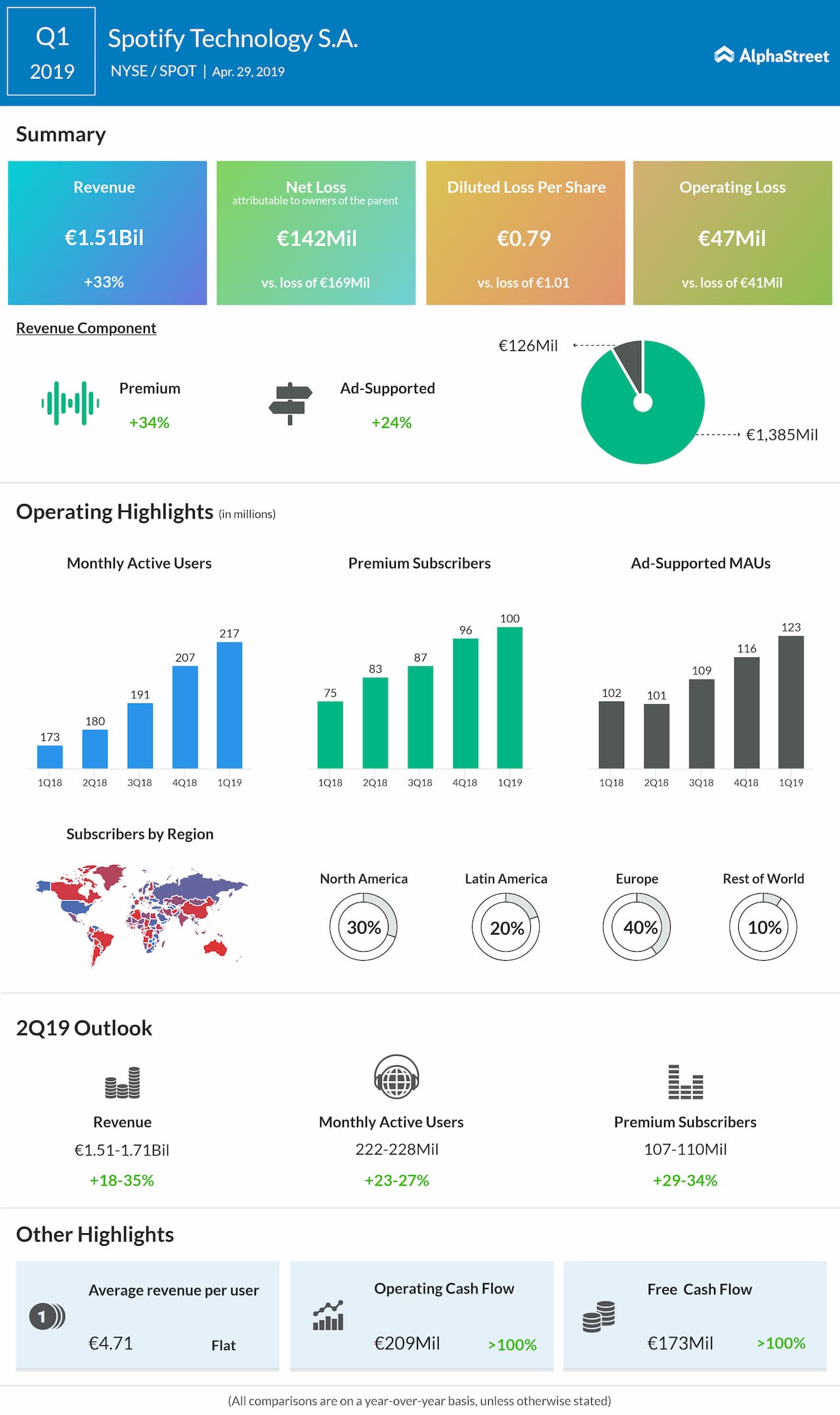

Net loss attributable to owners of the parent was EUR142 million, or EUR0.79 per share, compared to EUR169 million, or EUR1.01 per share, in the same period a year ago.

Monthly active users (MAUs) grew 26% year-over-year to 217 million, slightly lower than the midpoint of the company’s guidance range of 215-220 million MAU.

Average revenue per user (ARPU) was EUR4.71, roughly flat year-over-year. Spotify has experienced a declining trend in ARPU due to shifts in product and geographic mix. The company believes the downward pressure on ARPU has moderated and now expects ARPU declines through the remainder of the year to be in the low single digits.

Spotify’s key areas of growth during the quarter were measurement and programmatic revenues. Measurement-related revenues doubled from 20% to 40% of total ad revenues year-over-year. Programmatic and Self-Serve grew 53% from last year and now account for 26% of total ad-supported revenue.

In late February, Spotify launched its service in India and now has more than 2 million users in the country. The company’s global market footprint now spans 79 countries.

Premium subscribers grew 32% year-over-year to 100 million, reaching the high end of the company’s guidance range of 97-100 million. The outperformance was driven by a better than plan promotion in the US and Canada and continued strong growth in Family Plan.

For the second quarter of 2019, Spotify expects revenue to grow 18-35% year-over-year to EUR1.51 billion to EUR1.71 billion. Operating loss is expected to come in the range of EUR15-95 million. Total MAUs are expected to increase 23-27% year-over-year to 222-228 million while total premium subscribers are expected to grow 29-34% to 107-110 million.

For the full year of 2019, the company expects revenue to grow 21-29% to a range of between EUR6.35 billion and EUR6.8 billion. Operating loss is expected to be EUR180-340 million. Total MAUs are expected to increase 18-28% year-over-year to 245-265 million while total premium subscribers are expected to grow 21-32% to 117-127 million.