Days after announcing an extensive restructuring program, which includes tough measures like workforce reduction, cannabis producer Tilray, Inc. (NASDAQ: TLRY) reported a wider net loss for the fourth quarter. Meanwhile, revenues rose sharply, benefiting mainly from business expansion in the overseas markets. The results missed the market’s prediction.

The dismal bottom-line performance triggered a selloff and the company’s stock fell sharply during Monday’s after-hours trading session.

For the medical marijuana industry, 2019 was a tough year as shrinking demand and regulatory hurdles weighed on the performance of companies. Dashing hopes of a recovery in the first quarter, the coronavirus outbreak dealt a fresh blow and pot companies lost significant market value.

Loss Widens

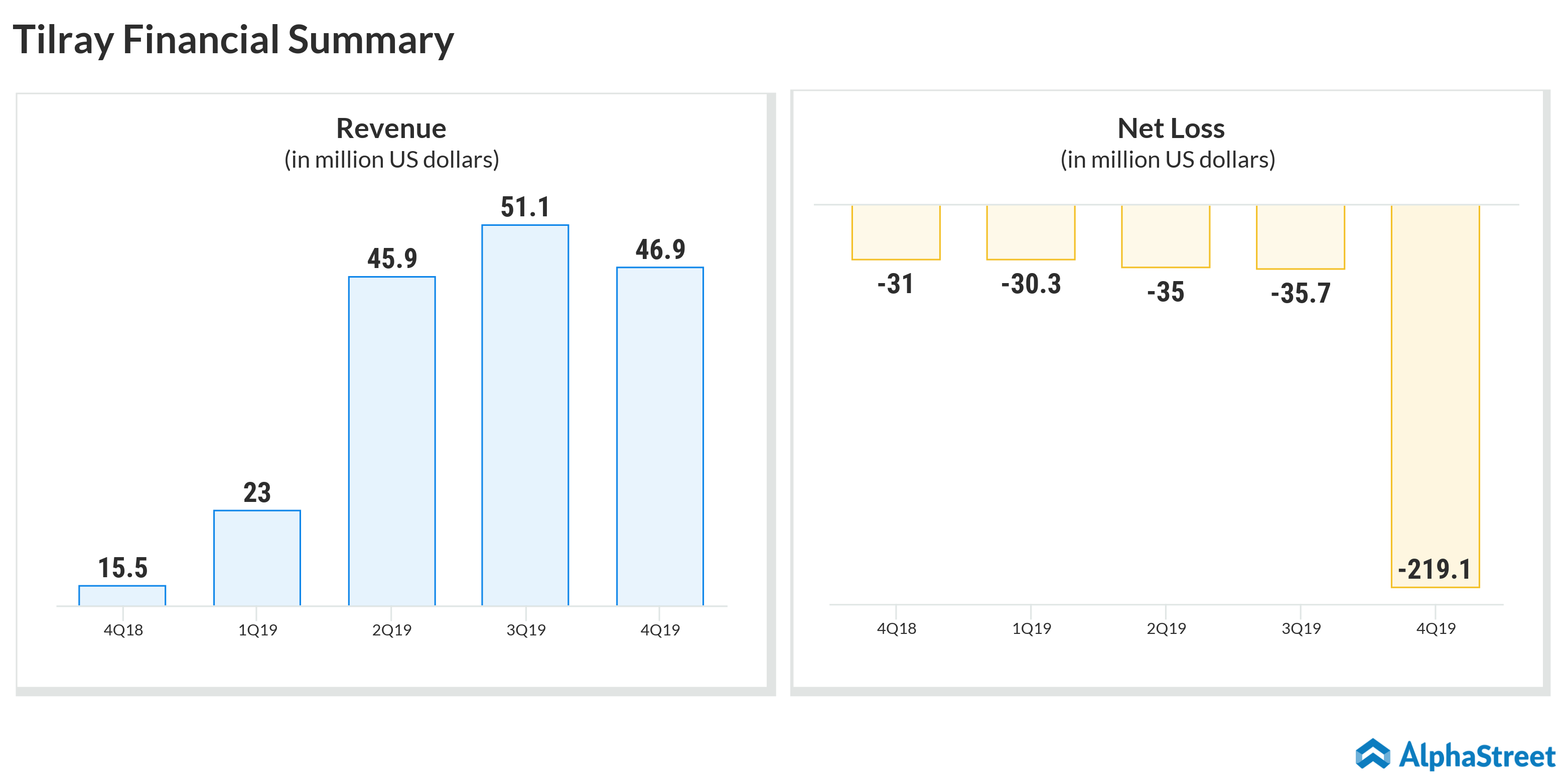

The Canada-based firm’s net loss, excluding special items, widened to $0.62 per share in the December-quarter from $0.28 per share in the same period of 2018. Unadjusted net loss was $219.15 million or $2.14 per share, compared to a loss of $31 million or $0.33 per share last year. Analysts had forecast a narrower loss.

Meanwhile, revenues surged to $46.94 million from $15.53 million last year but missed the Street view. The top-line growth was spurred by a sharp increase in adult-use revenue, strong international sales and contributions from Manitoba Harvest, which was acquired last year.

Production

At 15,039, total cannabis kilogram equivalents sold during the quarter was more than seven times higher. There was a modest increase in the average cannabis net selling price per gram.

Tilray’s president and CEO Brendan Kennedy said, “Like our peers, we have faced industry challenges, but we remain committed to driving long-term value for our shareholders. Tilray has a diversified business model comprised of global medical, Canada adult-use and hemp products which positions us well in the current volatile market environment.”

Peer Performance

Among peers, Canopy Growth (CGC) and Aurora Cannabis (ACB) reported net loss for their most recent quarters. Both companies, meanwhile, recorded positive top-line growth.

Also read: A look at the odds of Aphria surviving the cannabis bubble

ADVERTISEMENT

Shares of Tilray witnessed significant volatility in recent months and maintained a steady downtrend. They dropped 79% in the past twelve months and 12% since the beginning of the year. The stock closed Monday’s regular session higher, but suffered a big loss soon after the earnings announcement.