North America

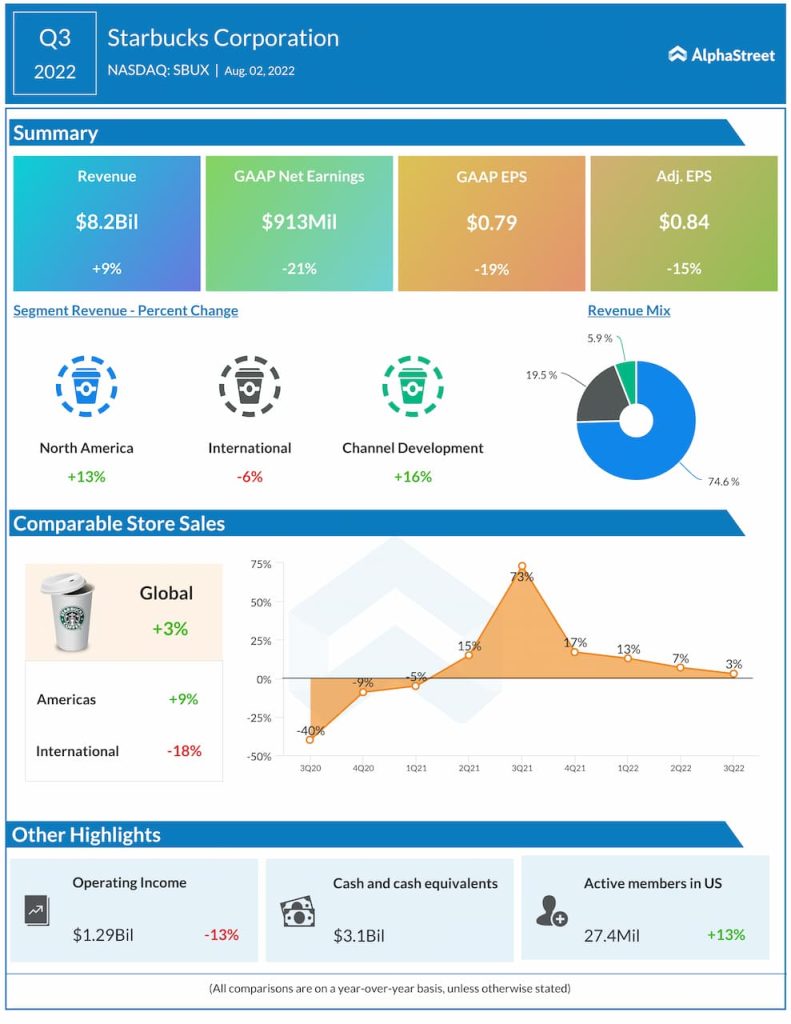

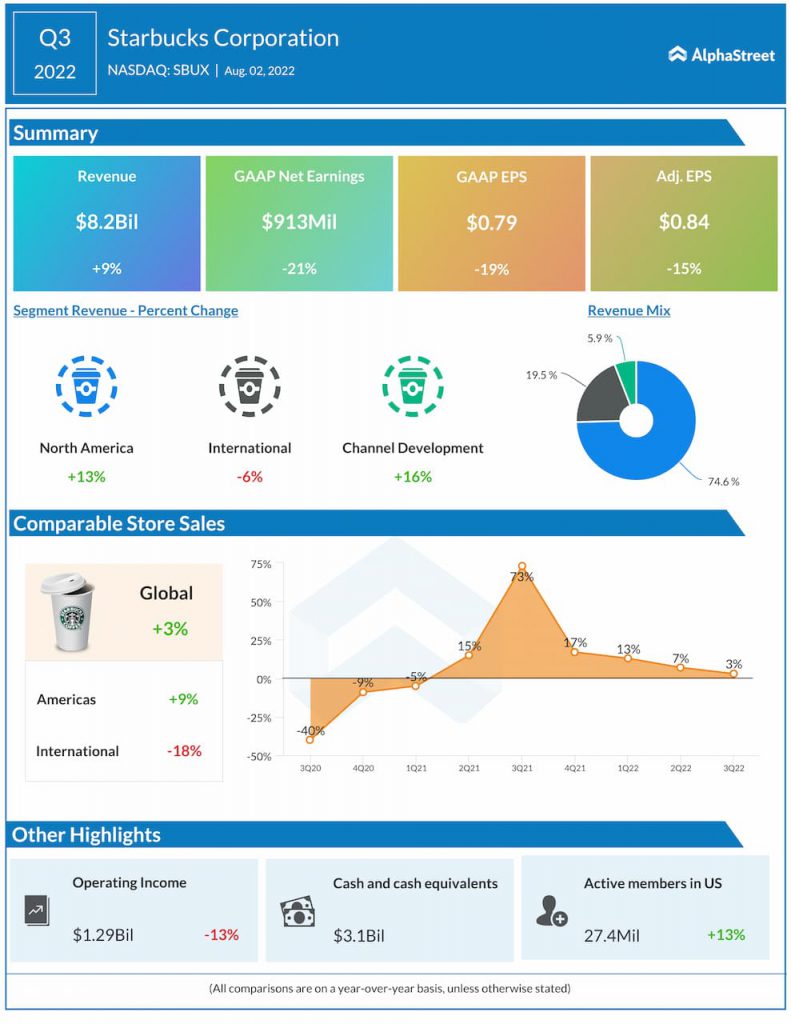

Comparable store sales increased 9% during the quarter, fueled by increases in average ticket and transactions. Revenue growth of 24% from its licensed store business also contributed to the growth in comp sales.

Starbucks continued to see strong demand for its coffee in the US with comparable store sales rising 9% in Q3. The company’s Rewards program played a meaningful role in driving traffic and momentum in its business. During the quarter, 53% of US company-operated revenue came from Starbucks Rewards members. Starbucks also saw strength in its Mobile Order & Pay, drive-thru, and delivery channels which drove 72% of revenue in the US.

At the end of Q3, Starbucks had 15,650 stores in the US. It plans on investing an incremental $450 million in its existing US store base in fiscal year 2023 with continued investment in fiscal years 2024 and 2025. These investments are expected to create efficiencies and increase throughput to meet the rising customer demand. Over the long term, Starbucks is looking to ramp up US store growth to 3-4% annually with new store economics expected to deliver 50% return on investment and 25% cash margin.

China

China is Starbucks’ second largest market and together with the US it makes up 61% of the coffee purveyor’s global store portfolio. The COVID-19 pandemic disrupted the company’s operations in China during the third quarter of 2022 causing net revenues to fall 40% and sales comps to drop 44% year-over-year.

Despite the headwinds, Starbucks continued its store expansion in the region, opening 107 new stores and entering three new cities. The company ended the third quarter with 5,761 stores in China and remains on track to increase this number to 6,000 by the end of this year.

China’s coffee market is still in its early stages and Starbucks is making strategic moves to capture its full growth potential. The company continues to invest in its stores, omni-channel capabilities and digitization. The company expects sales in China to nearly double over the next three years and store count to grow by 50%, reaching 9,000 stores.

Starbucks expects comparable store sales performance in China to be substantial in FY2023 and FY2024 as it laps the negative effects of the pandemic. Growth is expected to normalize in the range of 4-6% in FY2025 reflecting the vast opportunity in this market.

Long-term targets

Starbucks expects global revenue growth of 10-12% annually from FY2023 to FY2025, which is up from its previous range of 8-10%. Over this time period, comparable store sales growth is expected to be 7-9% annually, both globally and in the US, up from the previous range of 4-5%. The global store portfolio is expected to grow by roughly 7% annually versus the previous estimate of 6%. Adjusted EPS is projected to grow 15-20% annually through FY2025 versus the previous range of 10-12%.