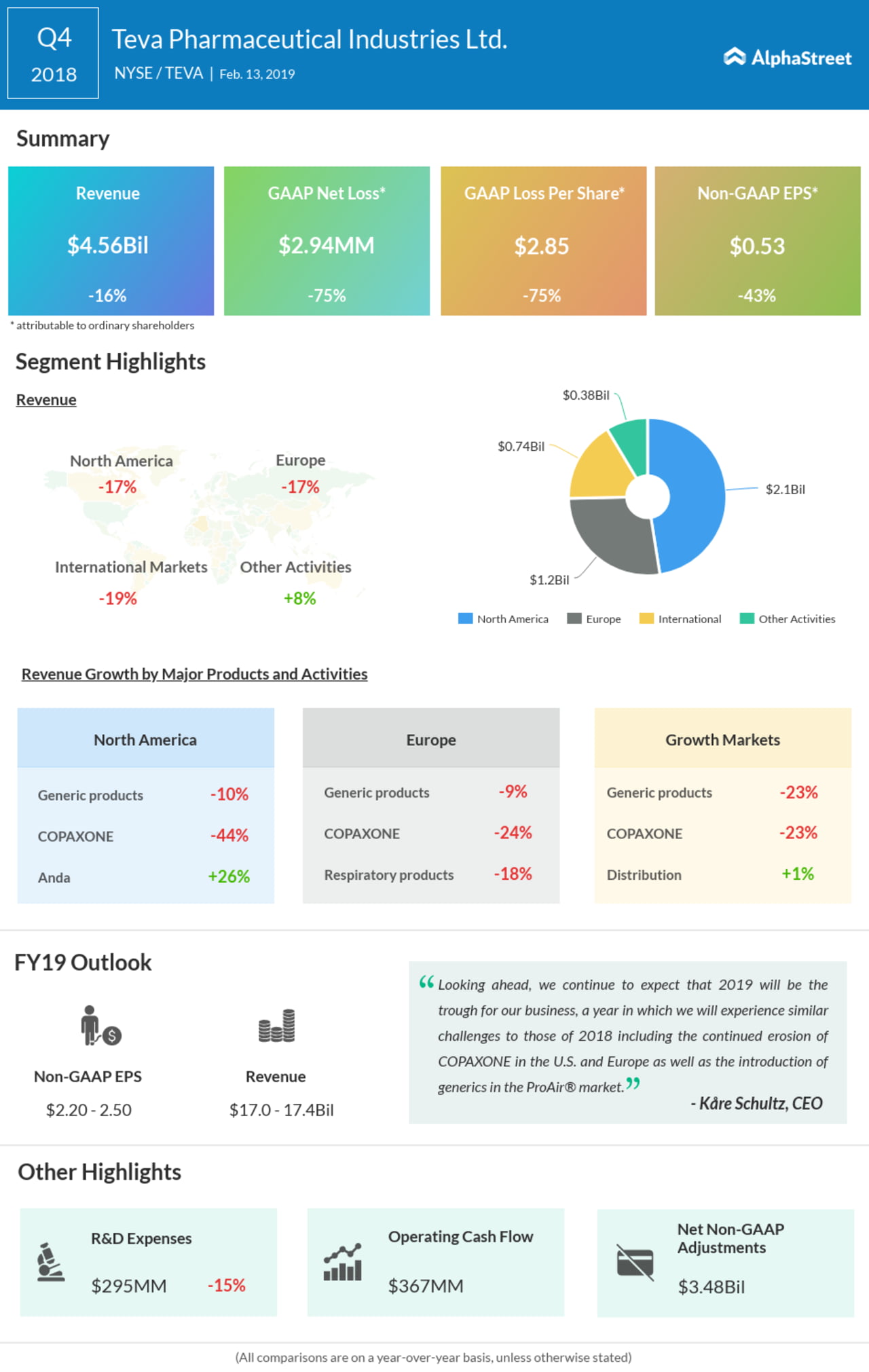

Net non-GAAP adjustments for Teva in the fourth quarter were $3.48billion. Non-GAAP net income and non-GAAP EPS for the fourth quarter were adjusted to exclude a goodwill impairment of $2,73 billion related to International Markets, a $990-million impairment related to the acquisition of Actavis Generics, and other effects and expenses.

LOOKING TO 2019

For 2019, Teva sees revenues of $17.0-17.4 billion generating non-GAAP operating income of $3.8-4.2 billion and non-GAAP EPS of $2.20-2.50.

For the coming year, Teva expects continued generic erosion in global COPAXONE sales, touting it to be at about $1.5 billion.

However, the drugmaker expects new launches to offset slight volume decline toNorth America Generics. For International generics, Teva expects an adverse impact in Japan due to NHI price revision and LLP erosion.