Net income was $7 million, or $0.07 per share, compared to

$9.4 billion, or $0.09 per share, in the year-ago period.

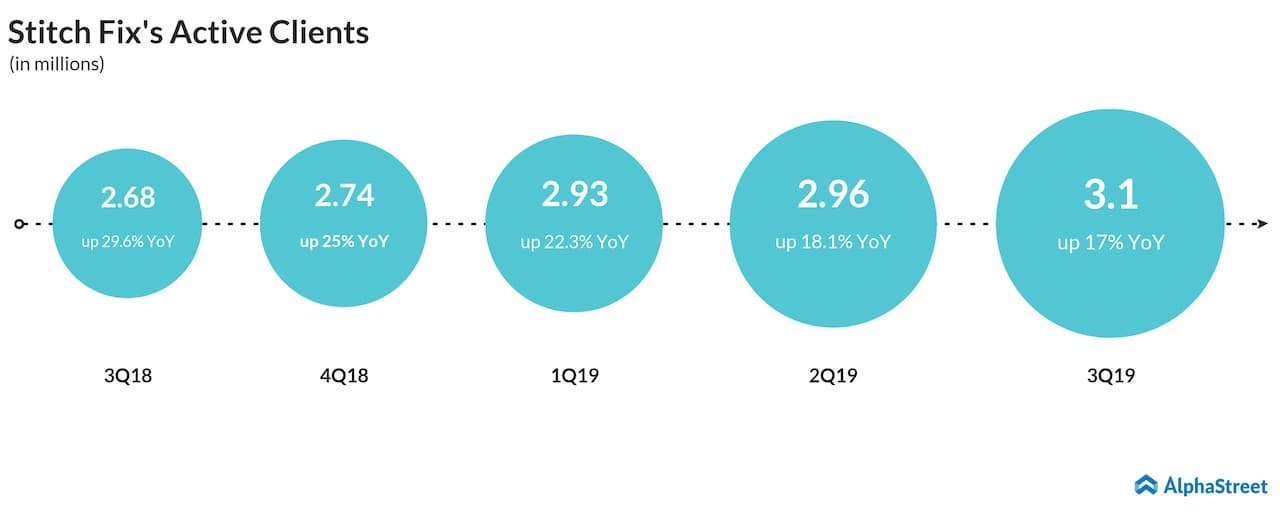

Active clients increased 17% year-over-year to 3.1 million.

CEO Katrina Lake said, “We grew our active clients to 3.1 million, an increase of 17% year over year. At the same time, we continue to drive engagement with our existing client base, growing revenue per active client 8% year over year. These results demonstrate our ability to attract new clients and to serve our existing clients well. The continued strength of our Women’s category and the growth of our Men’s category give us even more confidence in our ability to scale new categories and geographies.”

Gross margin increased by 150 basis points to 45.1%, marking the fifth consecutive quarter of year-over-year gross margin improvement. The growth was driven by lower clearance activity and lower shrink expense.

For the fourth quarter of 2019, Stitch Fix expects net revenue to increase 34-37% year-over-year to $425 million to $435 million. Adjusted EBITDA is expected to be $5-10 million. For fiscal-year 2019, net revenue is expected to grow 28-29% year-over-year to $1.57 billion to $1.58 billion while adjusted EBITDA is estimated to be $38-43 million.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.