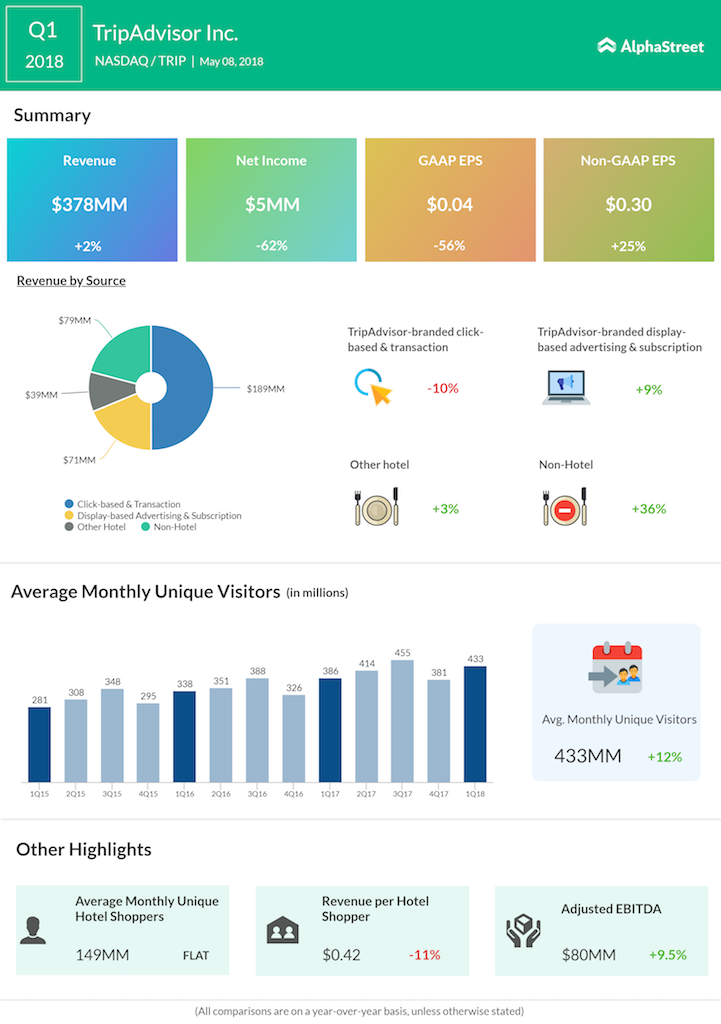

Earnings of the Massachusetts-based company fell 56% to $0.04 a share. Excluding items, the company earned 30 cents, an increase of 25% from the prior-year period.

Considering the preference shift from offline to online systems, the company’s non-hotel segment is expected to reap more benefits in the coming quarters. This also explains the company’s sudden interest in its non-hotel segment.

Off late, the online-travel business has become highly competitive, forcing major companies like TripAdvisor, Expedia (EXPE) and Booking Holdings (BKNG) to step up their marketing efforts to generate more bookings.

The non-hotel business, which accounted for just 9% of total revenue in 2014, today makes up over 23% of the company’s total revenue.

Average monthly unique visitors on TripAdvisor-branded websites and apps grew 12% year-over-year to approx 433 million, but average monthly unique hotel shoppers remained flat year-over-year at about 149 million.

“We are expanding our global platform for the benefit of users and partners and we are executing along our key product, supply and marketing initiatives that position our business for long-term profitable growth,” said CEO Steve Kaufer.