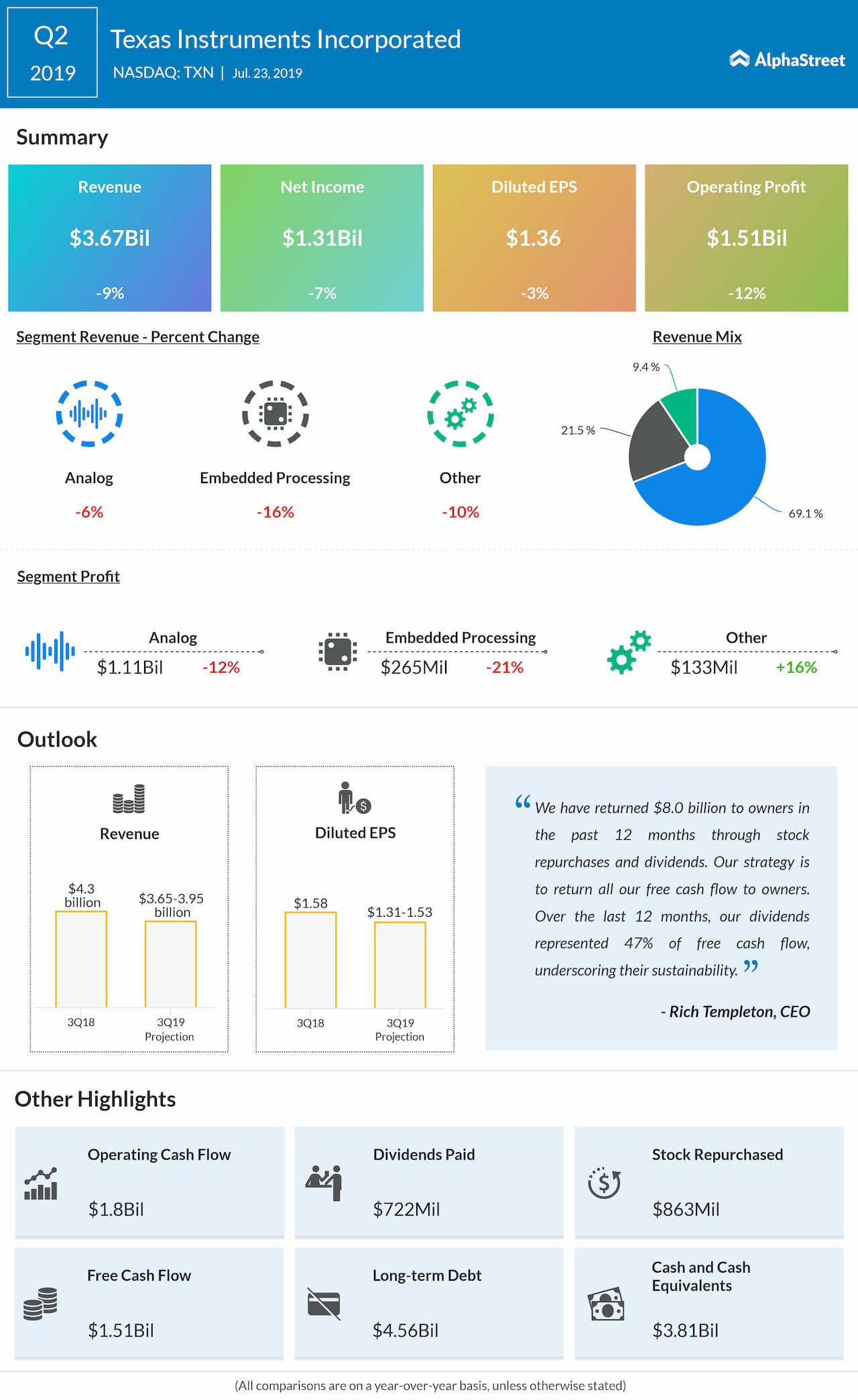

Looking ahead into the third quarter, the company expects revenue in the range of $3.65 billion to $3.95 billion and earnings in the range of $1.31 to $1.53 per share, which includes an estimated $10 million discrete tax benefits. For 2019, the company’s annual operating tax rate is still expected to be about 16%.

In core businesses, Analog revenue for the second quarter declined by 6% year-over-year due to decreases in High Volume, Power, and Signal Chain. Embedded Processing revenue dropped by 16% from the same quarter a year ago due to lower demand for Connected Microcontrollers and Processors.

In the past twelve months, the company has returned $8 billion to owners through stock repurchases and dividends. The company’s strategy is to return all its free cash flow to owners. Over the last twelve months, Texas Instruments’ dividends represented 47% of free cash flow, underscoring their sustainability.

Cash flow from operations of $7.2 billion for the trailing 12 months again underscored the strength of the business model. Free cash flow for the trailing 12 months was $5.9 billion, or 39% of revenue. This reflects the quality of the product portfolio, as well as the efficiency of the manufacturing strategy, including the benefit of 300-millimeter Analog production.

Shares of Texas Instruments ended Tuesday’s regular session up 1.60% at $120.07 on the Nasdaq. Following the earnings announcement, the stock rose over 6% in the after-market session.