In an interview with AlphaStreet, Solar Integrated CEO Dave Massey said EV is going to be a huge revenue driver for the firm going forward, with the expected ban on new gas vehicles after 2035 and the regulations surrounding the mandated solar on new homes acting as a major tailwind.

Growing EV charging business

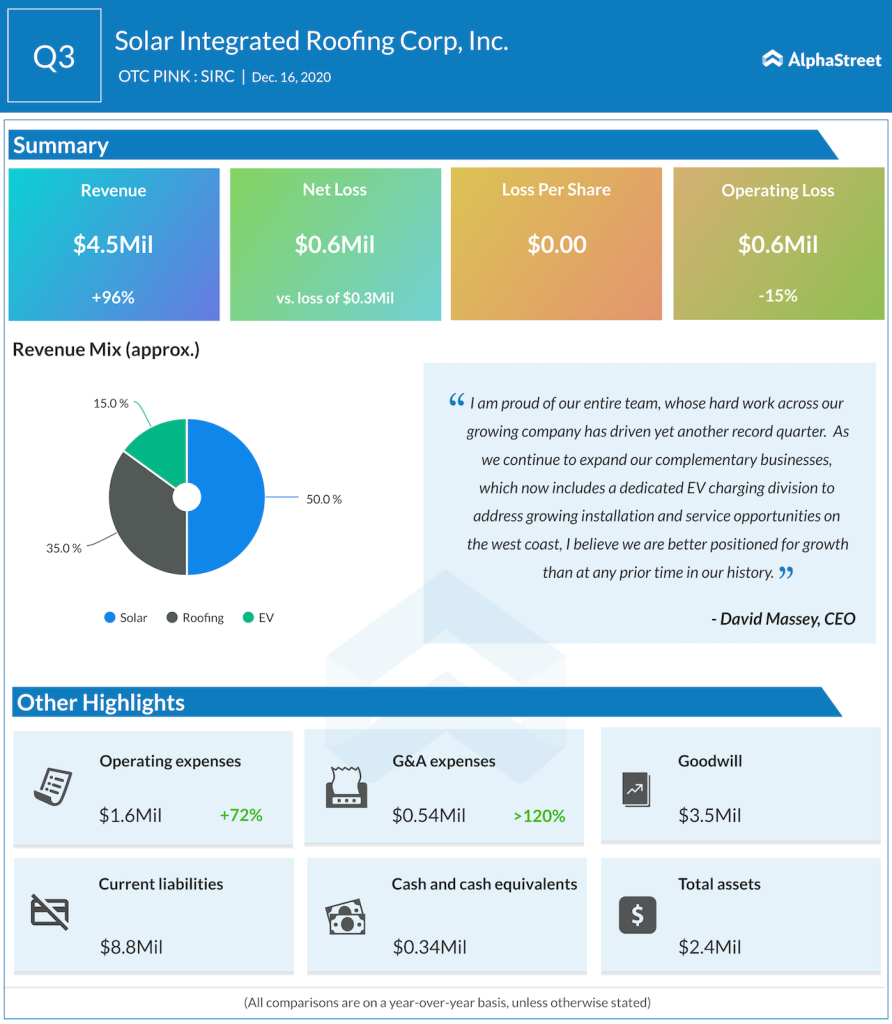

The CEO said, “Currently our revenue mix is about 50% solar, 35% roofing, and 15% EV. But we feel like EV is going to gain a lot of momentum throughout the year and is going to account for a larger section of revenue going forward. It’s a huge growing market right now.”

To enhance its EV capabilities, SIRC had recently acquired Pacific Lighting Management, a provider of charging stations with both commercial and government facilities as customers. SIRC aims to grow through more acquisitions in the EV and solar space over the next few years and increase its annual revenue run rate to $100 million, from the current level of $50-60 million.

Currently, Solar Integrated management is focusing on gaining inroads into new markets including Texas and Indiana, with a long-term target of establishing a presence in all solar states. The management expects to have a significant US presence by the end of 2022.

Gevo will be a milestone company for the next few years: CEO Patrick Gruber

Profitability

Asked about the profitability targets, Massey said, “We definitely plan on being profitable this year. We are still in a growth stage, but with our revenues getting where they are, they’re going to overcome the extreme cost of being public. We are very confident that in the fiscal year 2022, we will show at least 5% profit. And then we will build on that going forward.”

The company is soon likely to be uplisted to OTCQB, and the management looks forward to another uplist to Nasdaq sometime around the fall. The company’s stock currently trades at less than $1 per share, and has seen a threefold increase in valuation since the start of the year.

______