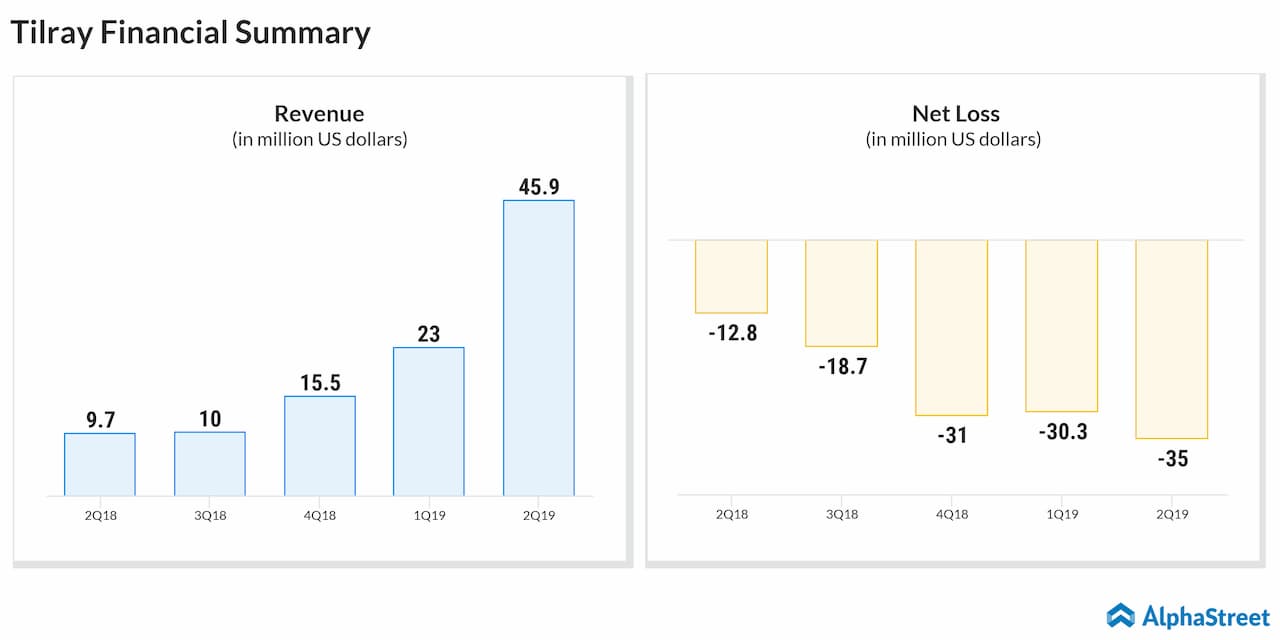

Total kilogram equivalents sold tripled to 5,588 kilograms from 1,514 kilograms in the prior-year period. However, the average net selling price per gram decreased to $4.61 from $6.38 a year ago.

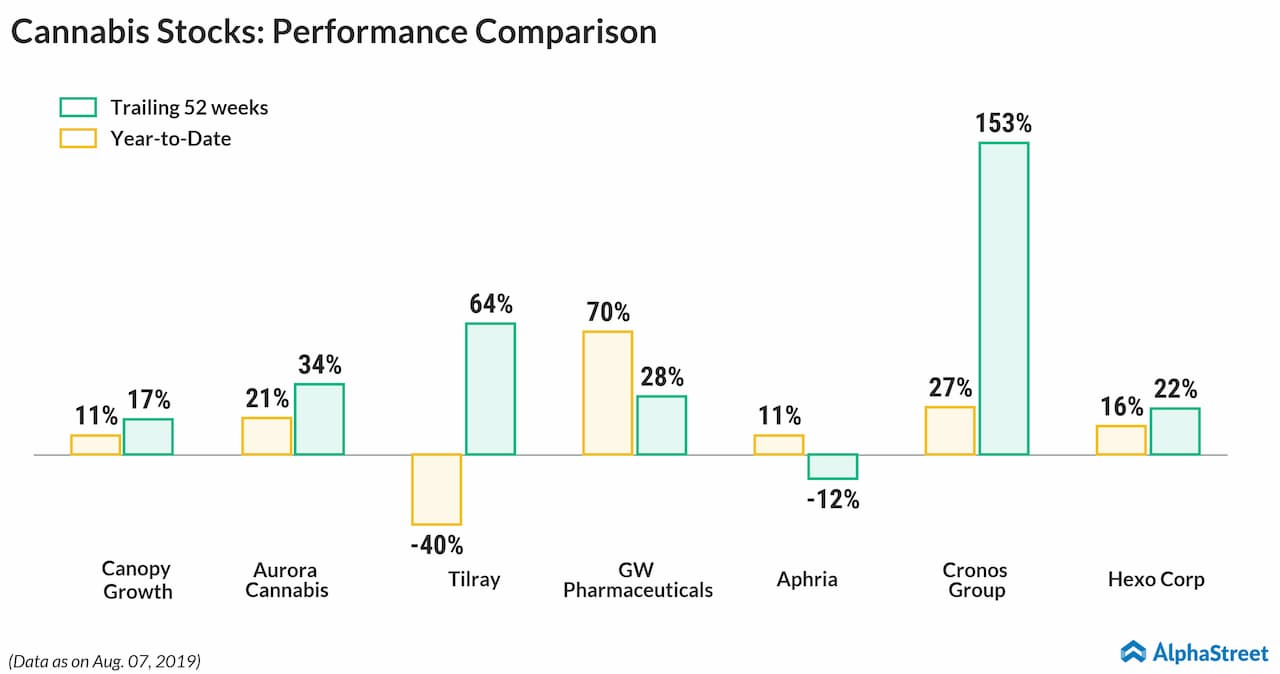

TLRY shares were down 5.9% immediately following the announcement. The stock has tumbled 80% since its IPO last year. However, it has stabilized from April, trading mostly between $40 and $50.

Gross margin increased sequentially to 27% from 23% in the prior quarter.

Though Tilray has put in a considerable amount of investments

into beverage and retail partnerships, there is rising criticism that even

these initiatives are overvalued in the markets. It’s hard to be sure though,

given we are at the early stages of the cannabis industry.

As Tilray trailed behind its rivals in the medical marijuana segment, it shifted its focus to the abundant opportunities in the CBD-infused food products industry. The acquisition of Manitoba Harvest and more recently, UK-based alcohol gummy maker Smith & Sinclair, were aimed at producing food products based on cannabinoid.

READ: Canopy Growth earnings preview: Q1 crucial in the recent turn of events

In Q2, revenue from Food Products segment grew to $19.9 million, representing almost 43% of total revenues.

However, the Federal Drug Administration recently questioned

the authenticity and safety aspects of such products, besides initiating the

first hearing on it two weeks ago.

Rival Aurora Cannabis (NYSE: ACB) will report earnings results on August 20, while Canopy

Growth (NYSE: CGC) will report on August 14.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.