Since Apple (AAPL) has stabilized – after the recent losing streak triggered by the iPhone rout – and the semiconductor sector is getting back on track as the demand and pricing issues related to memory chips started to ease, tech investors can now look for a stable year ahead for the sector.

The tech index has emerged from the recent lows, and the quick recovery has come as a surprise to many

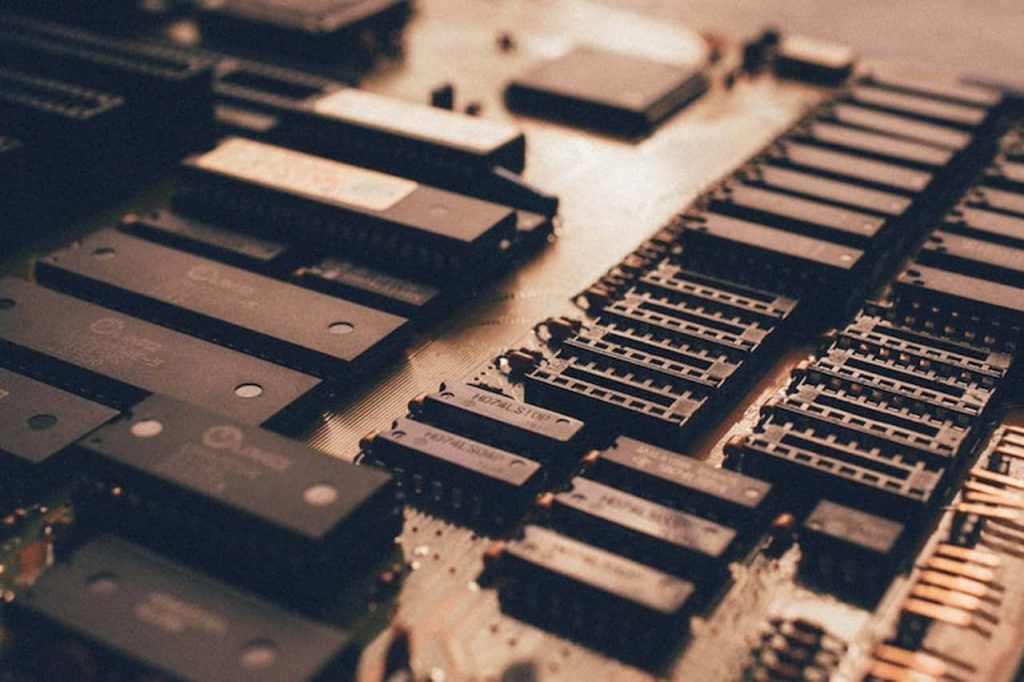

This week’s prominent gainers include Micron Technology (MU) and Advanced Micro Devices (AMD), who along with their peers in the semiconductor industry took the lead to push up the S&P 500’s tech index. Considering experts’ view that the remaining quarters of the year will be better than the first quarter, the current momentum could gain further strength going forward.

Though the earnings season is almost over, the performance of the market in the coming weeks will depend largely on the upcoming quarterly reports and the direction in which the global economy moves. Meanwhile, the increasing prospects of Washington and Beijing arriving at a final solution to end the ongoing trade war have added to the positive mood.

The other major gainers in the tech space include Nvidia (NVDA) and Intel (INTC). Meanwhile, Micron pared most of the gains after Morgan Stanley downgrades the chipmaker to underweight on Thursday. The FAANG group has also returned to the growth path, gaining 23% since last year’s selloff.

The S&P 500 index closed Wednesday’s session at $2,873.40, and the 0.2% intraday gain added to the 14.6% growth it registered since the beginning of the year. The tech-heavy Nasdaq Composite index closed up 0.6% and the Dow Jones Industrial Average edged up 0.1%, extending the uptrend seen during the first three months of the year.