Revenue and profit growth

Improvement in discretionary trends

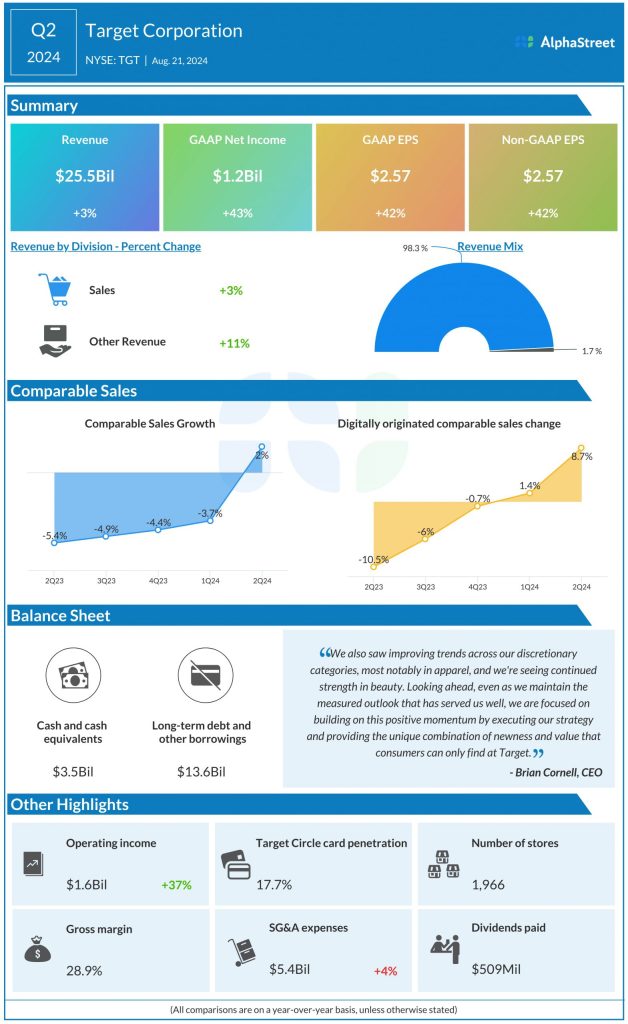

Target’s comparable store sales grew 0.7% and comparable digital sales rose 8.7% in Q2. The results benefited from a rise in traffic, which was partly offset by a drop in average ticket. Discretionary category trends continued to improve, particularly in apparel, where comp sales grew over 3% in the quarter. The beauty category continued its momentum with a 9% growth in comps.

Against an inflationary backdrop, consumers continue to be budget-conscious and they remain focused on value. In this environment, Target’s strategy of cutting prices on a wide range of frequently purchased items paid off, as it saw traffic growth in its food & beverage and essential categories during the quarter.

During the quarter, the company saw double-digit growth in its same-day delivery services, which was led by Drive Up and Target Circle 360. As mentioned on the conference call, same-day services now account for over two-thirds of sales. Of this, the biggest contribution comes from Drive Up, which generated sales of more than $2 billion in Q2.

Raised outlook

Target hiked its earnings outlook for the full year of 2024, based on strong profit performance in the first half. The company now expects GAAP and adjusted EPS to range between $9.00-9.70 versus the previous range of $8.60-$9.60. It expects comparable sales for the year to increase 0-2%.

For the third quarter of 2024, Target expects comparable sales to increase 0-2%. GAAP and adjusted EPS are expected to range between $2.10-2.40.