Strong portfolio

NBA 2K22 exceeded the company’s expectations with over 8 million units sold in worldwide. In Q3, the average number of users playing the game every day was up 10% compared to NBA 2K21 in the same period last year. NBA 2K22 saw an 8% increase in total in-game purchasers and a 30% increase in new-to-franchise spenders. Red Dead Redemption 2 also performed well selling nearly 43 million units worldwide in Q3.

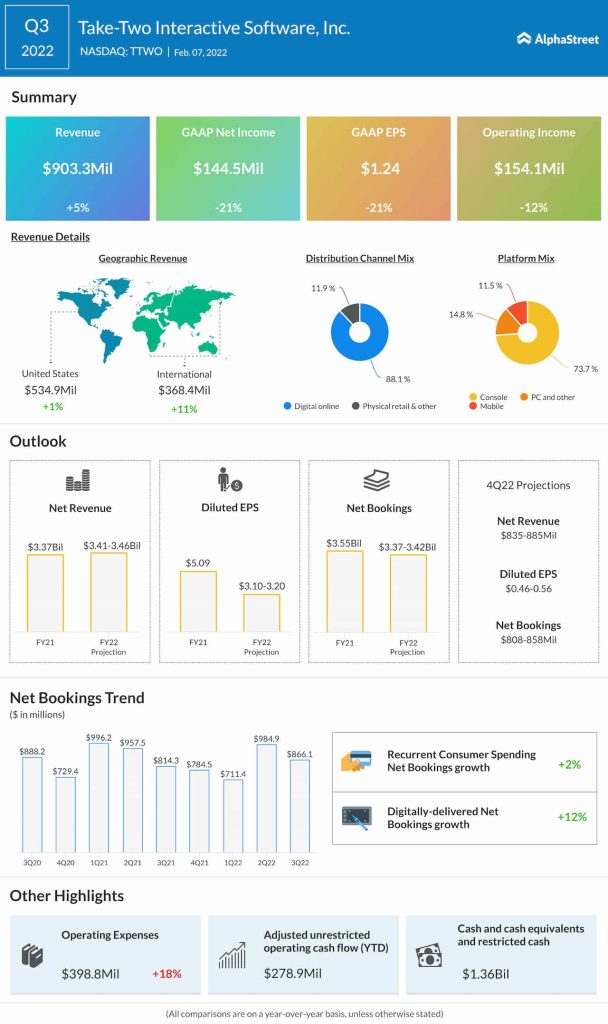

Strength in these titles helped drive a 5% growth in revenue and a 6% increase in net bookings during Q3. Although the strong momentum seen during the pandemic is starting to wane as people return to their pre-pandemic activities, there is still opportunity for growth with the release of new offerings such as OlliOlli World and Tiny Tina’s Wonderlands.

Zynga acquisition

Take-Two’s acquisition of Zynga, which is expected to close in the first quarter of FY2023, is another growth driver for the company. This transaction will help Take-Two diversify its business and expand its position in the interactive entertainment industry. By bringing in titles such as FarmVille, Toon Blast, Toy Blast and Golf Rival from Zynga, Take-Two can establish a strong position in the rapidly growing mobile gaming space.

Take-Two has identified $100 million of annual cost synergies that it expects to achieve within the first two years after the closing of the deal and over $500 million of annual revenue opportunities that can be delivered over time.

Growth in the industry

Based on data from IDG Consulting, the global video game market stood at $233 billion in 2021. This number is estimated to grow to $253 billion in 2022 and to $286 billion in 2025. This would reflect a compound annual growth rate of 5%.

Click here to read the transcript of Take-Two Interactive’s Q3 2022 earnings conference call