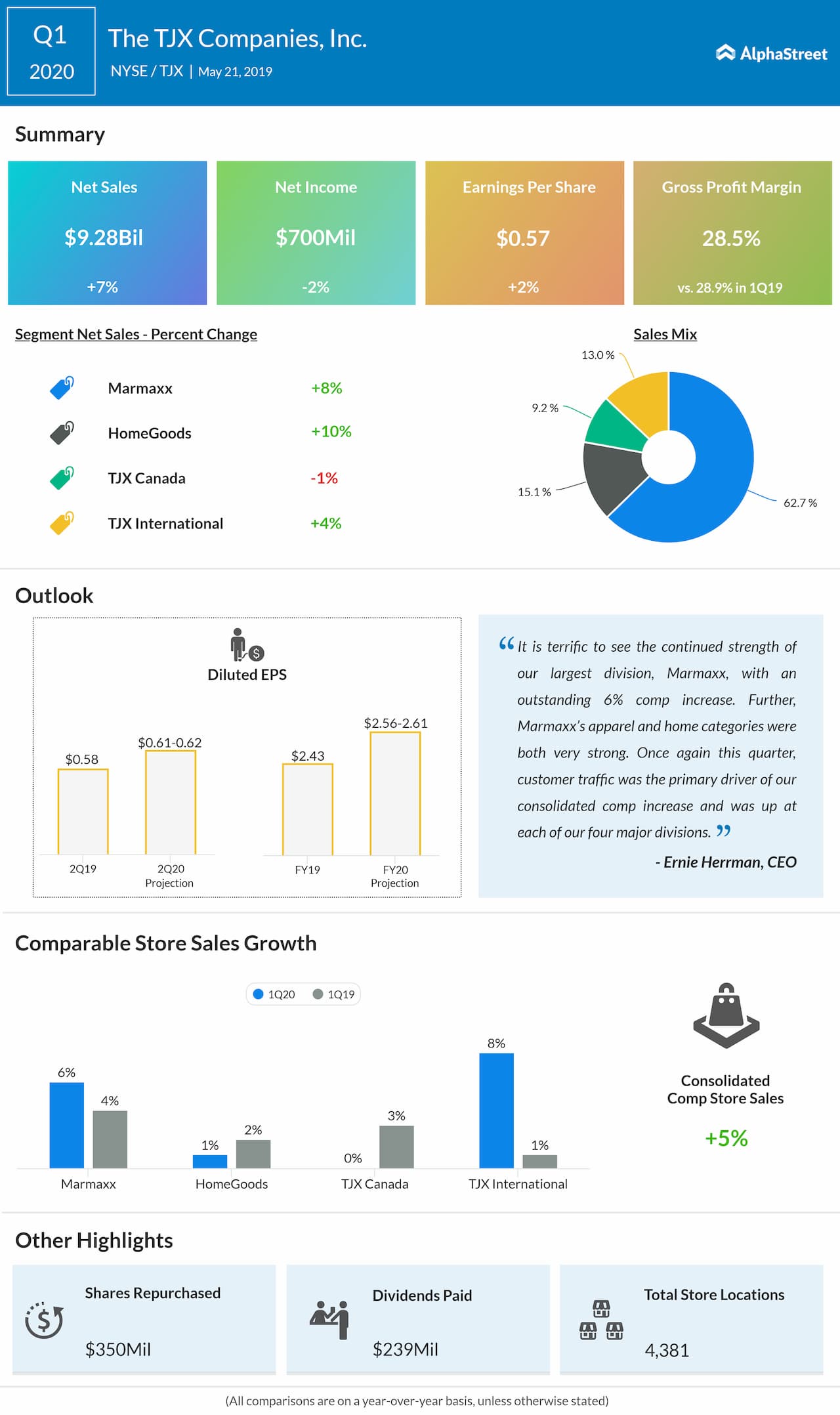

For the fiscal year ending February 1, 2020, TJX lifted its EPS guidance. The company now expects FY20 EPS to be in the range of $2.56 to $2.61 versus the prior estimate of $2.55 to $2.60. This guidance reflects an assumption that the combination of incremental freight costs and store wage increases will negatively impact EPS growth by 3% to 4%.

Commenting on comp store sales growth, CEO Ernie Herrman stated, “It is terrific to see the continued strength of our largest division, Marmaxx, with an outstanding 6% comp increase. Further, Marmaxx’s apparel and home categories were both very strong. Once again this quarter, customer traffic was the primary driver of our consolidated comp increase and was up at each of our four major divisions.”

Kohl’s Corp (KSS) and J.C. Penney (JCP) reported their recently ended quarter’s results before the market today. Kohl’s tanked 12% in the pre-market as it slashed the earnings forecast and reported disappointing Q1 results. J. C. Penney also plunged about 8% in the early hours after it missed Q1 earnings target.

TJX stock, which dropped slightly by 0.13% to $52.97 on Monday, had advanced 18% since the beginning of 2019 and 25% in the last 12 months.