as dine-in restrictions led to a 30% drop in page views and searches versus pre-pandemic levels. Yelp gets a significant portion of traffic from this category, making it important to its long-term strategy.

Yelp saw a 31% year-over-year decrease in paying advertising locations but the company believes this effect will be temporary and many of the businesses that have shut down will resume operations once things get back to normal. The pace of recovery in paying advertising locations is expected to be in line with the pace of overall recovery.

Cash position

Operating cash flow amounted to $57.2 million at quarter-end. The company generated adjusted EBITDA of $11 million and managed to reduce operating expenses by 13%. Yelp’s cash balance increased to $526 million at the end of the second quarter compared to $491 million at the end of the first quarter.

Outlook

Looking ahead, Yelp still faces economic uncertainty. Despite business performance improving in June, due to the return of spend from many customers, revenues in the month fell 25% year-over-year.

Traffic began to plateau in July due to the resurgence of COVID-19 cases and looking forward, Yelp expects businesses will see fluctuations in their operations until the arrival of a vaccine or other medicines. This volatility is expected to impact the company’s pace of revenue recovery.

In the current volatile environment, Yelp expects its operating costs in the third quarter to increase as much as $30 million from the second quarter as it spends on salaries and healthcare costs for employees and deals with doubtful accounts.