“We now expect our ongoing annual operating tax rate to be about 16 percent starting in 2019 and 20 percent in 2018, lower than our previous expectations of 18 percent and 23 percent, respectively,” said Rich Templeton, President and CEO.

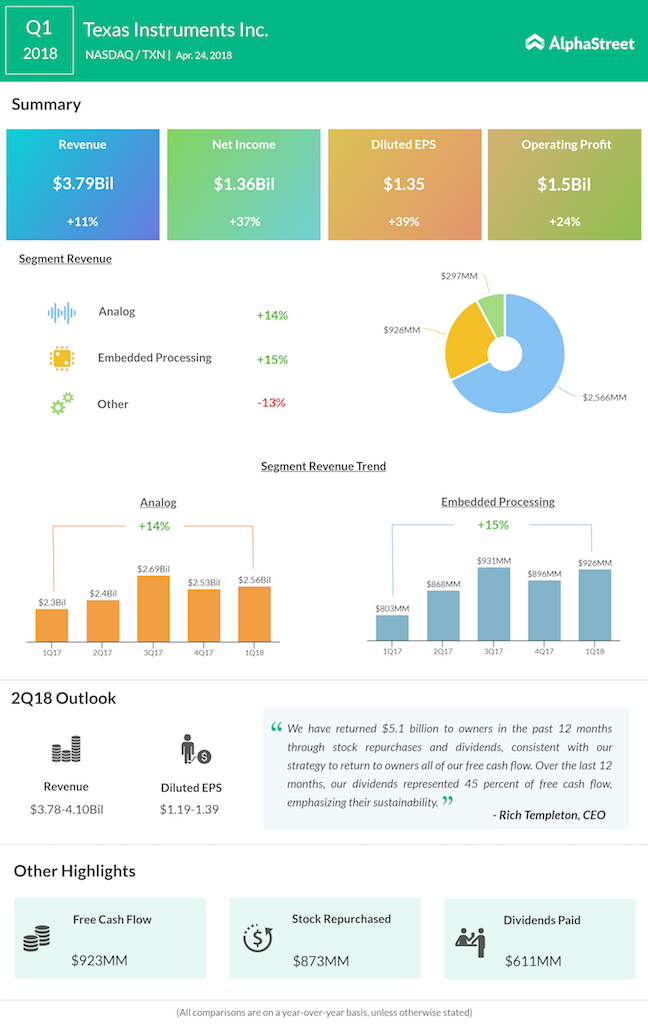

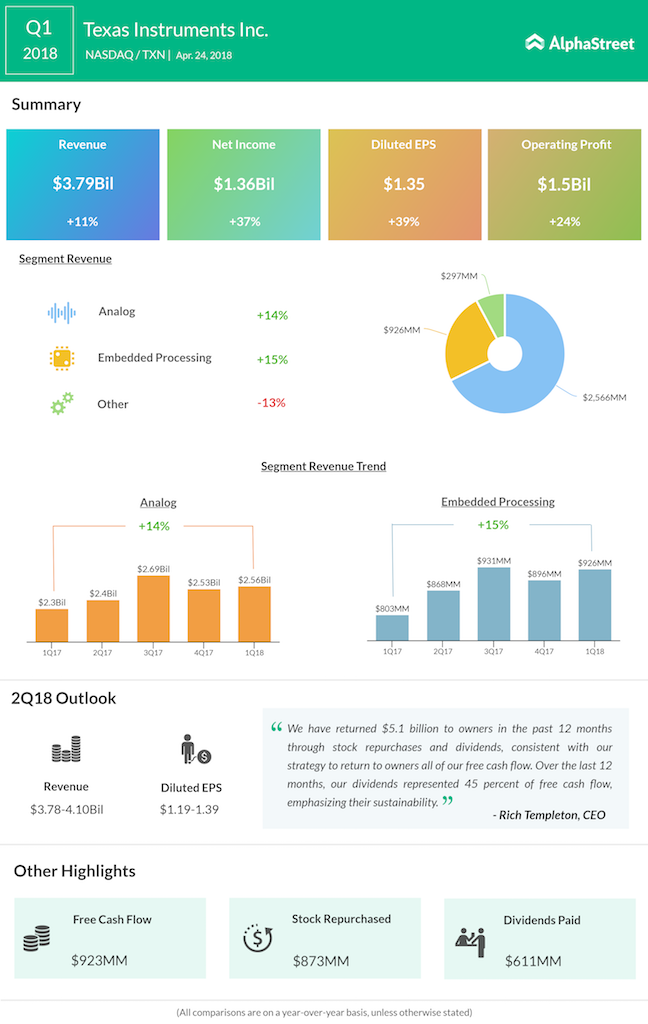

Going forward, Texas Instruments is seeing second quarter 2018 revenue to be in the range of $3.78 billion to $4.10 billion, and earnings per share to be between $1.19 and $1.39, which includes an estimated $10 million discrete tax benefit.

Post the earnings release, the company’s stock jumped almost 5% in after-market trading.