Trxade operates primarily as a drug procurement platform for independent pharmacies across the US. At the end of Q3, its network comprised around 11,800 pharmacies, representing over 50% market penetration. The company also offers telehealth services and a virtual wholesale platform.

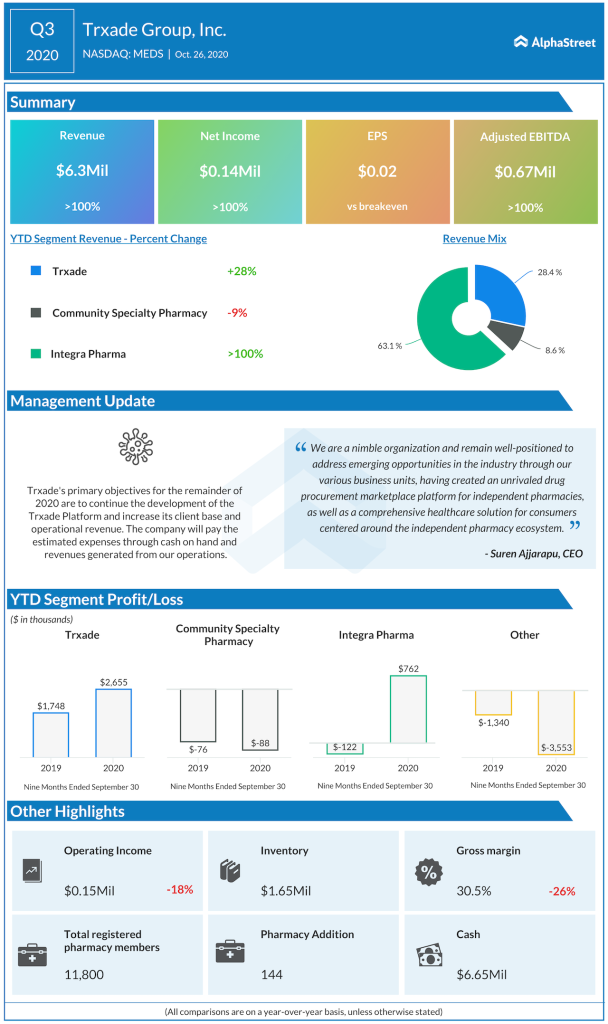

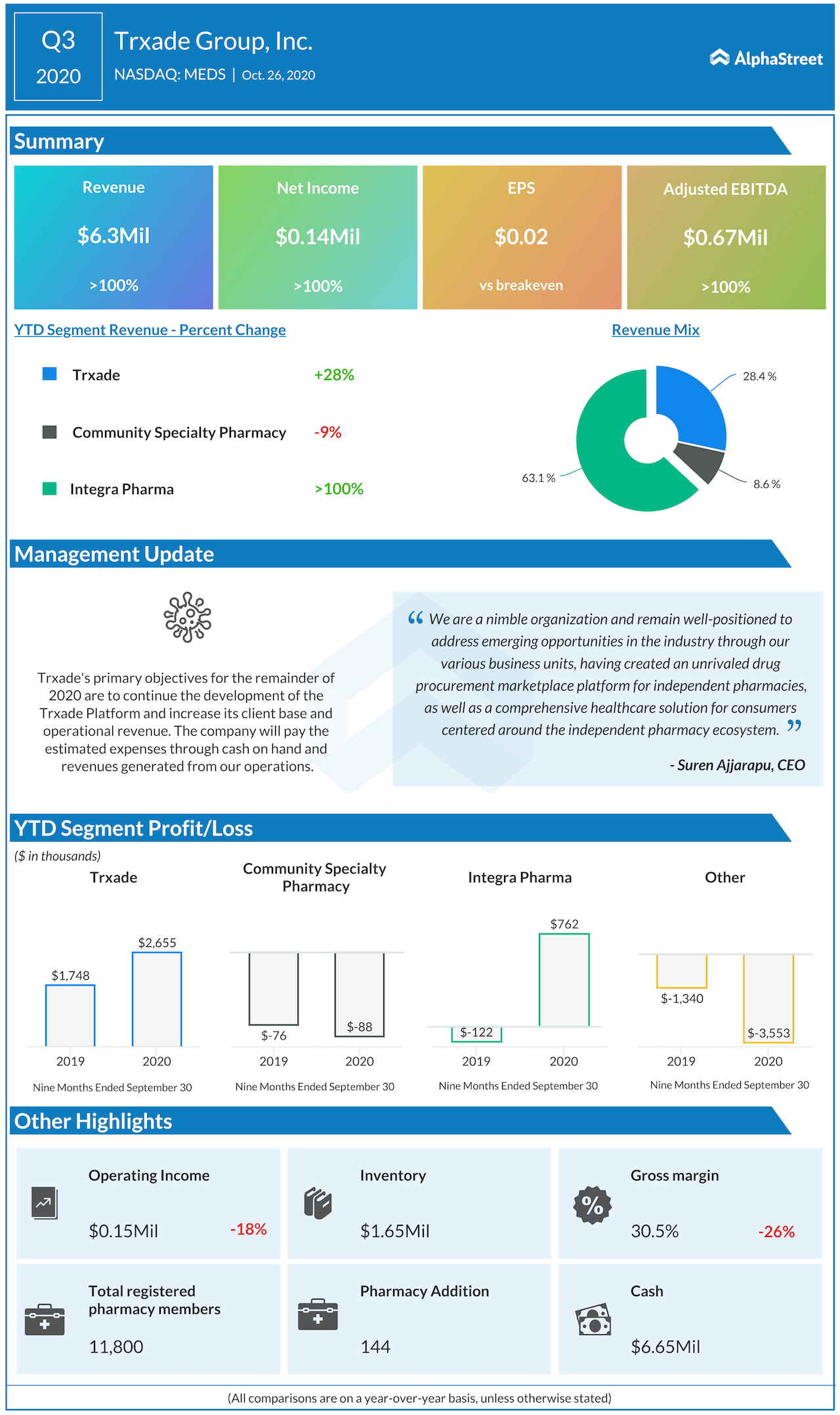

The company had earlier this week reported a 174% increase in third-quarter revenues to $6.3 million, which was well above the average analysts’ consensus. The strong top-line growth was primarily driven by strong demand for PPE, which, on the other hand, weighed heavily on the margin side.

Ask Suren what happens without PPE sales and he responds, “If the PPE sales are not there, we are going to recoup through other divisions, like our Bonum Health, Bonus Plus, subscriptions, and so on. We may not achieve the entire percentage growth that is currently seen, but we can match the current revenue standard.”

Gradual market recovery

Even though drugstores are opening up after the lockdowns, the recovery has been slow in many areas. And this has slowed down Trxade’s pharmacy additions to some extent in Q3. Despite adding 144 new pharmacies in the third quarter, some investors were left underwhelmed, given the company’s history of adding over 300 stores in the prior quarters.

Meanwhile, Suren stated that the focus during the quarter was on helping existing clients rather than adding new ones. He also pointed out that marketing was minimal during this period.

“It’s a slow pace of opening the doors. Because everybody is scared and don’t want to come to the stores. So it’s a slow and steady recovery.”

The CEO expressed hopes of hitting Q4 net adds at least on par with Q3, given that the final quarter is cyclically a slow period.

Trxade was uplisted to NASDAQ earlier this year. The stock was trading at $4.58 as of Oct 29, 2020.

_____

For more insights into Trxade Group, read the latest earnings call transcript here.