Revival Plan

The key to achieving the goals will be to expand market share, competing with other players like DoorDash and Uber. As far as shareholders are concerned, the good news is that the stock is shifting to recovery mode. The relatively low price, which is sharply below the record highs seen two years ago, should be an encouragement to those planning to invest.

Wait & Watch

However, the prevailing uncertainty over Grubhub’s future calls for caution, especially in the wake of unconfirmed reports that the company might be looking for buyers to sell its assets. Experts are of the view that it is not the right time to buy and suggest that those who already own the stock may hold it.

Related: GrubHub Q4 2019 Earnings Conference Call Transcript

ADVERTISEMENT

The management’s revival strategy, with focus on adding more restaurants to retain customers, needs a long-term execution plan. So, it will take some time before the efforts yield the desired results. Initial estimates indicate that 2020 will be a challenging year for the company when market headwinds like competition are expected to weigh on earnings and revenues.

Q4 Outcome

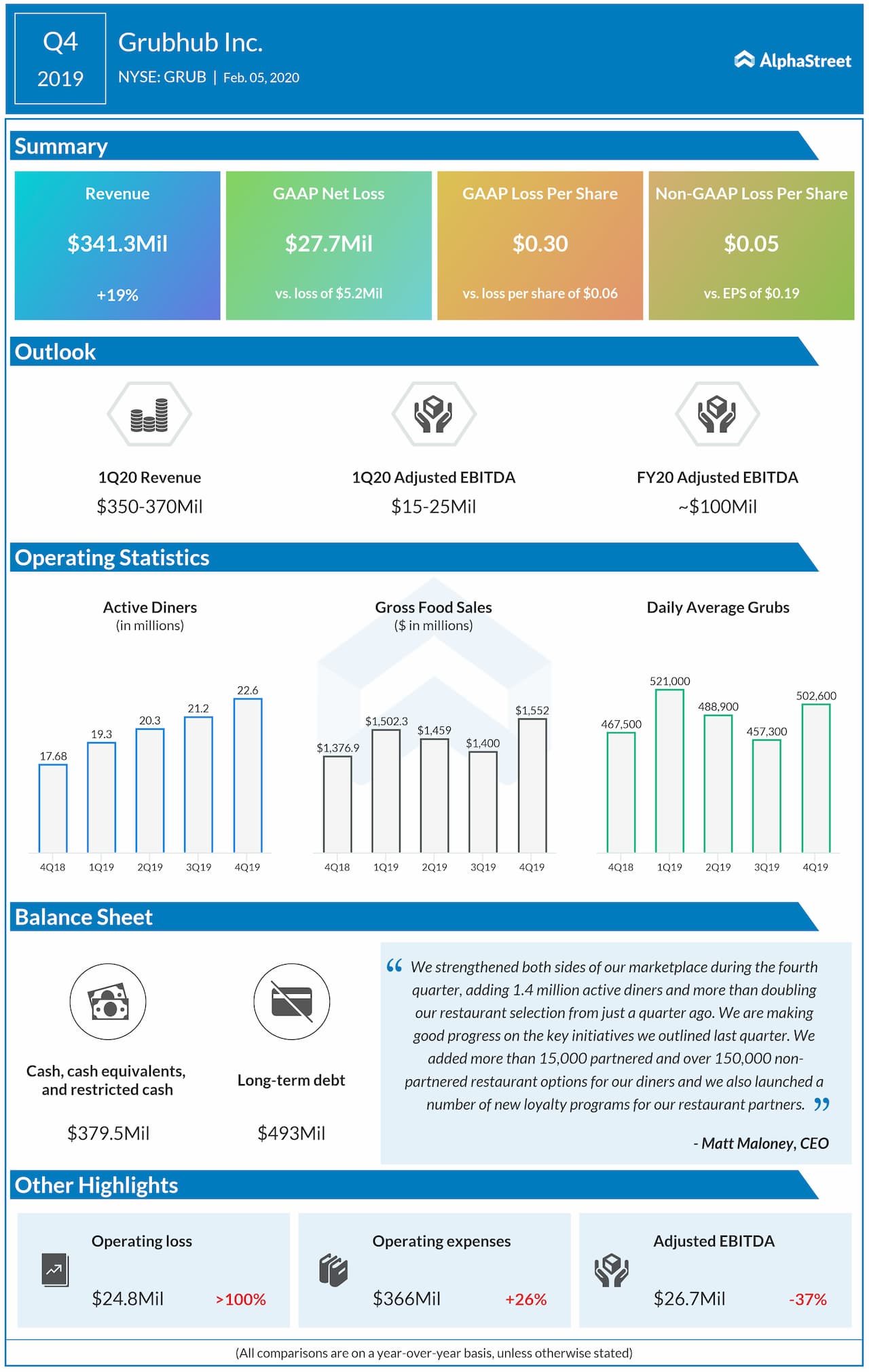

In the fourth quarter, Grubhub slipped to a loss of $0.05 per share, which also missed the estimates. Revenues, meanwhile, rose to $341.3 million aided by a double-digit increase in the number of active diners.

A few months ago, Grubhub’s shares slipped to the lowest level in two-and-half years, following its unimpressive quarterly results. After that, the stock almost fully recovered and gained about 15% since the beginning of the year.