SAP’s acquisition of Qualtrics had boosted SurveyMonkey’s stock price on Monday’s trading session, which rose 6.78% to $11.50. The survey software developer’s shares, which jumped about 60% on its first day of trading, got battered in the following days and was trading below its IPO price of $12 over the past three-week period.

The company reported $62.7 million in sales and a net loss of $12.5 million for the quarter ended June 30, 2018. For the year ending 2017, revenue was $218.8 million and loss was $0.24 per share and for the first six months of 2018, revenue stood at $121.2 million and loss was $0.27 per share. In the past five quarters, the San Mateo, California-based company has grown its quarterly revenue sequentially and has reported a profit in q4 2017 alone.

SurveyMonkey generates revenue by using “freemium” business model. The company provides free basic access to its customers which has got limited features and paid products to its customers at three different levels; Standard, Advantage, and Premier plans. In 2017, the company generated more than 90% of its revenues from subscriptions and 35% of its total revenue came from outside the US.

You may also like: SurveyMonkey jumps about 60% after the debut

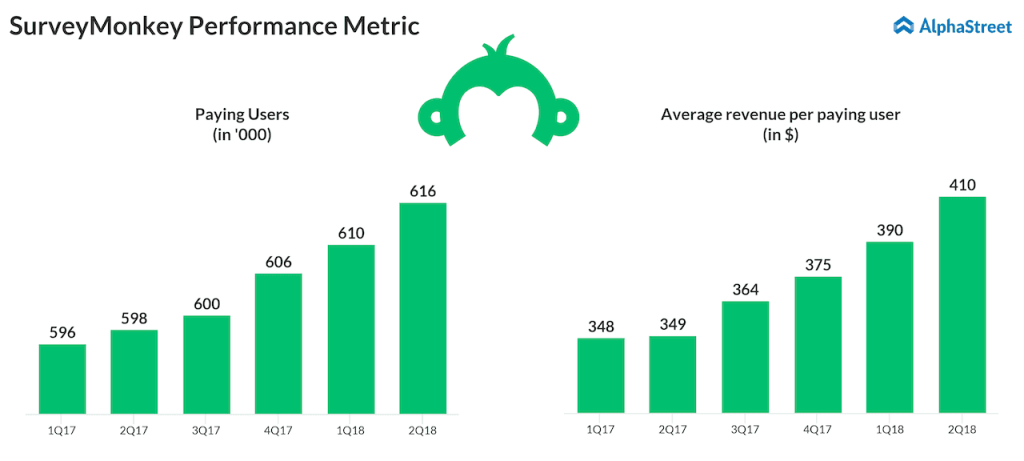

As of June 30, 2018, SurveyMonkey has a total of 60 million registered users and over 16 million active users in the past one year. 616,000 users are paid users across more than 300,000 organizational domains.

According to a report from Research and Markets, the global online survey software market was valued at $4.1 billion in 2017 and is estimated to grow at a CAGR of 11.25% to reach a market size of $6.9 billion by 2022. However, as per Datanyze, Google Surveys has got a market share of more than 90% and with heavy competition from other small players in this arena, SurveyMonkey struggles with a meager 4% share in the online survey space.

While there is a huge market potential, the low paid user percentage and the company’s small share in the online survey market are the negatives for the company and investors will watch out how SurveyMonkey improves them in the future.

SAP swoops up Qualtrics for $8 billion right before IPO

ADVERTISEMENT

Wall Street expects SurveyMonkey to report once again a loss for the third quarter, while revenue is expected to rise on a year-over-year basis. The recent slump in the tech sector is also expected to affect the market debutants like SurveyMonkey.