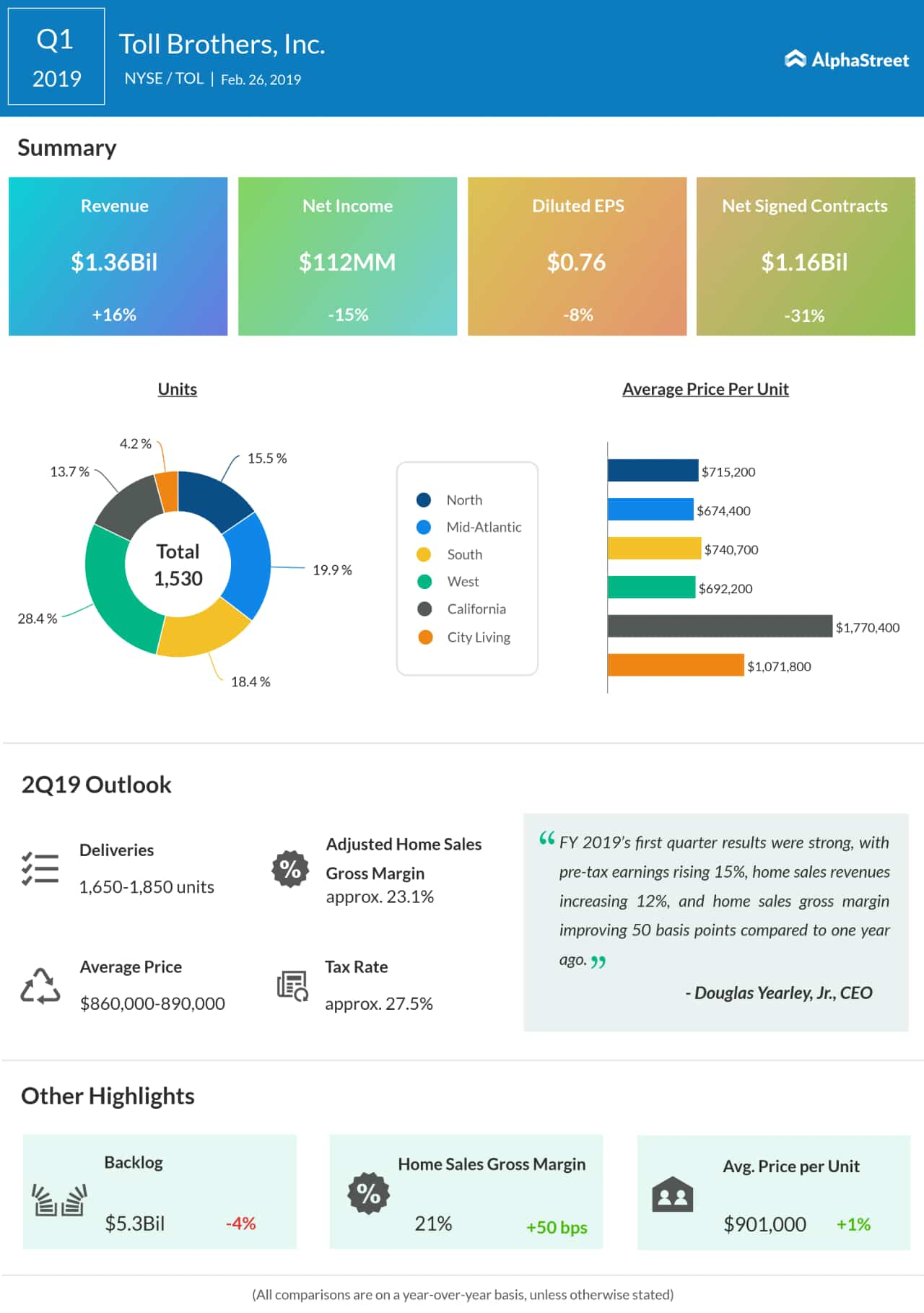

Net income dropped to $112.1 million, or $0.76 per share, from $132.1 million, or $0.83 per share, in the prior-year quarter, as last year’s results included a net tax benefit.

During the quarter, home building deliveries increased 8% to 1,530. Net signed contracts dropped by 24% to 1,379 units and by 31% to $1.16 billion.

At the end of the first quarter, backlog totaled $5.37 billion, down 4% year-over-year. In units, backlog dropped 5% to 5,954. The average price of homes in backlog was $901,000 compared to $892,000 last year.

Toll Brothers spent around $262.3 million on land to purchase approx. 2,686 lots during the quarter. The company ended the quarter with 317 selling communities, compared to 295 last year.

For the second quarter of 2019, the company expects deliveries of between 1,650 and 1,850 units with an average price of between $860,000 and $890,000.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.