Early this year, Tyson’s chief executive Tom Hayes said the company expects to pay an additional $200 million towards freight costs this year. He also indicated a rise in meat prices for the U.S. consumers due to the rising freight and rising labor costs.

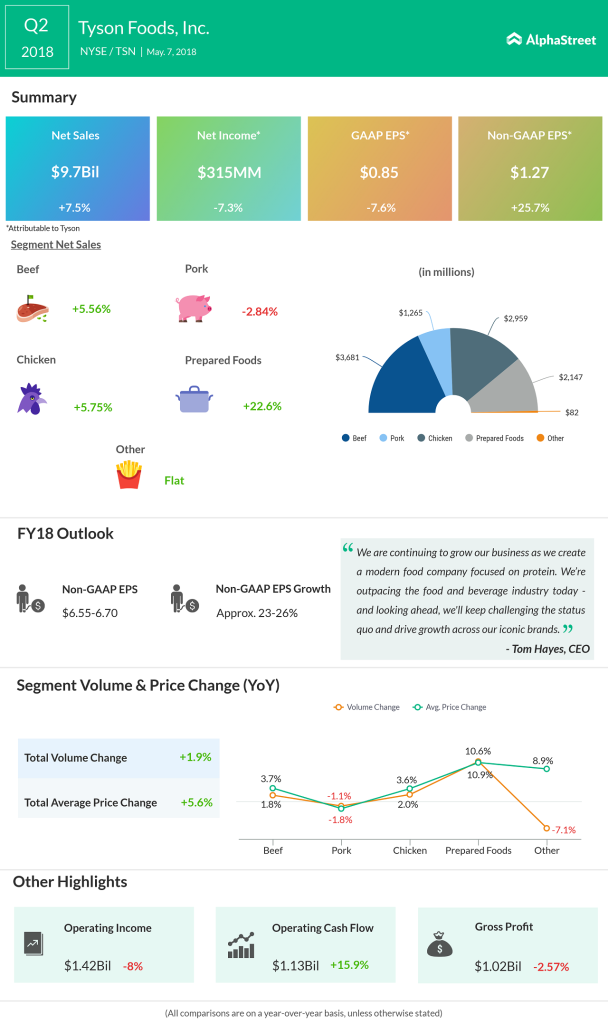

Tyson, who invested $2 million last week in Future Meat Technologies, an Israel-based company to develop lab-grown meat, said its profit fell to $315 million, or $0.85 per share, lower than $340 million, or $0.92 per share registered a year earlier. Excluding items, Tyson Foods earned $1.27 per share, up 26% from last year.

The consumer demand for the Arkansas-based company’s products remains high, as it reported an increase in sales in the beef, chicken and prepared foods segments with registering a sales growth of 10.6% in the Prepared Foods segment. However, the Pork segment declined close to 2% during the quarter.

Prepared Food segment’s sales were boosted by the acquisition of AdvancePierre Foods Holdings, which the company completed last year. The $4.2 billion deal helped the maker of Jimmy Dean sausages to expand its Prepared Food unit portfolio.

For the full year, the company targets its adjusted EPS to be in the range of $6.55 and $6.70, which represents a growth of 23-26% from fiscal 2017.

“We’ve built a strong foundation of sustainable growth that positions us well for the second half of the fiscal year and beyond. We’re outpacing the food and beverage industry today – and looking ahead, we’ll keep challenging the status quo and drive growth across our iconic brands,” said CEO Hayes.