Revenue/bookings decline

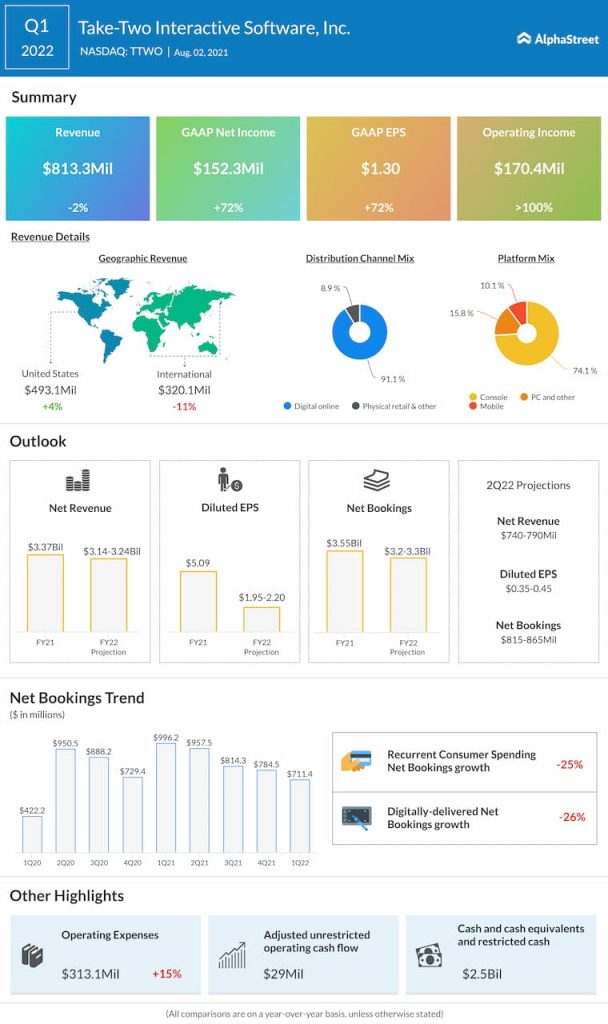

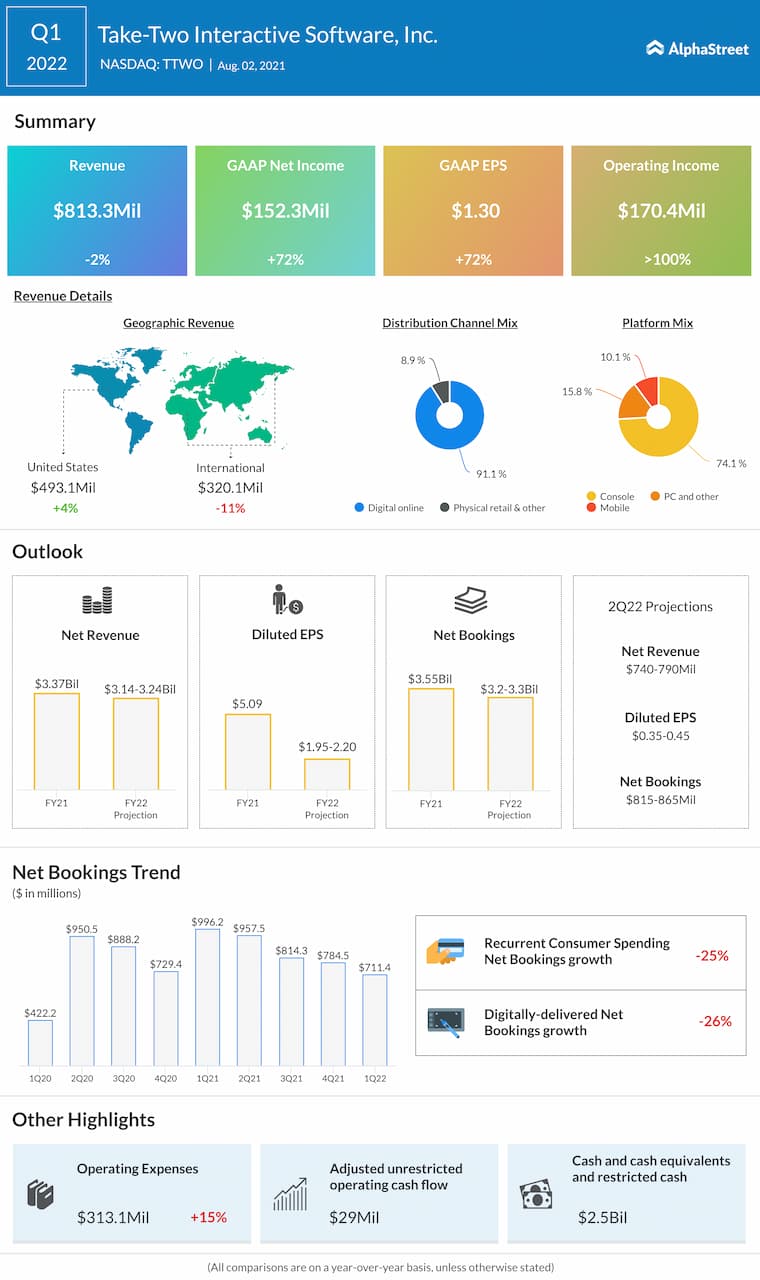

Console and PC and other revenues fell 1.4% and 22% respectively during the quarter while mobile revenues increased 51%. Revenues in the US increased 4% but international revenues fell 11%. Recurrent consumer spending, which includes virtual currency and in-game purchases, increased 15% in Q1.

Net bookings declined 29% YoY to $711.4 million but surpassed the company’s guidance of $625-675 million. Net bookings from recurrent consumer spending dropped 25%. Digitally-delivered net bookings were down 26% while physical retail and other bookings were down 56%.

Lackluster outlook

For the second quarter of 2022, Take-Two estimates net revenue to range between $740-790 million and GAAP EPS to come in the range of $0.35-0.45. For the full year of 2022, net revenue is expected to be $3.14-3.24 billion while GAAP EPS is estimated to be $1.95-2.20. Analysts projected revenues and EPS of $878 million and $1.36 for Q2 2022 and $3.45 billion and $4.72 for FY2022.

Take-Two expects net bookings of $815-865 million for Q2 and $3.2-3.3 billion for FY2022. NBA 2K, Grand Theft Auto Online, Grand Theft Auto V, Red Dead Redemption 2 and Red Dead Online are expected to be the largest contributors to net bookings. 60% of full-year net bookings are expected to come from the US and 40% from international.

Recurrent consumer spending is expected to be relatively unchanged from last year and comprise 65% of total net bookings. Digitally-delivered net bookings are expected to decrease by around 6% for the year. In Q2, recurrent consumer spending is projected to decline by approx. 11% while digitally-delivered net bookings are expected to decline by approx. 5%.

Delays in new releases

Take-Two expects some delays in the release of its new games which has impacted its guidance.

“For the year, we are reiterating our outlook, as there has been some movement in our release schedule, including two of our immersive core titles shifting to later in fiscal 2022 than contemplated by our prior guidance. As we deliver on our expansive multi-year pipeline, we believe that we will achieve sequential growth in fiscal 2023 and establish new record levels of operating results over the next few years.” – Strauss Zelnick, Chairman and Chief Executive Officer

Despite this, the company remains optimistic about its plans for the year and the launch of new franchises. In November, Rockstar Games will launch the enhanced version of Grand Theft Auto V and Grand Theft Auto Online for Gen 9 consoles. In the fourth quarter, 2K and Gearbox Software will launch a new franchise called Tiny Tina’s Wonderlands. Take-Two is also expanding its offerings in mobile and the company continues to invest in new games that it plans to deliver in the coming years.