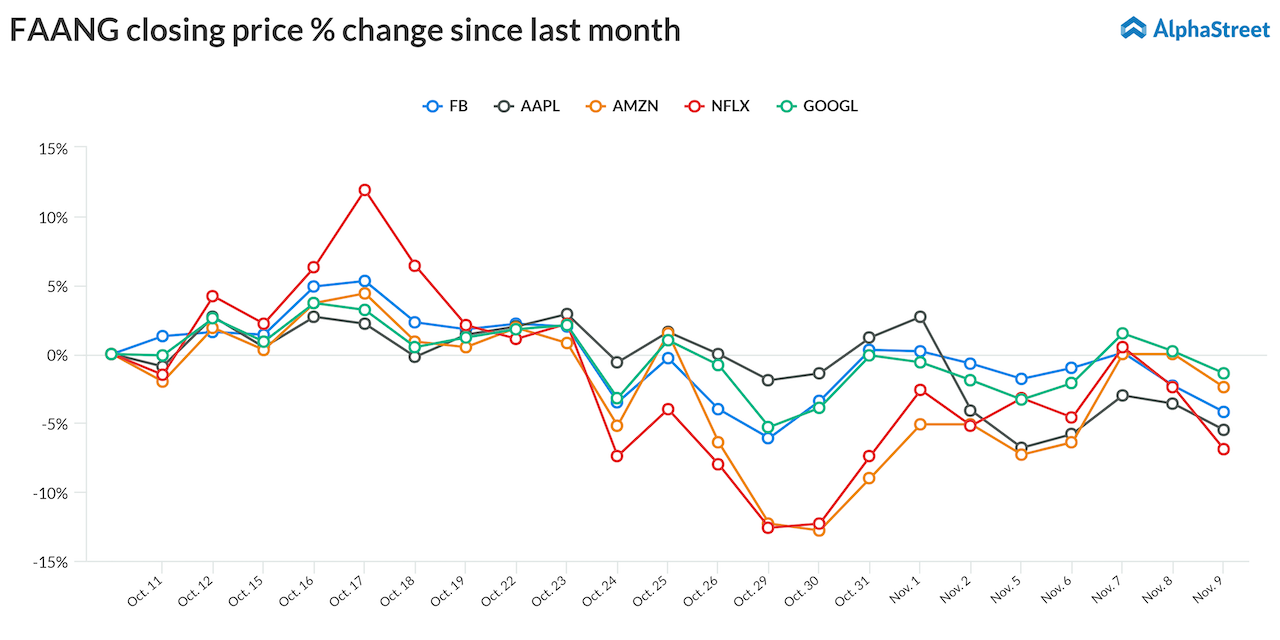

Trump-induced trade war fears, higher corporate borrowing costs and higher wages have kicked in as factors, and they are now affecting the stocks.

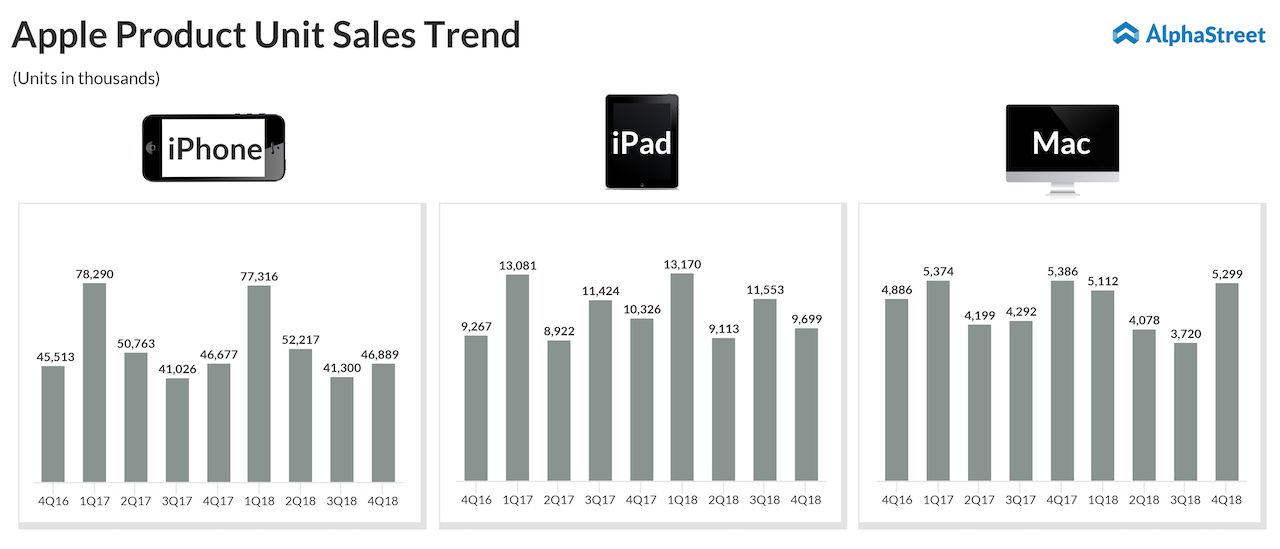

Apple (AAPL) sales have slowed down. Netflix (NFLX) is getting more competition with the rest of the industry catching up. Social media is also getting bashed for alleged election meddling, and in a much more grave manner, for privacy infringement concerns. There is even a push for various social media platforms such as Facebook (FB), Twitter (TWTR) and various Google products (GOOGL) to help local law enforcement agencies.

Many factors also trickled down to their earnings report. Taken Facebook, for instance. Adjusted earnings growth is touted to slow down to 5% in 2019 from the 2018 rate of 20%.

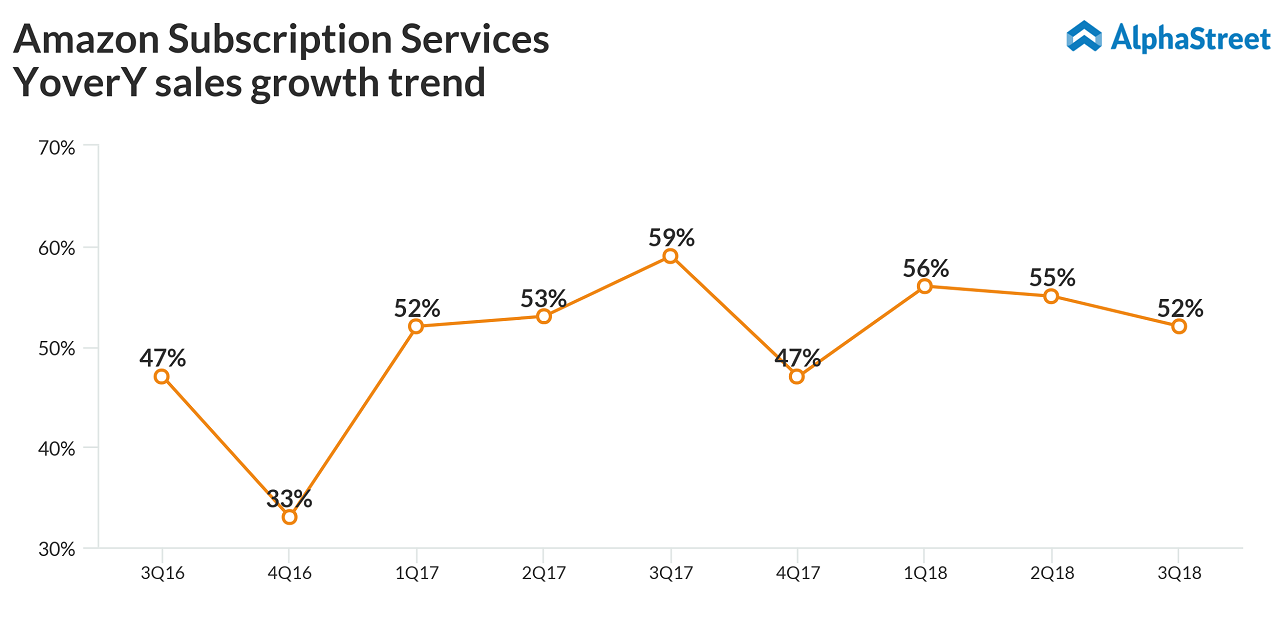

When you take Amazon (AMZN), the same is said to shrink to 32% from the current 173%.

Of course, none of these companies have come out with official statements regarding the same. But that doesn’t discount the fact that investors have started to accept ground reality.

Higher interest rates were all that was needed for many investors to sell these stocks. And this is not just limited to American stocks.

The global effect will soon translate to the likes of Chinese giants Tencent, Alibaba (BABA), and Baidu as well.

And yes, for US stocks, the worst might be over. But the damage done last month will take time to recover. The bottom line is that tech stocks aren’t now as safe as they used to be. And the recent trading activities are a testament to that.