Teva’s revenue and adjusted EPS figures beat market estimates, and the stock rose more than 6% in premarket trade.

R&D expenses for the first quarter decreased 27% to $317 million compared to last year, primarily due to pipeline optimization, project terminations, phase 3 studies that ended and related headcount reductions.

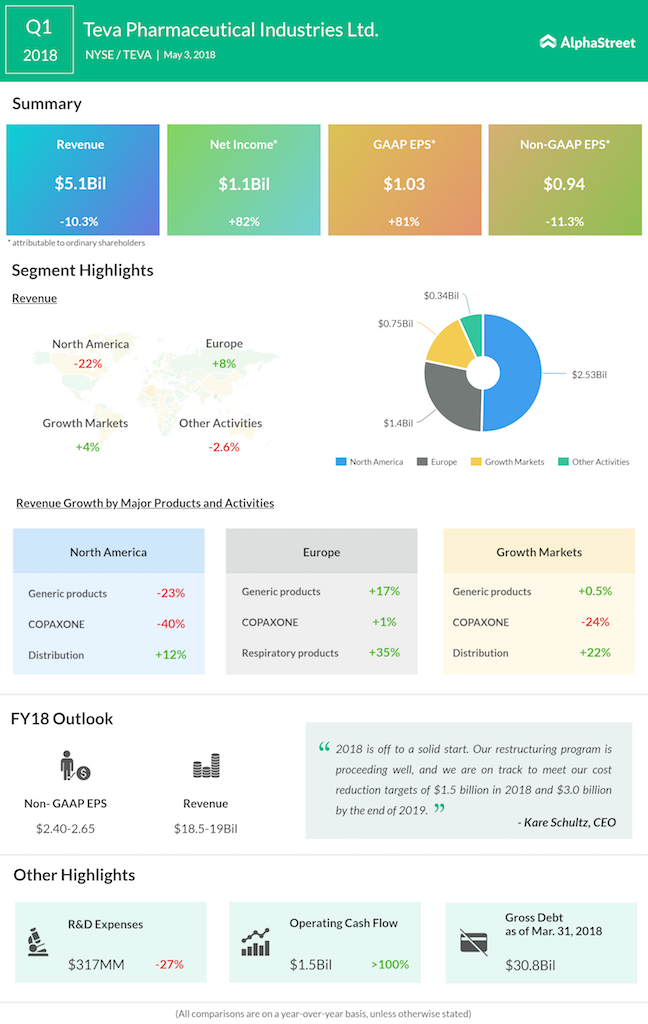

The company’s restructuring program seems to be proceeding well, and Teva is on track to meet cost reduction targets of $1.5 billion in 2018 and $3 billion by the end of 2019.

Teva made changes to its reporting segments. The new segments are North America, Europe, and Growth Markets.

In the North America segment, which includes the United States and Canada, revenues fell 22% to $2.5 billion, mainly due to adverse U.S. generics market dynamics, a decline in COPAXONE revenues due to generic competition and loss of revenues from the sale of the women’s health business. Revenues in Teva’s largest market, the United States, were down 23%. Revenues from generic products in the North America segment were down by 23%, while COPAXONE revenues fell 40% during the quarter.

In the Europe segment, revenues grew 8% to $1.4 billion. Generic products revenues rose 17%, while COPAXONE revenues grew 1%. Revenues in the Growth Markets segment improved 4% during the quarter to $750 million. Generic products revenues were flat while COPAXONE revenues fell 24%.

The company does not expect to receive FDA approval for its migraine medication fremanezumab by mid-June. Teva and its partner Celltrion Inc. are working with the FDA and expect the approval to come before the end of this year.

Teva raised its guidance for full-year 2018. The company expects non-GAAP revenues to be $18.5-$19 billion and non-GAAP EPS to be $2.40 to $2.65.