Missed results

Bookings guidance cut

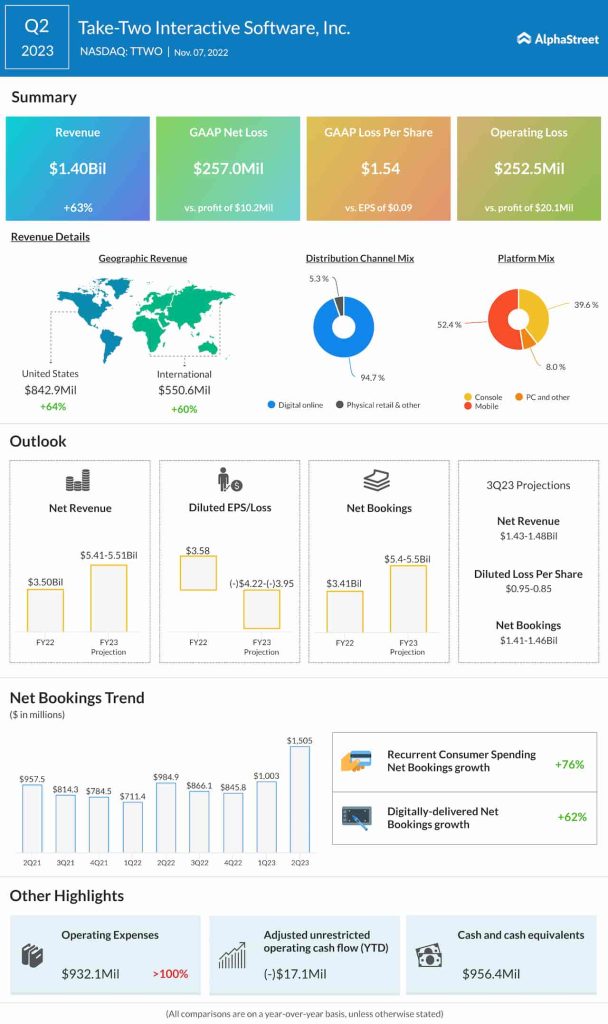

In Q2 2023, Take-Two’s net bookings increased 53% year-over-year to $1.5 billion. Net bookings from recurrent consumer spending grew 76% while digitally-delivered bookings were up 62% compared to the year-ago period. The largest contributors to net bookings were NBA 2K23 and NBA 2K22, Grand Theft Auto, Red Dead Redemption 2, and Rollic’s hyper-casual portfolio, among others.

However, the company lowered its net bookings guidance for the full year citing shifts in its pipeline and softness in mobile. Take-Two now expects net bookings for FY2023 to range between $5.4-5.5 billion versus the prior outlook of $5.8-5.9 billion.

“We now expect to deliver Net Bookings of $5.4 to $5.5 billion in Fiscal 2023. Our reduced forecast reflects shifts in our pipeline, fluctuations in FX rates, and a more cautious view of the current macroeconomic backdrop, particularly in mobile.” – Strauss Zelnick, Chairman and CEO

On its quarterly conference call, Take-Two said it lowered its expectations for recurrent consumer spending, with most of it for mobile as its previous guidance assumed that mobile would see improvement in the back half of the year but based on current industry data and real-time performance, the company believes it will instead be lower in the second half of the year.

Take-Two also mentioned that in times of inflation, people are less likely to spend on entertainment and these factors could put some pressure on in-game purchases in the near-term. The company believes that by the end of 2023, things are likely to normalize.

Lower-than-expected outlook

Take-Two expects revenues for the full year of 2023 to range between $5.41-5.51 billion. This is lower than its previous outlook of $5.73-5.83 billion and also below Street projections of $5.89 billion. The company also expects loss per share of $4.22 to $3.95, which is wider than the previous range of $2.75 to $2.50.

For the third quarter of 2023, Take-Two expects net revenue of $1.43-1.48 billion and net bookings of $1.41-1.46 billion. Net loss per share is expected to range between $0.95-0.85.

Click here to read the full transcript of Take-Two Interactive’s Q2 2023 earnings conference call