Shares of Take-Two Interactive Software Inc. (NASDAQ: TTWO) were up over 2% on Wednesday. The stock has dropped 30% year-to-date but has gained 17% over the past three months. The company’s first quarter 2023 earnings results, reported earlier this week, did not impress the Street. In addition, concerns over the impacts of a recession on the industry has led to a bearish outlook over the stock. Here’s a look at some of the positives and negatives from the company’s recent quarterly report:

Revenue and profits

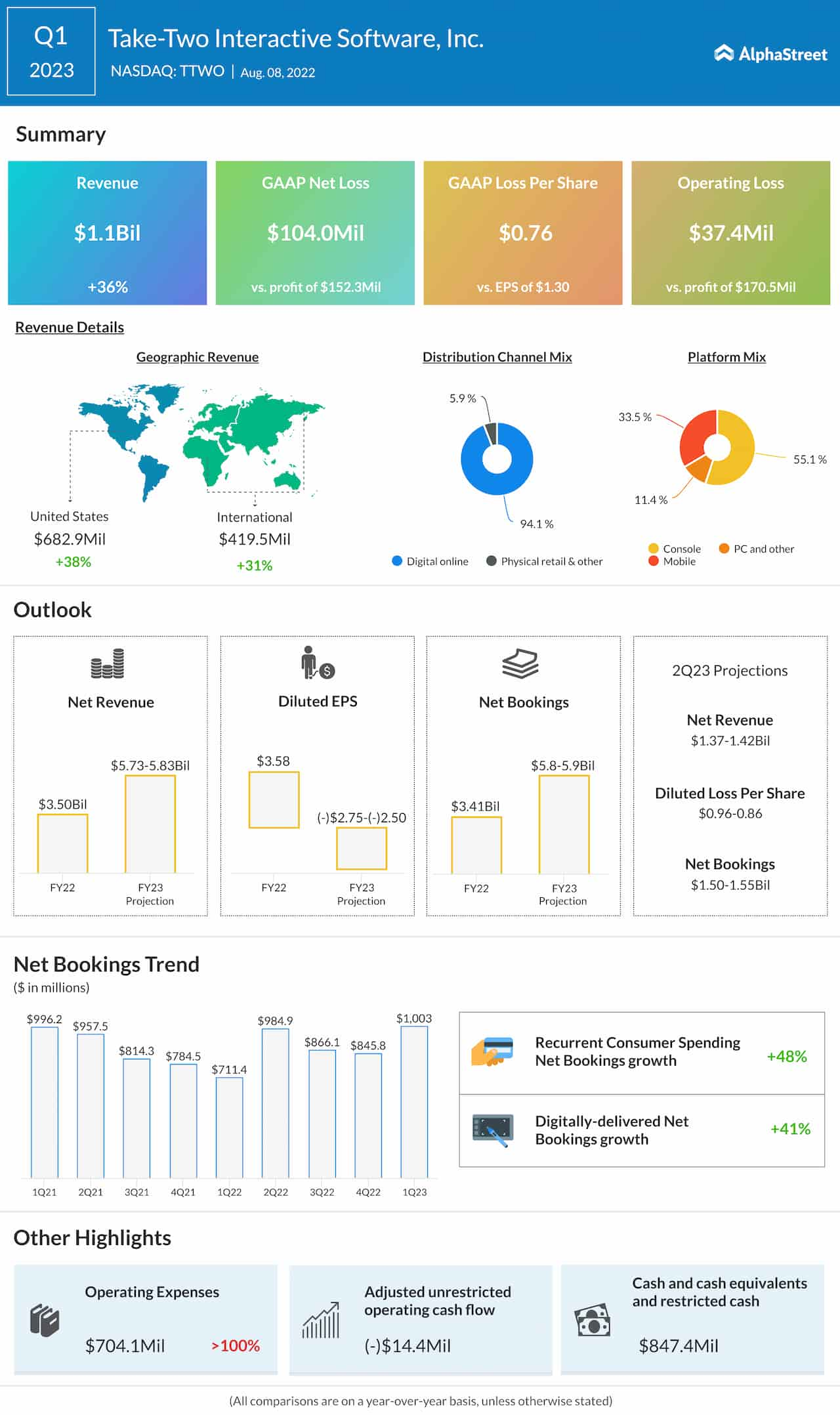

Take-Two reported net revenue of $1.1 billion for the first quarter of 2023, which reflected a growth of 36% from the year-ago quarter. Despite the year-over-year growth, the top line missed market projections. In addition, the company reported a net loss of $0.76 per share in Q1 versus EPS of $1.30 in the prior-year period, which also fell short of expectations. The misses did not go down well with investors.

For the full year of 2023, Take-Two expects net revenue of $5.73-5.83 billion and a loss of $2.50-2.75 per share. For the second quarter of 2023, net revenue is expected to be $1.37-1.42 billion while net loss is estimated to be $0.86-0.96 per share.

Bookings

In Q1, net bookings increased 41% YoY to $1 billion but this too fell below analysts’ projections. This net bookings number included the Zynga acquisition. The pre-combination net bookings number was $731 million, which came within the company’s guidance range of $700-750 million that excluded Zynga, and also reflected a growth of 3% from the year-ago period.

Recurrent consumer spending rose 48% during the quarter making up 73% of net bookings. Digitally-delivered net bookings made up 95% of total bookings and were up 41% in Q3. The momentum in bookings was led by the outperformance of titles like NBA 2K22 and WWE 2K22. The company also saw strong performances from Grand Theft Auto V, which has sold-in nearly 170 million units, and Red Dead Redemption 2, which has sold-in more than 45 million units worldwide.

Take-Two updated its full-year bookings guidance to include Zynga. The company now expects net bookings to range between $5.8-5.9 billion, with the largest contributions coming from titles like NBA 2K, Grand Theft Auto Online, Grand Theft Auto V and Red Dead Redemption 2. For the second quarter, bookings are expected to be $1.50-1.55 billion.

On its quarterly conference call, the company said that a decline in consumer spending and an increase in inflation could impact the entertainment industry and that this impact was likely to be greater on free-to-play games. This point has raised concerns among investors about the company’s prospects in the event of a recession.

Zynga acquisition

The acquisition of Zynga provides Take-Two with a strong position in the interactive entertainment industry. The company sees vast opportunity in the mobile game market over the long term and the potential to expand into several emerging markets where mobile gaming is popular.

The addition of mobile games like Harry Potter: Puzzles & Spells, Empires & Puzzles and Words With Friends to its portfolio provides Take-Two with further opportunity for player engagement and retention. Take-Two believes it can realize $100 million of annual cost synergies within two years post-close.

On its call, the company said it is currently seeing some softness in the mobile market. The company added that in free-to-play mobile games, there is likely to be a drop in discretionary spending among players amid rising inflationary pressures.

While Take-Two has done well in terms of revenue and bookings growth and the addition of Zynga opens up opportunities, the concerns over a recession and the impacts of inflation on the company’s growth prospects are clouding the optimism.