The results were negatively impacted by one-time charges, unfavorable pricing and higher duties on imports from China

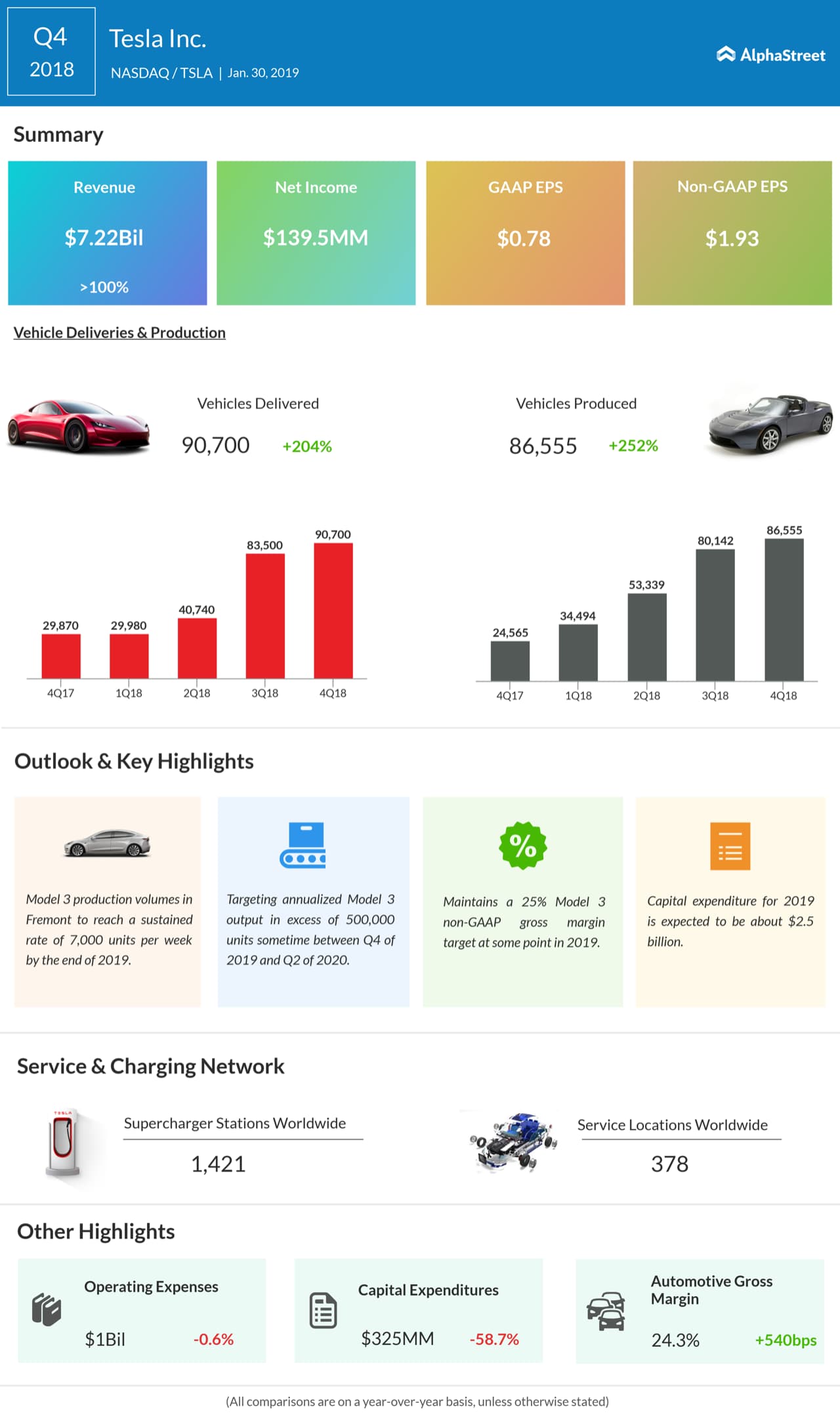

Adjusted earnings were $1.93 per share, compared to a loss of $3.04 per share in the fourth quarter of 2017. Earnings, however, missed Wall Street estimates. On an unadjusted basis, the company reported a net profit of $139.5 million or $0.78 per share, compared to a loss of $675.35 million or $4.01 per share a year earlier. The results were negatively impacted by charges related to non-controlling interests, unfavorable pricing and higher duties on components imported from China.

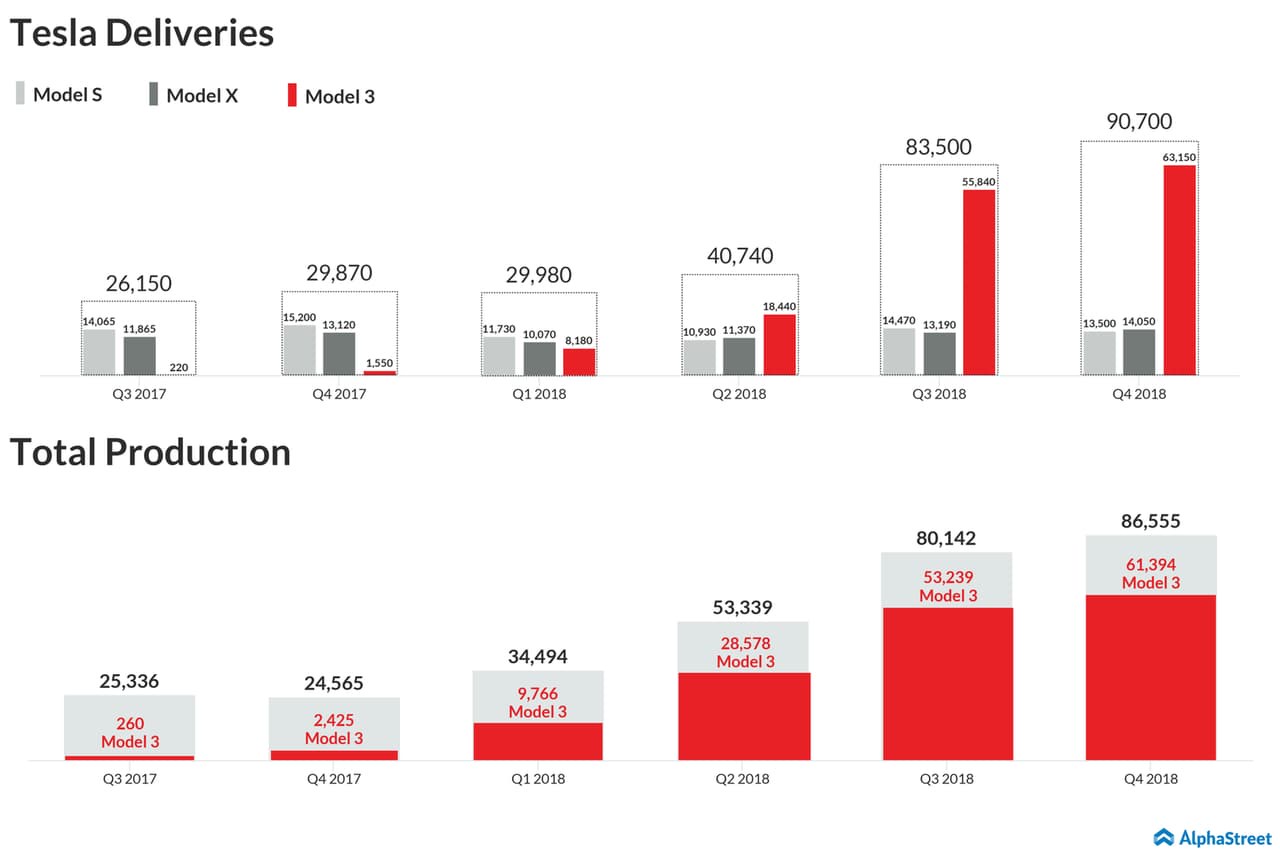

The gross margin of Model 3 remained stable at 20% during the fourth quarter, when 63,359 units were delivered in North America. Recently, the company had started production of Model 3 vehicles for the European and Chinese markets.

Earlier this month, the electric carmaker said it produced 86,555 vehicles in the fourth quarter and delivered 90,700 units. As part of its efforts to ramp up sales, the company also lowered the prices of Model X, Model S and Model 3 vehicles.

Analysts are of the view that Tesla will record positive earnings throughout this year, easing concerns over its high debt levels and stressed cash flow. In the December quarter, operating cash flow improved sequentially to $910 million.

The European expansion and construction of the Gigafactory in China have been a major morale booster for investors. Recently, CEO Elon Musk reiterated his resolve to reduce debt and not to refinance the loans.

Looking ahead, the management expects Model 3 volumes to grow sharply in fiscal 2019, owing to a full year of high production volumes at the Fremont factory. The company looks to start full-fledged production of Model 3 vehicles at the Gigafactory in Shanghai by year-end.

Tesla shares witnessed a great deal of volatility after reaching a new peak mid-2018. Earlier this month, the stock plunged after the company announced job cuts and lowered its guidance. The stock, which dropped about 11% in the past twelve months, lost further in the after-hours Wednesday following the earnings report.