Analyst activity today remained focused on target price adjustments. Sanford C. Bernstein raised its price target to $298.00 from $277.00, maintaining an “Outperform” rating. Citigroup also boosted its target to $270.00, citing the $10.6 billion in total proceeds from the Digital Aviation sale as a critical buffer for the company’s $54.1 billion consolidated debt load.

The Boeing Company’s (BA) Commercial Deliveries Hit Post-2018 Peak Amid Macro Hardware Shift

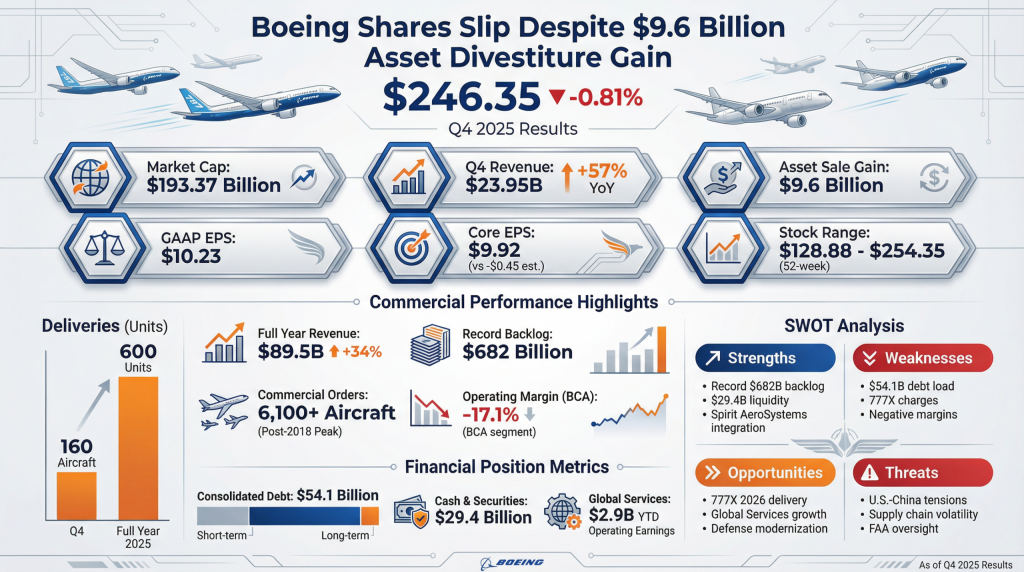

The Boeing Company’s (BA) Commercial Airplanes segment delivered 160 aircraft in the fourth quarter, bringing the full-year 2025 total to 600 units. This represents the company’s highest annual delivery volume since 2018. Full-year 2025 revenue reached $89.5 billion, a 34% increase from $66.5 billion in fiscal 2024. Despite the revenue growth, the Commercial Airplanes segment […]

“The Boeing Company’s (BA) Commercial Airplanes segment delivered 160 aircraft in the fourth quarter, bringing the full-year 2025 total to 600 units. This represents the company’s highest annual delivery volume since 2018. Full-year 2025 revenue reached $89.5 billion, a 34% increase from $66.5 billion in fiscal 2024. Despite the revenue growth, the Commercial Airplanes segment […]

· January 27, 2026

The Boeing Company’s (BA) Commercial Airplanes segment delivered 160 aircraft in the fourth quarter, bringing the full-year 2025 total to 600 units. This represents the company’s highest annual delivery volume since 2018. Full-year 2025 revenue reached $89.5 billion, a 34% increase from $66.5 billion in fiscal 2024. Despite the revenue growth, the Commercial Airplanes segment reported an annual operating margin of -17.1%, weighed down by $4.9 billion in pre-tax charges on the 777X program earlier in the year.

While the broader technology sector, particularly SaaS and cloud software stocks, faces valuation pressure from high interest rates and “seat-count” rationalization, Boeing is contending with industrial macro pressures. Supply chain constraints in specialized alloys and engine components continue to cap production rates. However, the company’s total backlog grew to a record $682 billion, including over 6,100 commercial airplanes.