Model 3s base price is fixed at $45,000 now and this is expected to reduce to $35,000 in 2019. It’s worth noting that Tesla last week cut its Model 3 prices in China. In November, Tesla reduced the prices of Model X and Model S cars in China by 12-16%. The automaker also slashed down the Model X and Model S prices earlier this month in China as a result of Chinese government’s decision to stop additional tariffs on the vehicles produced in US.

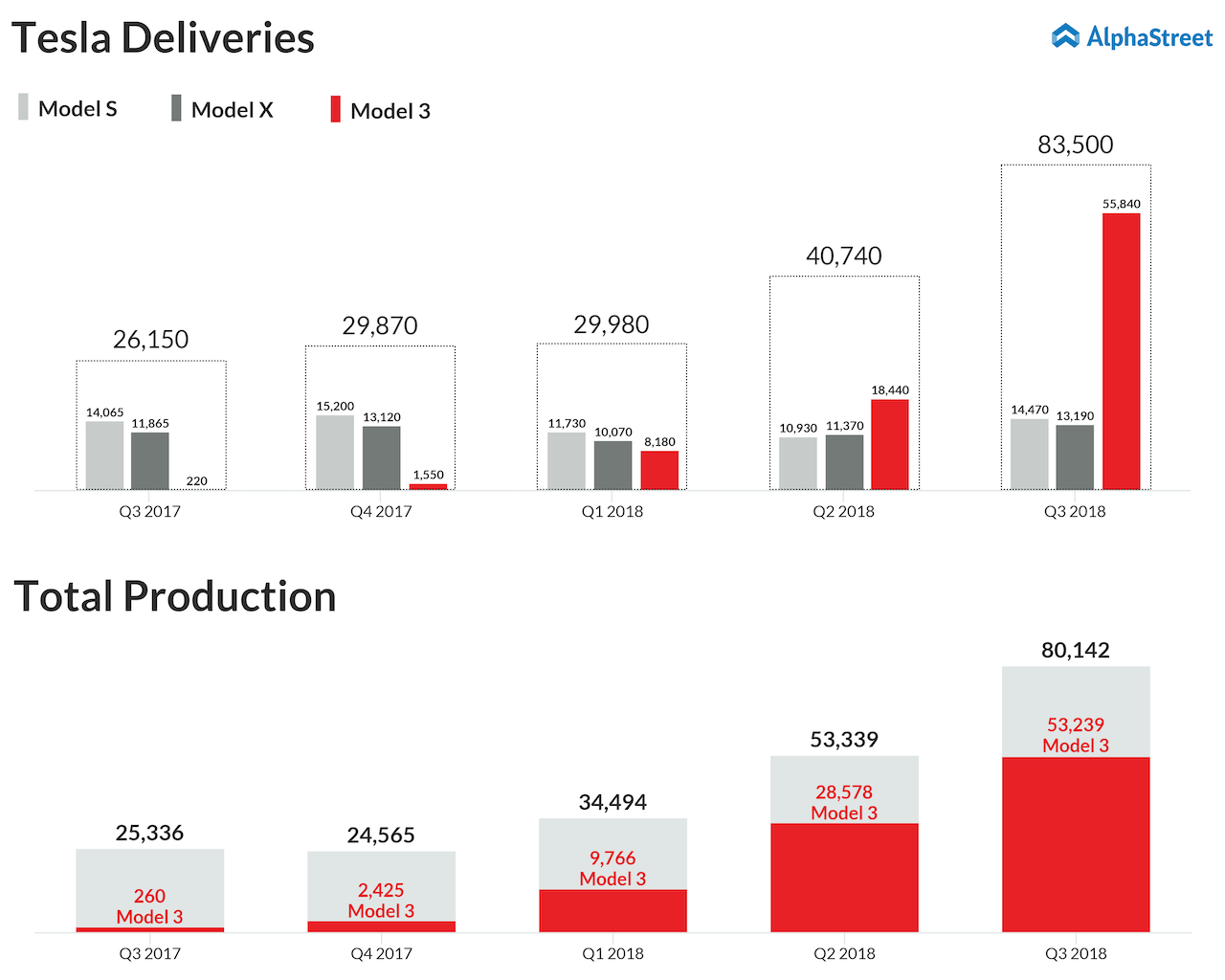

In Q3 2018, Tesla delivered 83,500 vehicles totally, which include 55,840 Model 3; 14,470 Model S; and 13,190 Model X vehicles. Based on the demand, Tesla sales are expected to increase in 2019 in US and worldwide.