Starbucks Corporation (NASDAQ: SBUX), the fast-food chain that popularized the coffeeshop culture across the globe, has been able to create shareholder value consistently. The company is all set to unveil its first-quarter results Tuesday after the market’s close.

Related: Starbucks Q4 2019 Earnings Conference Call Transcript

It is widely expected that the uptrend in Starbucks’ top-line performance would continue this tome, with experts predicting a sharp increase in revenues to $7.1 billion. Profit is expected to remain unchanged year-over-year at $0.75 per share, reflecting the softness in margin performance and high costs.

Comp Sales Trend

The company has been recording decent comparable sales growth in China, a key market in terms of market share, despite intense competition from local player Luckin Coffee (LK). While the trend is likely to continue in the to-be-reported quarter, the slowdown in the Chinese economy could have a negative impact on sales.

Starbucks’ global strategy, with focus on enhancing customer experience through store remodeling and digital innovation, has been producing the desired results, especially in China where it has a delivery partnership with Alibaba (BABA). The company’s top-line is estimated to have benefited from new store openings also, in the first three months of 2020.

Brand Power

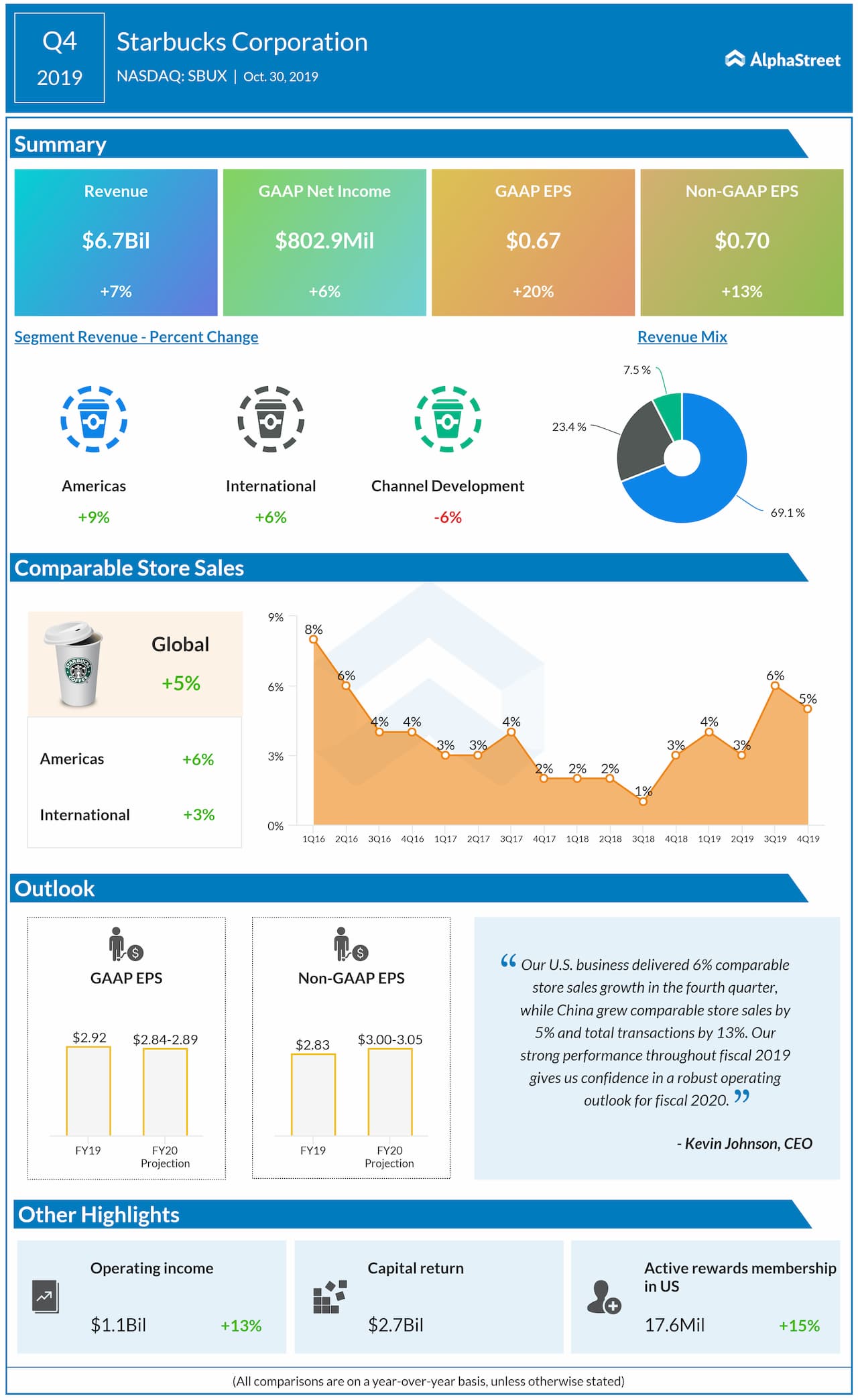

The response to Starbucks’ new Rewards program has been positive and last year alone, the number of customers availing the facility grew by 15%. The demand for the company’s pricey specialty drinks, the primary source of margin, has increased in the recent past. The trend is encouraging both in terms of profitability and brand expansion. However, the coffee segments of rivals McDonald’s (MCD) and Dunkin Brands (DNKN) are trying to catching up, which points to the need for Starbucks to keep innovating.

Q4 Outcome

In the fourth quarter of 2019, the coffeehouse chain recorded in-line earnings but guided full-year 2020 earnings below the Street view. Benefiting from solid sales in both the U.S and overseas markets, revenues moved up 7% and surpassed the estimates. Earnings grew in double digits to $0.70 per share.

Starbucks shares have been moving up steadily, after retreating from the record highs seen early last year. The stock, which is currently trading below the $100-mark, gained 39% in the past twelve months. Analysts’ consensus rating is moderate buy, with a price target of around $98.