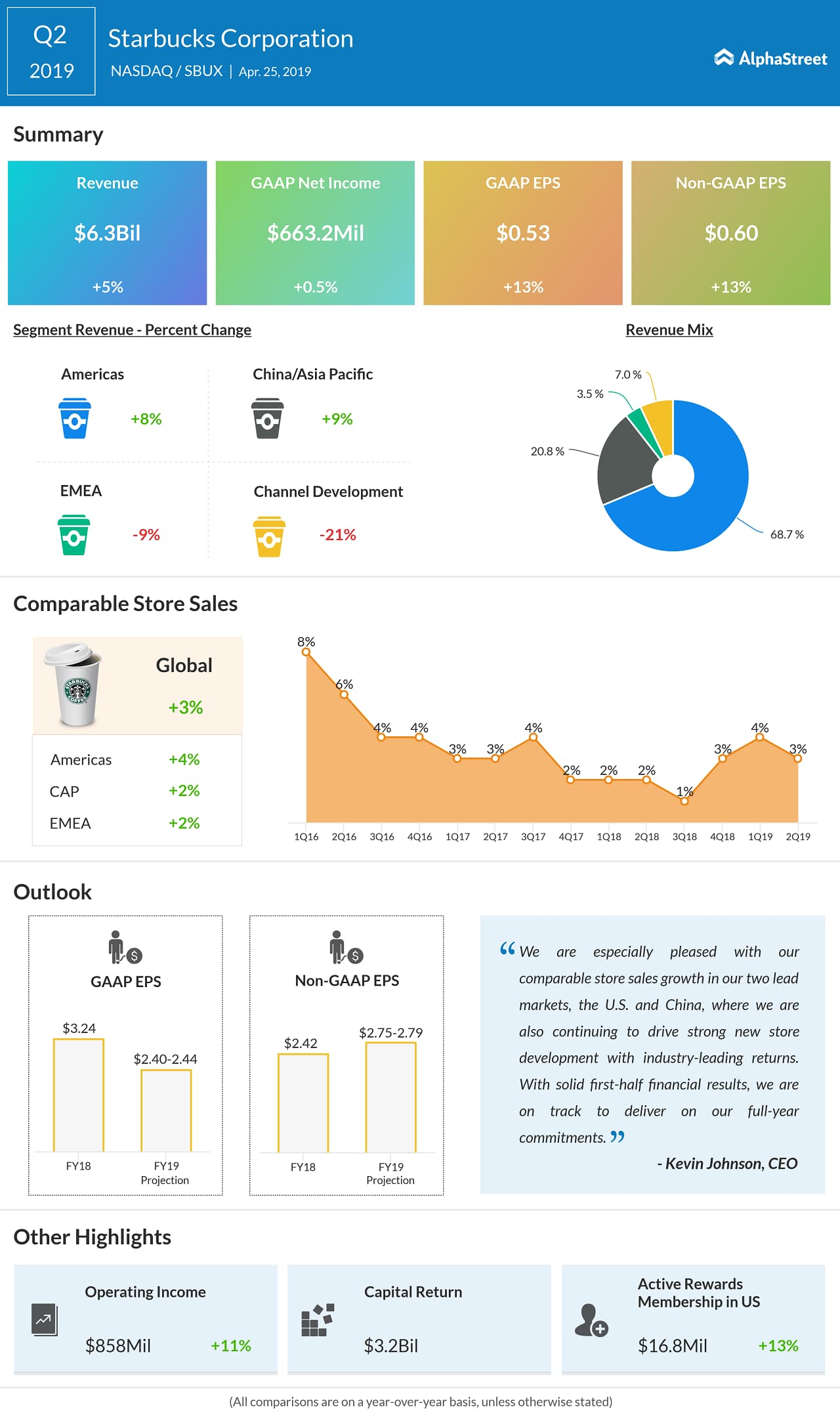

On a GAAP basis, net income rose 12.8% to 53 cents per share, helped by a 5% growth in net sales to $6.31 billion. The top line came in line with the street expectation.

Global comparable sales rose 3%, in line with the street projection, driven by a 3% increase in average ticket.

READ: THE CANNABIS-BEVERAGE INDUSTRY IS SOMETHING YOU DON’T WANT TO MISS THIS YEAR

The second-quarter earnings come at a time when the coffee company is facing tight competition in its second-largest market – China. We had earlier reported how Chinese coffee joint Luckin Coffee is offering stiff resistance to Starbucks’ growth, by offering affordable coffee on the go.

Earlier this week, Luckin filed for a US IPO, to reportedly raise up to $800 million. All this has contributed to a recent spike in short interest in SBUX stock.

Outlook

Looking ahead into fiscal 2019, the company expects global comparable store sales growth between 3% and 4%. It is also aiming to open approximately 2,100 net new stores around the globe before the end of this year.

Starbucks raised its guidance for FY2019 Non-GAAP EPS in the range of $2.75 to $2.79. Previously it was projected to be in the range of $2.68 to $2.73.

Outlook for FY2019 GAAP EPS was raised to $2.40 to $2.44 from the prior range of $2.32 to $2.37.

Price target hike

Last week, Andrew Charles of Cowen raised the price target on the coffee chain from $63 to $69. However, the new price is still at a 9% discount from the current trading price.