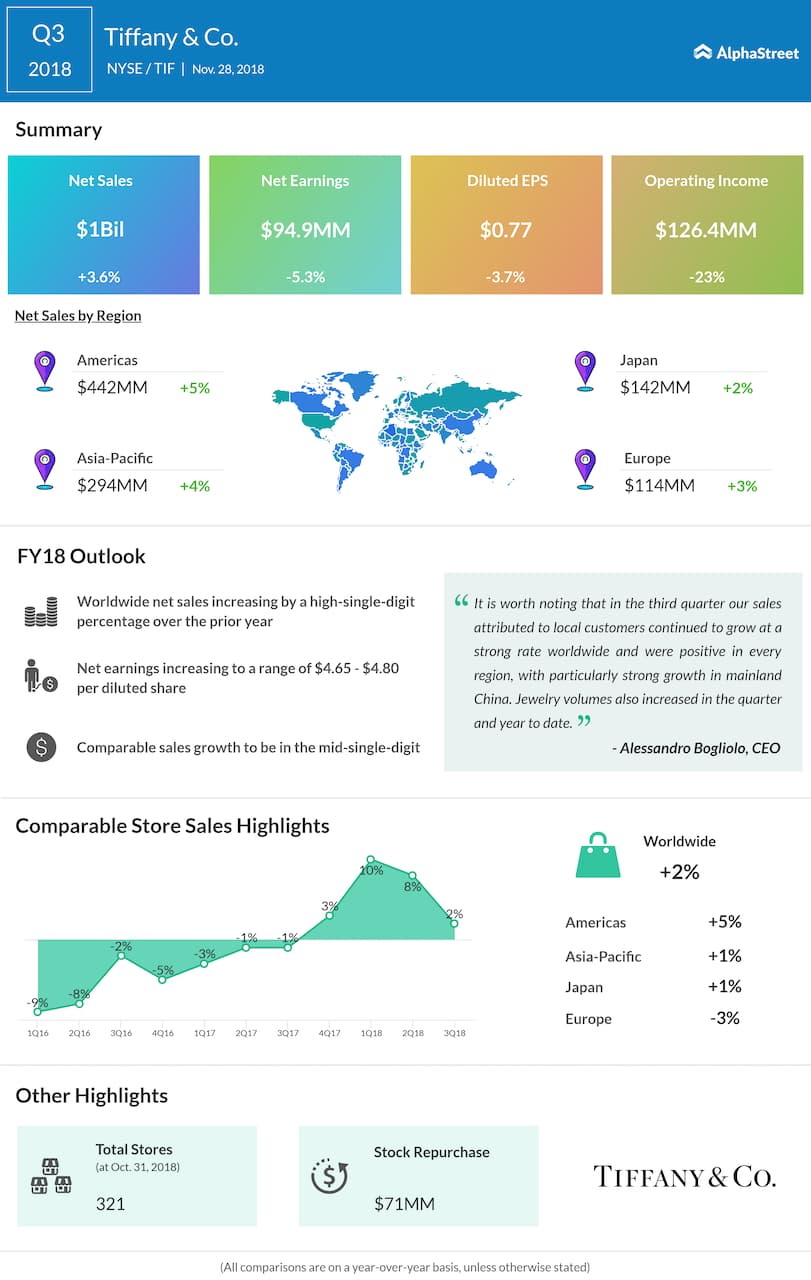

In the Americas, total net sales inched 5% up to $442 million, while Asia-Pacific net sales rose 4% to $294 million.

At Oct. 31, Tiffany operated 321 stores — 124 in the Americas, 89 in Asia-Pacific, 55 in Japan, 48 in Europe, and five in the UAE — vs. 315 stores a year ago.

Over the years, Tiffany stock has handsomely paid its investors. The stock soared 24% immediately following the market-beating first-quarter results in May. However, since then, a bear market in the luxury industry pulled down the stock. Yet, the stock managed to outperform the S&P 500 index with a 17% growth this year. SPX index recorded only an 8% gain during the same period.

Last year, Tiffany had announced a slew of management changes including the appointment of Alessandro Bogliolo as its CEO; posting of Reed Krakoff to the newly-created role of Chief Artistic Officer; naming of Roger Farah as the Chairman of the board; as well as the appointment of three new independent directors.