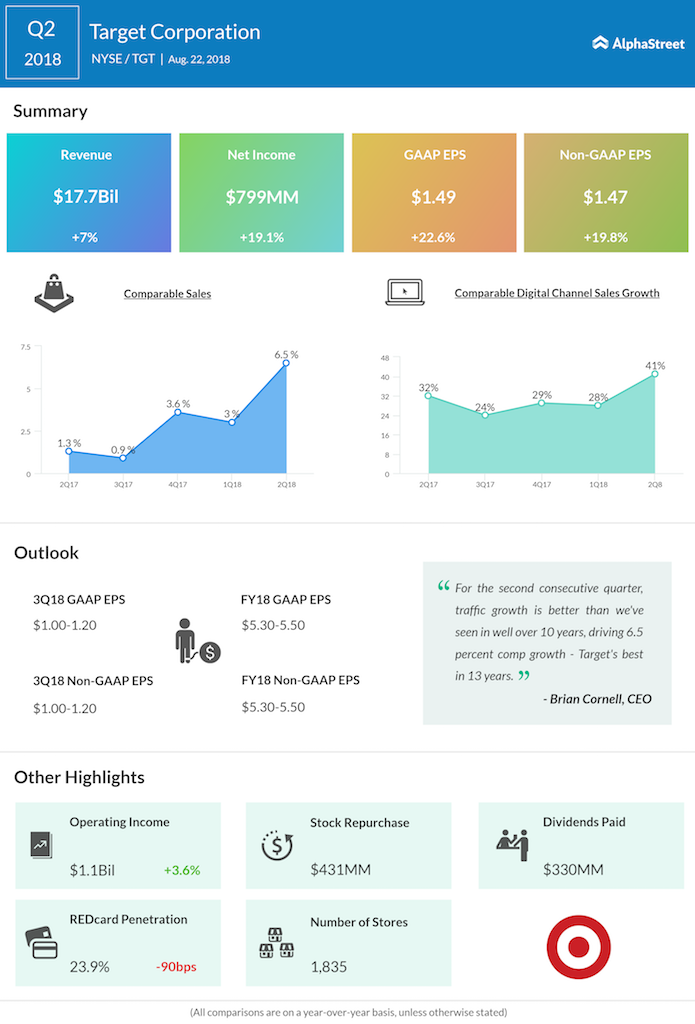

Revenues advanced 7% annually to $17.78 billion, exceeding the Wall Street forecast. The top-line growth was driven by a 6.4% rise store traffic – the fastest since the company started reporting the metric – in a sign that the ongoing investments in store remodeling are yielding the desired results.

Total comparable sales moved up 6.5% and comparable digital sales grew 41%, benefitting from the initiatives launched last year to expand the e-commerce platform. Of late, Target has been witnessing strong market share gain for all of its core merchandise categories.

“We laid out a clear strategy at the beginning of 2017, and throughout this year we’ve been accelerating the pace of execution. As we look ahead to 2019, we expect to achieve scale across the full slate of our initiatives – creating efficiencies and cost-savings, further strengthening our guest experience and positioning Target to continue gaining market share,” said CEO Brian Cornell.

RELATED: Target expands delivery service

Looking ahead, the Minneapolis, Minnesota-based company currently predicts adjusted earnings in the range of $5.30 per share to $5.50 per share for fiscal 2018, raising the midpoint from the earlier projection of $5.15-$5.45 per share.

For the third quarter, the company is looking for adjusted earnings per share between $1.00 and $1.20. Comparable sales growth for the upcoming quarter and second half is estimated at 4.8%, in line with the levels seen in the first half.

Walmart (WMT), which competes with Target, last week posted a 4% increase in revenues, while the bottom-line was dragged by losses from asset sales and equity investment in JD.com (JD). Among others, Costco (COST) reported above-consensus earnings for its most recent quarter aided by robust sales growth.

Target shares, which closed the last trading session slightly lower, gained about 6% in the premarket after the earnings announcement.

RELATED: Target Q1 earnings at multi-year high