Sprint Corp. (S) turned to profit in the second quarter as revenues increased amidst stable subscription growth, defying analysts’ expectations for a loss. Shares of the company, which is currently in merger talks with rival T-Mobile (TMUS), gained around 6% after the announcement.

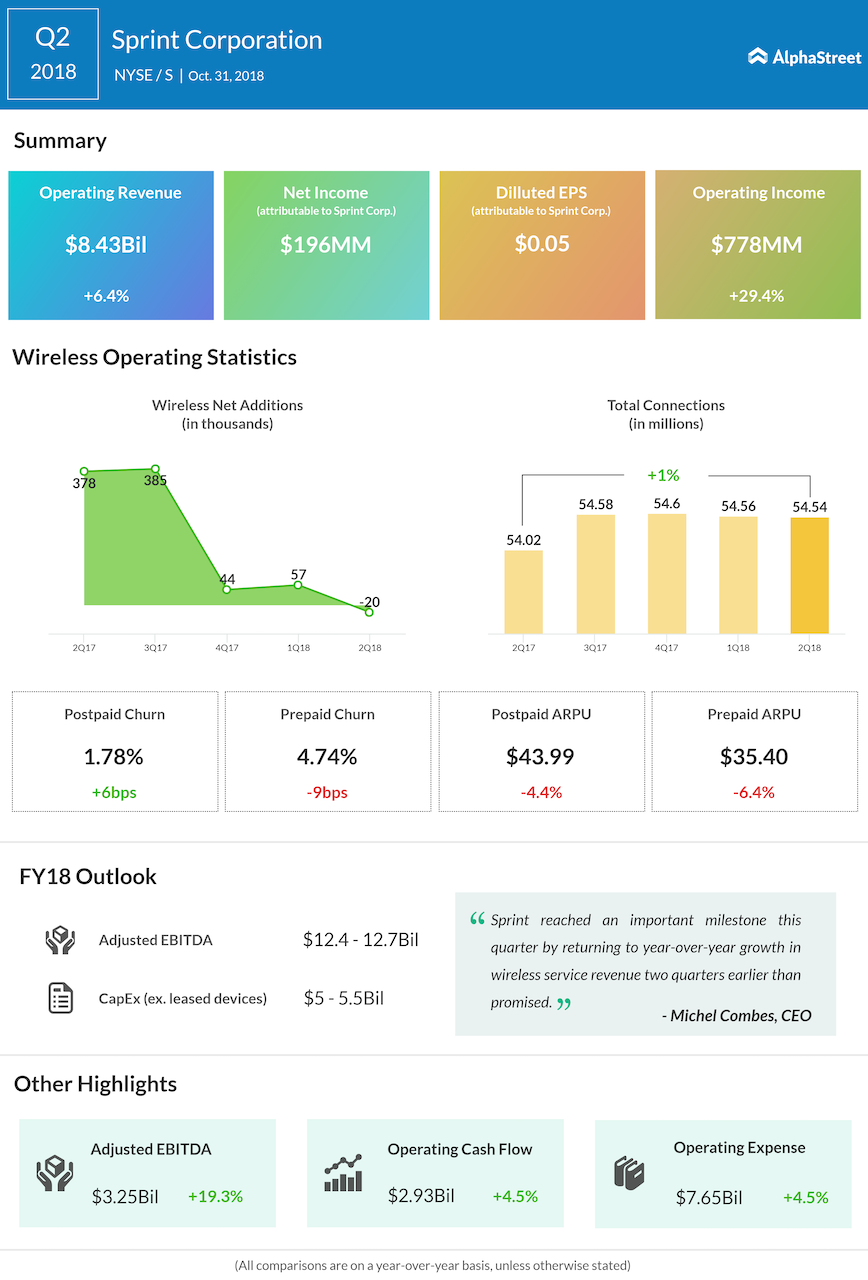

The Overland Park, Kansas-based company reported net income of $196 million or $0.05 per share for the second quarter, compared to a loss of $48 million or $0.01 per share in the corresponding period last year. Analysts had predicted the telecom firm would remain in the negative territory.

Net revenues advanced 6% annually to $8.4 billion during the quarter when wireless service revenue increased year-over-year for the first time in nearly five years. The top line beat Wall Street estimates.

At 109,000, overall net subscriber additions remained strong during the period, despite a decline compared to last year. The company said it recorded retail postpaid additions for the fifth straight quarter and prepaid net additions in the Boost brand for the seventh quarter.

At 109,000, overall net subscriber additions remained strong during the period, despite a decline compared to last year

“Sprint reached an important milestone this quarter by returning to year-over-year growth in wireless service revenue two quarters earlier than promised. Our strategy of balancing growth and profitability while we increase network investments and add digital capabilities continues to drive solid financial results,” said CEO Michel Combes.

Encouraged by the impressive results, the company raised its full-year adjusted EBITDA outlook to a range of $12.4 billion to $12.7 billion from the previous forecast of $12.0 billion-$12.5 billion. It is looking for cash capital expenditure between $5.0 billion and $5.5 billion for 2018. The management expects that a projected two-fold increase in network speed, after the nationwide deployment of LTE Advanced features, will improve the quality of service further.

The positive second-quarter results indicate Sprint managed to sustain its subscriber base despite the higher price tag on certain services, especially unlimited plans. Last week, Verizon (VZ) reported better-than-expected earnings for the third quarter, while AT&T’s (T) earnings for the most recent quarter missed estimates.

The market has been closely watching the progress of Sprint’s proposed merger with rival T-Mobile, with some experts taking a pessimistic view considering the headwinds to the deal, including regulatory roadblocks, uncertainties surrounding the 5G rollout and tariff-related issues.

Sprint’s stock, which closed the previous trading session lower, gained sharply in the pre-market following the earnings report. Over the past one year, the stock dipped about 15%.